熱門資訊> 正文

3个基础设施CEF的比较-为什么我们选择将UTF添加到客户的投资组合中

2019-08-29 00:00

UTF is currently available at a discount while its peers are trading at a premium.

UTF offers significantly more diversity in its holdings and holds asset types not included in UTG or BUI\'s portfolio.

UTG brings a 15-year history of consistently increasing dividends to the table and a modest yield just under 6%.

BUI is the new CEF on the block and its currently trading at a premium over NAV. BUI has paid a consistent dividend but hasn\'t raised it in several years.

Why we added UTF to our client\'s portfolio and a brief overview of which you should consider for yours.

When writing about my clients' John and Jane the primary focus has and continues to be on the growth of income so that they can create consistency in their retirement. Their current portfolio consists of dividend-paying stocks, brokered certificates, a few mutual funds, and an ETF.

One asset group that I have been skeptical of is closed-end funds (CEF) and so I have largely ignored this investment class in the past. My primary concerns when it comes to CEF's include:

With that said, I now fully acknowledge that my perception of CEFs wasn't entirely accurate and this is because there are both good and bad CEFs available (and is no different than a good/bad mutual fund).

This article will specifically focus on Cohen & Steers Infrastructure Fund (UTF) because I consider this to be one of the safer leveraged CEFs available and produces a monthly dividend yield of 7.16%. I want to emphasize that there is a higher risk of a dividend cut with a leveraged CEF but that this risk is compensated for by the quality of the underlying assets. A Leveraged CEF like UTF offers an above-average yield that is safer but does not mean that there is no downside potential or risk of a dividend cut.

The primary goal with this article is to determine whether or not the additional yield provided by UTF makes the fund a better choice than the alternatives. As a result of previous research, we believe that the above-average yield is worth the additional risk.

Infrastructure as an asset class is oftentimes overlooked by the investment community due to the fact that it doesn't produce attractive capital returns relative to other segments (technology for example). Historically speaking, infrastructure has always been a safe place to move assets to since it can help preserve value relative to riskier asset groups, and even more importantly, will generate meaningful dividends even as the rest of the market is struggling.

Simply put, infrastructure is necessary even when the economy is doing poorly and this means that oil will still flow through pipelines, cell phone towers will still need to operate, and people will still need their utilities to provide electricity and water. The general public considers most of these services to be necessities and modern-day society cannot continue to operate without them. Infrastructure is a great way to own assets that hold importance regardless of where we are in the economic cycle.

Ultimately, the defensive qualities of an infrastructure asset class make the dividend significantly more reliable than other asset classes which can see wild fluctuations in earnings per share (EPS) based on a swing in the economy or changes to monetary policy.

As mentioned previously, infrastructure as an asset class tends to lag the greater market and this is because the return potential from a capital perspective tends to be more limited than other asset groups. In the aftermath of the great recession, UTF has significantly underperformed the Dow Jones industrial average and the S&P 500.

Data by YCharts

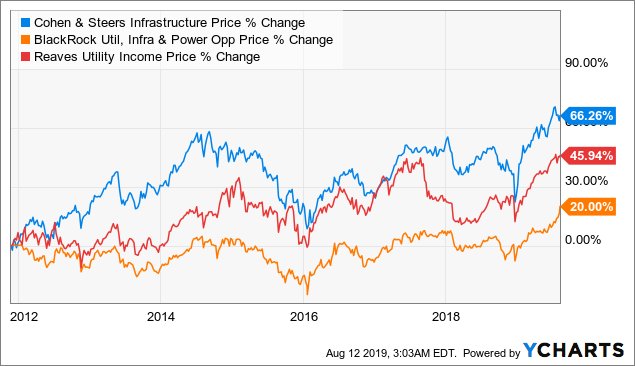

In order to truly understand how UTF is performing, we need to compare it against other major infrastructure CEFs. Two well-known infrastructure funds include Blackrock Utility and Infrastructure Trust (BUI) and Reaves Utility Income (UTG). Using 2012 as the starting point (BUI was created in 11/23/2011), UTF has continued to consistently outperform BUI and UTG over the last seven years.

Data by YCharts

Data by YCharts

One of the most notable differences between the three funds is in their exposure to domestic/international markets. Consider the following images that show how different the CEFs are when it comes to overall exposure.

Source: Charles Schwab - UTF

Source: Charles Schwab - BUI

Source: Charles Schwab - UTG

For those who are more bullish on infrastructure in the United States UTG offers the highest level of exposure with nearly 84% exposure to the United States and a total of 94% of its allocation in the North American continent. BUI, on the other hand, offers the most balanced diversification globally with significantly more exposure to the European continent while still maintaining roughly 52.5% exposure to North America.

I see UTF as the compromise between these two extremes with a total North America exposure of around 68.5% (Canada, United States, and Mexico). Additionally, I am much more comfortable with the balanced global exposure profile (Australia and Japan are looking better than Europe are currently) when compared with BUI's concentration of exposure in Europe.

The size of companies that make up the CEF is important to consider because typically larger or more well-established companies come with less risk than their smaller counterparts do. At the same time, small or mid-cap companies tend to have better growth prospects when compared to larger or more well-established companies.

Source: Data From Charles Schwab

Based on the image above, investors looking for certainty of share price may consider UTG to be the superior investment because approximately 92.4% of its exposure is to companies that qualify as giant-cap or large-cap. This is significantly above UTF's 77.1% and BUI's 71.4% exposure to the same categories.

UTF and BUI have greater exposure to mid-cap companies which likely adds a greater level of volatility to both CEFs when compared with UTG. Mid-cap companies offer a higher potential for returns due to the growth potential for companies with market caps between $2 billion and $10 billion.

One of the most important reasons why I like UTF more than UTG or BUI is because it has significantly more diversified holdings.

Included in this is a more diverse group of assets, many of which are not held by UTG or BUI. Preferred securities, convertible debt, and corporate bonds are all much more prevalent within UTF and helps create more balance in the fund.

Source: Charles Schwab - UTF - CEF Report Card

The biggest gripe income investors should have with UTF is that the dividend got hammered during the financial crisis between 2008 and 2009. At the end of 2008, UTF was paying a monthly dividend of $.2075 or $2.49/annually which then converted to quarterly payments of $.24 or $.96/annually in 2009. This is part of the reason why UTF has seen substantially larger dividend growth when compared with UTG (which continued to pay out increasing dividends during the same time period). Simply put, expect UTF to produce a strong dividend when the stock market is doing well but expect it to suffer tremendously in the event of another 2008/2009 crisis. It would also be fair to assume that in the event of a cut from another 2008/2009 event, UTF will be forced to decrease its dividend substantially.

Source: Seeking Alpha

Based on the figures and research above, I would expect many readers to wonder why we would choose to invest in UTF over a fund like UTG (since the primary goal is to generate consistent/reliable income). For John, we have already built a strong portfolio generates strong current income and his account is already less-prone to declines when the market falls because the holdings largely revolve around utilities and REITs. Since we already have the basic goals of the account covered, we added UTF for the following reasons:

Initially, I believed that UTG made the most sense because of its dividend history but there are already a number of similar holdings in John's portfolio that were the same as UTG's current composition. This means that UTG would be no different than adding to a number of already existing positions which doesn't do anything to create a more diverse portfolio. Ultimately, we decided that the diversity of UTF's assets and the additional yield made the fund worth the additional risk. Between the three funds, UTF presents the highest yield while also being available at a discounted price to NAV.

The majority of John's portfolio is already low-risk utilities, REITs, and other dividend stalwarts like Pepsi (PEP) and Chevron (CVX) which means that the infusion of a little risk that bumps up the yield is perfectly acceptable. For those looking to avoid risk while adding a modest amount of income, I would highly recommend researching UTG and consider it for your portfolio given its strong track record that spans more than 15 years.

What do you think about the addition of UTF to my client's portfolio? Are there any other stocks or CEF's that you think are worth researching? I'd love to hear some feedback and ideas from readers because that is exactly how I heard about UTF in the first place!

I/we have no positions in any stocks mentioned, but may initiate a long position in UTF over the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure:

This article reflects my own personal views and is not meant to be taken as investment advice. It is recommended that you do your own research. This article was written on my own and does not reflect the views or opinions of my employer.

推薦文章

千億資金需求下 OpenAI本周在ChatGPT上線廣告

華盛早報 | 美股、金銀全線暴跌,納指跌超2%!韓國人再度掃貨中國股票,大舉買入MINIMAX、瀾起科技;節前央行1萬億元買斷式逆回購來了

美國聯邦貿易委員會:蘋果新聞偏袒左翼媒體、打壓保守派內容

美股機會日報 | 就業數據轉弱!美國至2月7日當周初請失業金人數超預期;存儲概念股盤前齊升,閃迪大漲超7%

要點速遞!《跑贏美股》春節特別直播核心觀點總結

道指「一枝獨秀」連創新高!特朗普喊話還能翻倍,輪動行情下如何平穩「上車」價值股ETF?

華盛早報 | 非農數據大超預期!首次降息或延至7月;AI恐慌交易蔓延至房地產服務板塊, CBRE暴跌12%;智譜發佈新模型

美股機會日報 | 經濟數據強勁!美國1月非農就業大超預期,納指期貨漲至0.6%;AI應用股業績超預期,Shopify漲超10%