熱門資訊> 正文

揭开“资本回归”的神秘面纱,或者我如何学会停止担心它

2019-09-16 20:35

- Starwood Property Trust, Inc.(STWD) 0

- Cohen & Steers 有限久期優先收益基金(LDP) 0

- Cornerstone Strategic Investment Fund, Inc.(CLM) 0

What is return of capital (ROC)?

Why ROC isn’t always bad.

There are tax advantages to ROC as well.

Note: Below we discuss some general principles that apply to Return Of Capital. Please note that these are general rules, but there are exceptions and variances from fund to fund due to the complexity of the rules surrounding it. What follows is meant to be a general discussion and not designed to be any form of tax advice. Master limited partnerships (MLPs) and their funds are a different category altogether and while some similarities exist, this article is not designed to discuss them.

A closed-end fund (CEF) is required to distribute most of its net investment income (NII) and realized capital gains each year. In other words it has to distribute most of its taxable income. This creates a floor by which the distribution cannot fall below. The fund

distribute more than its taxable income. Return of capital (ROC) is any portion of a distribution from a company or fund that exceeds taxable income. For CEFs with a managed distribution policy (policy of paying a fixed amount each month), some portion of the distribution is usually designated as a ROC.

As long as the fund’s managed payouts

over the long term, the initial capital contributed by investors in the fund remains. Note: we said over the long term, as over short periods of time, most managed payout funds can and do dip into investors' capital.

Funds that invest primarily in fixed income, particularly bonds, tend to experience less unrealized gains. So for them, using ROC to support the distributions often has negative consequences for the funds' net asset value (NAV), but for funds with regularly occurring unrealized gains, using ROC to pay the distribution has several positive aspects. First, the fund isn’t required to sell investments before they achieve their full potential. For the investor, when the ROC distribution is received, it isn’t subject to immediate taxation. Instead, it reduces the cost basis of the CEF (or other security). This in turn creates more capital gains (or less capital losses, as the case may be) when the investor sells the fund.

Source: Nuveen

In the above chart, you can see the various sources of capital for a CEF. As long as ROC draws into only unrealized capital gains, it does not lower the shareholder’s initial investment. Only when ROC draws on the investor’s initial investment, and that too consistently, is it a NAV destructive thing in the long run.

In other words:

Fund Payouts < (NII+ Realized Gains + Unrealized Gains) =

NAV Increases/Good Outcome

Fund Payouts > (NII+ Realized Gains + Unrealized Gains) =

NAV Decreases/Bad Outcome

To best understand the difference between

ROC and

ROC, let's look at two very different funds. Remember that

ROC leads to a decline in NAV versus the index or a steady decline in NAV overall. Meanwhile with

ROC the fund's NAV will match the movements of its index or produce superior returns to it.

ROC

The easiest example of a fund that investors are drawn to by its mouth watering yield is Cornerstone Strategic Value Fund (CLM). CLM's distributions have long contained a component of ROC.

Source: CEF Connect

This offhand would not be concerning unless its NAV showed a steady rate of decay.

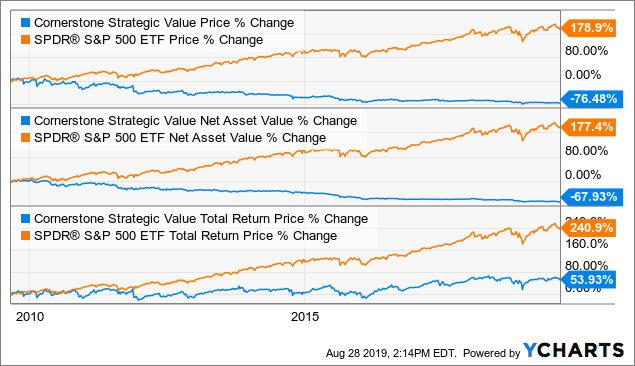

Data by YCharts

Data by YCharts

CLM invests in mostly non-dividend paying securities and cranks out a steady 20% distribution yield currently. This yield is supposed by many to be made up of the skillful trading of the fund's managers. The past 10 years tell a different story. The NAV has decayed 67.9%, and even factoring back in the distributions, the fund's returns have been poor vs. those of the market.

The flip side to CLM is another fund whose distributions contain a component of ROC but one that is beneficial to investors. This component allows you, the investor, to have a tax-deferred benefit - in a taxable account - and allows the fund to retain valuable positions. Cohen and Steers Limited Duration Preferred and Income Fund (LDP) is a classic example of this.

Source: CEF Connect

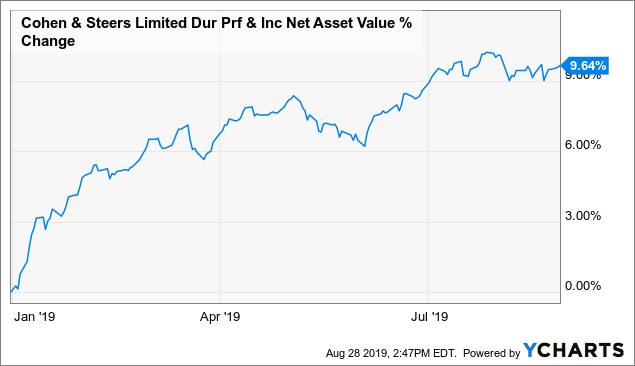

Every month a little portion of LDP's distribution is classified as ROC, however its NAV continues to march higher.

Data by YCharts

Data by YCharts

While over the long term we would prefer to see LDP not issue out ROC, it is not destructive to the fund's overall performance.

Understanding all this, we need to review the current situation of a High Dividend Opportunities pick.

In this report, we will look at specifics for Aberdeen Global Premier Properties (AWP). Global REIT funds, because of the structure in which they hold their non-US investments, are going to show far more ROC than do funds that hold only US REITs. Funds hold some foreign REITs in what is a called a passive foreign investment company, or a PFIC. These mostly don’t pay a dividend, but keep all real estate income to grow in value. So the funds get unrealized gains from them.

AWP is one of the picks we are recommending in our "conservative portfolio". AWP provides exposure to international REITs. It last reported an almost 65% of its distributed amount as ROC. While that may be alarming, let us look at it through the lens indicated above. The ROC consists of dividends generated inside PFICs, as well as some ROC consisting of unrealized gains. We would also note that the 65% relates to an annual 60-cent distribution, and not its current rate of 48 cents a year.

Those looking at this with a microscope can still reach a conclusion that AWP does pay a higher “yield” than it actually generates. By that we mean that its yield is higher than the underlying cash flow of its REITs. This is easy to derive, as the REITs in its portfolio average about 5% in yield. It has some big yielders like The GEO Group (GEO), which yields 11.6%, and Starwood Property Trust (STWD), yielding 8.2%. But it also has some REITs that yield a lot lower, like Welltower (WELL) with its 3.9% yield. Even with modest leverage, AWP cannot boost this past 5.5%, but remember that this yield is generated on NAV and not on market price. On a NAV of $6.76 a 5.5% yield translates into $0.37 a year. AWP is paying $0.48 a year. So, yes, there is overpayment and that difference is what AWP expects to make up with capital appreciation of its underlying assets over time.

Managed payout firms often do pay out more than they make in just “yield”, and that is part and parcel of the game. At the current rate of distribution, AWP is well balanced and we like the valuation of its income-producing assets in this low-rate environment. We further like the global exposure and this has worked well for AWP.

Source

As one can see, AWP did much better on a total-return basis than a blend (35%/65%) of the index-based ETFs Vanguard Real Estate ETF (VNQ) and the Vanguard Global ex-U.S. Real Estate ETF (VNQI).

ROC is not the return of your capital, but rather the return of the fund’s capital. Provided that the fund has its NAV performing at least in line with its benchmark, this means that the funds designated ROC are not necessarily a bad thing.

Source: AWP

While some part of an equity CEF’s distribution being designated as ROC does require more investigation, it does not necessarily mean the fund isn’t earning its distribution via yield and unrealized gains. Since 2017, AWP’s NAV has grown over 8%. Over that same period, an investment in AWP, with distributions reinvested, has grown with a CAGR of 19.2%. While the distribution was recently cut, that was due to a change in strategy to focus more on safety and future growth potential and less on immediate income.

I am/we are long AWP, GEO.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

推薦文章

美股機會日報 | 凌晨3點!美聯儲將公佈1月貨幣政策會議紀要,納指期貨漲近0.5%;13F大曝光!巴菲特連續三季減持蘋果

美股機會日報 | 阿里發佈千問3.5!性能媲美Gemini 3;馬斯克稱Cybercab將於4月開始生產

港股周報 | 中國大模型「春節檔」打響!智譜周漲超138%;鉅虧超230億!美團周內重挫超10%

一周財經日曆 | 港美股迎「春節+總統日」雙假期!萬億零售巨頭沃爾瑪將發財報

從軟件到房地產,美國多板塊陷入AI恐慌拋售潮

Meta計劃為智能眼鏡添加人臉識別技術

危機四伏,市場卻似乎毫不在意

財報前瞻 | 英偉達Q4財報放榜在即!高盛、瑞銀預計將大超預期,兩大關鍵催化將帶來意外驚喜?