熱門資訊> 正文

PTY:昂贵的价格,积极的前景

2019-09-03 05:02

PTY trades at a significant premium to NAV, but its underlying holdings and recent performance may justify it.

Recent income metrics show the fund is comfortably earning enough to cover its current distribution rate.

PTY\'s largest individual sector weighting is non-agency MBS, which is a sector that has been performing well and looks set to continue climbing.

The purpose of this article is to evaluate the PIMCO Corporate & Income Opportunity Fund (PTY) as an investment option at its current market price. PTY is a fund I regularly review and often recommend, although in the short-term its premium price has made me cautious. This time around, the storyline is quite similar. I see bullish momentum within PTY's core holdings, specifically in the non-agency MBS category. Furthermore, recent income production metrics are resoundingly positive. However, PTY is trading at a very high premium to NAV, which makes me hesitant to recommend new positions. In fairness, PTY has been trading at a premium price for the majority of 2019, so there is a very good chance that valuation will continue as we wrap up the year. With an income stream near 9%, if investors are willing to withstand some share price volatility, this entry point could make plenty of sense. However, for investors who value capital preservation just as highly as income, it may make sense to hold off until a cheaper entry point presents itself.

First, a little about PTY. The fund's objective is "to seek high current income, with capital preservation and capital appreciation as a secondary objective". The fund invests at least 80% of its total assets in a combination of corporate debt obligations, corporate income-producing securities, and income-producing securities of non-corporate issuers, such as the U.S. government securities, municipal securities, and mortgage-backed securities. PTY is currently trading at $17.89/share and pays a monthly distribution of $.13/share, which translates to an annual yield of 8.72%.

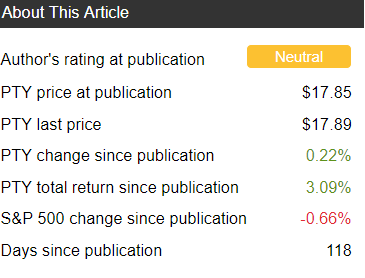

My last review of the fund was back in early May, when I slapped a "neutral" rating on the fund. Simply, I found PTY's portfolio generally attractive, but felt the cost to own it was a bit too rich. In hindsight, this was a reasonable call, as PTY saw a good deal of volatility since then, but still managed a 3% return:

Source: Seeking Alpha

Source: Seeking Alpha

Considering how the market has been behaving, I wanted to take the opportunity to reassess PTY to see if I should change my outlook from here. After review, I continue to see plenty of opportunity for the fund, but also remain wary of the rising premium to own it. Therefore, I believe the "neutral" rating remains appropriate, and I will explain why in detail below.

My primary reason deciding against a "bullish" rating this time around is definitely the fund's valuation. When I recommended PTY in December, the fund's premium was in the single digits, at around 8%. Since then, PTY has performed very well, in terms of market share price, and its premium has risen in turn. The fund's price to own was a reason for my cautiousness back in May, and the story this time around is similar. In fact, PTY is actually a bit more expensive than it was a few months ago, and its current premium is almost 4% above its year-to-date average, as shown in the chart below:

Source: PIMCO

As you can see, PTY is definitely on the expensive side, both at face value and once the fund's past trading history is considered.

My takeaway here is that, even with positive attributes, investors need to be cautious with respect to PTY. At such a lofty premium, the fund could see strong underlying performance but still experience a steep decline in share price - such is the nature of high premium CEFs. Of course, PTY does have a history of trading at an above-average price, even when compared to other PIMCO CEFs that also look quite expensive. It is completely plausible that PTY will maintain this valuation, or even move higher, as long as the income stream remains in tact. This is a reason why I believe the "neutral" rating is very appropriate. PTY has an expensive price, but there are other reasons to get excited about the fund, which I will explain next.

One of the most positive attributes going for PTY right now is the fund's income production metrics. This was an area of concern for me during my last review, as the fund's UNII balance was quite small, and the distribution coverage ratios were relatively weak. I noted that while PTY's distribution was not at risk, these were metrics to monitor going forward.

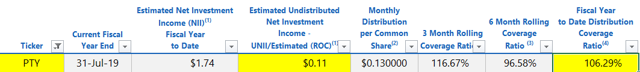

Fortunately, after monitoring for the past four months, I am happy to report that these metrics have dramatically improved. Specifically, PTY's UNII balance has increased to the point where the fund has almost a full month's worth of distributions in reserves, which is a good sign. Furthermore, PTY's short-term coverage ratios are seeing plenty of bullish momentum, as shown below:

As you can see, this report is quite positive, which continues to give me confidence that the fund's high yield is safe. The short-term coverage ratio has improved dramatically, sitting just under 117%. This illustrates that PTY is holding the right type of assets for our current climate, and tells me income-oriented investors don't have much of a reason to sell based on these metrics.

As a further point on underlying fund performance, it is worth noting that PTY has seen its underlying value increase as 2019 has gone on. Currently, the fund has a NAV of $14.11/share, while it started the year off at $13.81/share. This represents a 2.2% YTD NAV gain, while simultaneously paying out an almost 9% yield. This should give investors further confidence that PTY is holding the right types of assets.

My takeaway here is PTY appears to be performing quite well in the short-term. While I am cautious on the price to own the fund, this underlying performance tells me there is still a case to be made for buying a position, and certainly confirms that current investors should probably hold on for now. With a yield close to 9% and an income stream that appears safe, PTY should continue to meet its distribution obligations with little trouble going forward.

I now want to shift my attention to the underlying holdings in PTY, to get a better sense of how the fund will perform going forward. Last time around, I focused on the high-yield credit sector, but for this review I am going to discuss Non-Agency MBS holdings, which make up PTY's largest individual sector weighting, as shown below:

Source: PIMCO

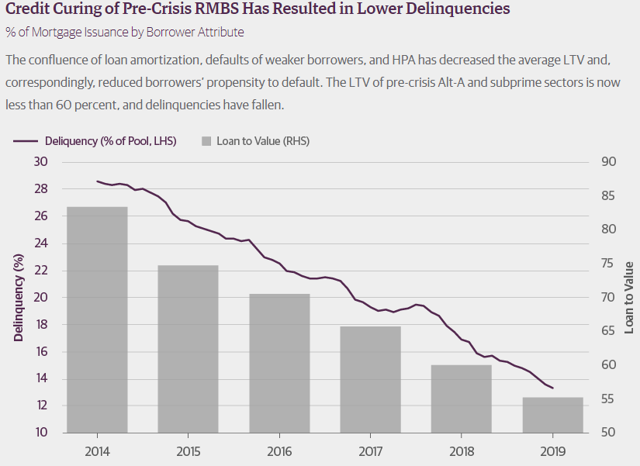

Clearly, this sector will have an out-sized impact on PTY. Fortunately, post-recession, this is a sector that has helped drive PTY's overall returns, as fewer homeowners fell in to foreclosure proceedings. When home values began to recover, homeowners had an additional incentive to make good on their mortgage obligations, which fueled consistent gains across the sector. This has been a multi-year trend that has actually been accelerating this year. In fact, the pool of residential delinquencies continues to drop off substantially, and the value of the outstanding loans compared the value of the homes has also dropped markedly, on average, as shown below:

As you can see, residential MBS has been a strong performer. With employment and wage figures still looking good across the country, I would expect this trend to continue as we push in to 2020. With outstanding loan values sitting below 60% of home value, homeowners are not anywhere near being "underwater" on their homes, on average. While there are pockets of weakness and foreclosures levels are not zero, the continued strength in the sector should allow PTY's NAV to grow and its income stream to stay steady. These trends tell me that PTY could be an attractive play for the more risk-taking investor.

I will use this paragraph to discuss my general macro-economic view of the current state of our market, as it impacts PTY and fixed-income more broadly. As my readers know, I have been advocating for careful positioning over the past few months. With the market still only a few percentage points off all-time highs, I continue to adjust my portfolio by taking some risk off the table. This has involved selling off individual holdings, moving some of my broad market assets into more defensive dividend-paying positions, and building a municipal debt position as a core holding.

My point here is that while I have been generally expressing caution, I simply believe investors need to make tactical moves at this time. I do not believe a recession is imminent, and the broad rally in government treasuries has pushed yields down to the level where I do not see the point in owning them, except for capital preservation. But the money flowing in to bonds right now does tell me a couple of things, with respect to how investors are reacting to certain events. If we understand these trends, we can get out in front of these movements for profit.

One, investors appear to be reacting in a fairly straight forward manner when it comes to fixed-income exposure. When there is trade-induced volatility, investors are hiding out in government treasuries, which explains the dramatic drop in the yield of 10-year treasuries through August, shown below:

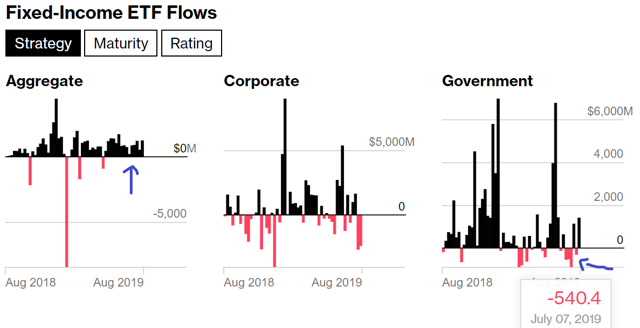

However, when we look back a few weeks prior, investor sentiment is markedly different. What was the reason for the divergence? The Fed's expected move on interest rates. Leading up to the July rate cut, investors had been pulling money consistently out of government bond ETFs, and in to other types of fixed-income products. One big winner was mortgage-debt. (The outflows/inflows for various sectors is shown below):

As you can see, while aggregate fixed-income funds saw inflows, government bonds saw multi-week drops in fund flows. As mentioned, mortgage-debt was a beneficiary, along with municipals:

Source: Bloomberg

So what does this mean for investors? Well, my takeaway here is that investors can look to these cash movements as a way to position themselves in September. One of the big developments that will come out of September will be the Fed's movement on interest rates. While the Fed has not laid out a clear message for how it will act during its September 18th meeting, the market seems convinced another rate cut is coming. According to data from CME Group, which tracks the futures market for upcoming interest rate movements, the market is pricing in another cut with almost 96% probability. With investors this sure of an imminent rate cut, I recommend starting to rotate in to the sectors that performed well before July's rate cut. With trade-induced volatility clouding the market's direction, it seems like a perfect time to adjust holdings to benefit off this potential action. With President Trump announcing new trade talks with China, as reported by Bloomberg, it appears to me the flight to government bonds may be overdone in the short-term, and investors could benefit from shifting gears before the market does.

PTY is up handsomely in 2019, and the fund has multiple positive attributes, such as positive underlying performance and improving income metrics. With investors continuing the hunt for yield, PTY could fit the bill for the right investor. However, I do need to urge some caution at these levels, as PTY sports a premium price, which makes it susceptible to sharp price moves, as we have seen over the past few months. However, I do expect higher-yielding products to perform well going forward. With a Fed rate cut potentially coming in a few weeks, investors could profit by rotating to mortgage-debt, municipal debt, or preferred corporate shares, which all saw big inflows preceding the July rate cut. PTY is just one way to play this potential trade, and it is up to investors if they feel the premium to own the fund is worth it at these levels.

I am/we are long PCI, PMF, PCK.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

推薦文章

港股周報 | 中國大模型「春節檔」打響!智譜周漲超138%;鉅虧超230億!美團周內重挫超10%

一周財經日曆 | 港美股迎「春節+總統日」雙假期!萬億零售巨頭沃爾瑪將發財報

一周IPO | 賺錢效應持續火熱!年內24只上市新股「0」破發;「圖模融合第一股」海致科技首日飆漲逾242%

從軟件到房地產,美國多板塊陷入AI恐慌拋售潮

Meta計劃為智能眼鏡添加人臉識別技術

危機四伏,市場卻似乎毫不在意

美股機會日報 | 降息預期升溫!美國1月CPI年率創去年5月來新低;淨利、指引雙超預期!應用材料盤前漲超10%

財報前瞻 | 英偉達Q4財報放榜在即!高盛、瑞銀預計將大超預期,兩大關鍵催化將帶來意外驚喜?