熱門資訊> 正文

高收益投资:通过房地产投资信托基金保护您的收入

2019-06-02 21:30

At HDO, our primary focus is finding investments that provide a high-level of current dividends.

We are sometimes criticized by those who focus on total returns but all too often fail to recognize that unrealized total returns can disappear quickly.

Retirees and income investors who rely on steady income can find attractive and consistent cash flow from REITs in the form of stable and consistent dividends.

We look at how REIT dividends were impacted during the last recession.

We look at how we can optimize our portfolio to avoid dividend cuts and provide a more secure income stream in any economic conditions.

In a recent article, we

highlighted the difference

between total returns and receiving dividend income. We wrote,

and continued,

This reality is especially stark for investors who are relying on their investments to supplement their income. Suppose you have an investment that is up 100%, 200% or even 1,000%, you are probably feeling really great about it. Maybe, every few months, you sell off a small portion of that investment to realize the gain and live off of those funds.

What happens when the whole market drops?

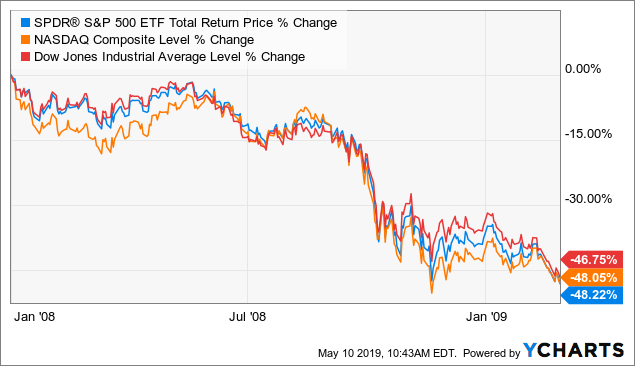

Data by YCharts

Suddenly, those gains are much smaller, and all that value you thought you had is gone. The ideal strategy would be to wait out the bear market, sell nothing, and eventually, it will turn around and your gains will return. That is a great strategy... if you don't need to take out any cash.

If you are relying on your investment portfolio to supplement your income, it is unlikely you can afford to go 6 months to a year without cashing anything out without seriously impacting your standard of living. This forces selling into a bear market for those who need cash, damaging the future value of their portfolio.

Having a portfolio of reliable dividend payors prevents the need to sell anything during a bear market. Instead of selling, investors can actually be receiving regular dividend payments and use a portion of those payments to be buyers when equities are trading at huge discounts.

Clearly, one of the largest reasons that Property REITs are attractive to retired or other fixed-income investors is their dividends. REITs are designed to be "pass-through" entities and are required by law to pay out 90% of their

taxable income

.

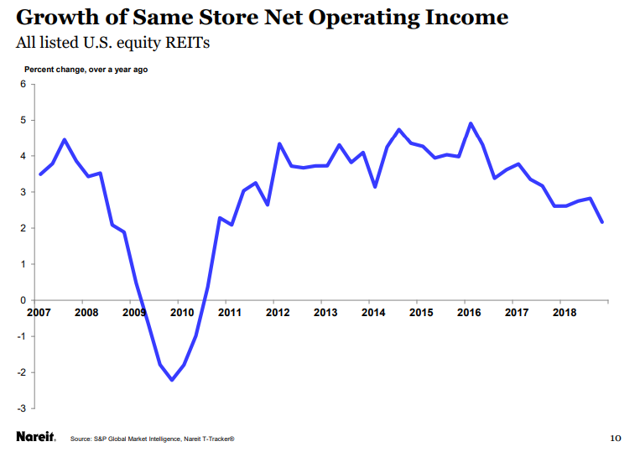

Often in a recession, the market's perception is worse than reality. The market might reduce the price of equity 50+%, while cash flow is experiencing a much smaller dip. This was the experience of many REITs in 2008-2010.

Source:

NAREIT TTracker

Cash flow did take a hit, but it did not drop nearly as much as REIT valuations did.

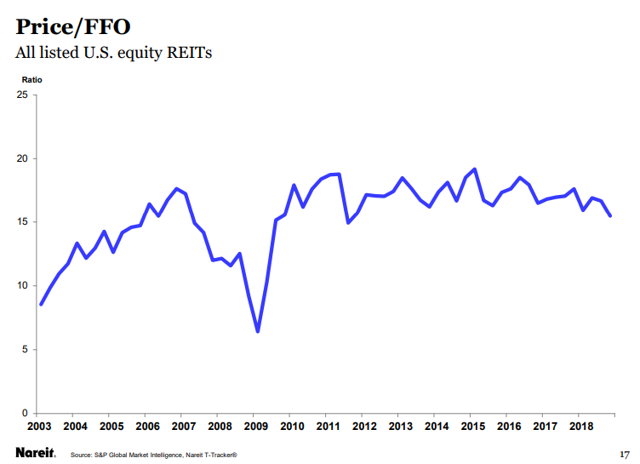

Source: NAREIT TTracker

Even through the depths of the recession, most REITs continued to pay a dividend and

were required

to continue paying a dividend to maintain their REIT status.

The result is a class of investments that offers growth potential, a significant portion of their total return coming as dividends, and an opportunity to invest in an

income stream that grows faster than inflation

. REITs can be a powerful addition to any income portfolio and can help reduce the sting of a recession by providing cash flow in any economic conditions

without selling any shares

.

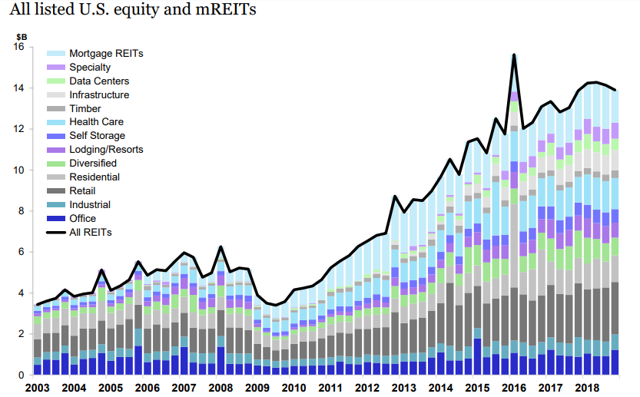

Source: NAREIT TTracker

Nothing is guaranteed in the stock market, and during the recession, total dividends paid by REITs on a trailing 12-month basis dropped from a peak of $22.3 billion in Q2 of 2017 to $14.4 billion in, a drop of approximately 35% in Q4 of 2009. By Q4 of 2011, the trailing 12-month dividends exceeded the pre-recession highs.

Investors with a perfectly diversified portfolio of REITs would have experienced a decline in their income. Starting in Q1 of 2009, income would have dropped for 3 consecutive quarters before bottoming out and climbing back to previous levels over the next 5 quarters.

Investors could have limited their blow by avoiding sectors that were particularly hard hit, including Office REITs which cut dividends 55%, Diversified REITs which cut dividends 72%, and Lodging REITs which cut dividends 82%.

We believe these sectors were impacted particularly hard because they have complex business models, require high levels of capex, and have more exposure to day-to-day operations of their tenants.

Other sectors outperformed as dividends paid

actually increased

for freestanding retail, manufactured homes, healthcare, and some specialty REITs. With a bull market that appears to be nearing the end, these are the types of sectors that we will be focusing on.

Freestanding retail does well because typically it utilizes "triple-net" leases, which put responsibility for most of the expenses on the tenants. Additionally, freestanding retail buildings are often easily converted for new tenants. This creates significant stability and predictability of cash flows.

These REITs have become very popular post-recession and big names like

Realty Income

(

O

) and

National Retail Properties

(

NNN

) trade at premiums. We

recently recommended

Spirit Realty

(

SRC

) in this sector. SRC lacks the premium but has

the same fundamental business model

that can be expected to survive a recession without impacting the dividend.

Manufactured homes and healthcare both have the benefit of being necessities and economic cycles that do not directly correlate to the macro-economic cycle. We continue to like the preferred shares of

UMH Properties

(

UMH.PC

) and are glad

we locked in

a 7.3% yield when the opportunity presented itself.

The healthcare industry has been going through some sector-specific turbulence, and we will keep an eye on the fundamentals and consider an investment when it stabilizes.

We discussed specialty REITs in a

previous article

, these are REITs that have the potential to do well if they are specialized in a niche that will persist through a recession.

EPR Properties

(

EPR

) remains a favorite of ours although it is trading near the top of our buy range as Mr. Market has realized the great value we recognized last year.

Iron Mountain

(

IRM

) is another niche REIT that performed well through the last recession, and we have confidence will remain strong through the next one. A recent hiccough in their quarterly earnings is producing a long-term opportunity, pushing IRM back into our buy range.

History rhymes, but it does not necessarily repeat. A REIT sector which performed poorly the last cycle is not necessarily going to have the same impact the next cycle. Also, within a sector, there are always individual REITs which perform better or worse than their peers.

In order to mitigate risk, one option we have been exercising is focusing on preferred equity versus common equity. While many REITs reduced their common dividends, very few suspended the common dividends completely. Preferred dividends generally continued to be paid, and even when they were suspended, if they are cumulative (as most REIT preferred shares are), the shareholders received the full payments before the REIT could resume paying the common dividend.

These factors make preferred dividends from REITs a great source for reliable income for retirees.

RLJ Lodging Trust

(

RLJ.PA

) remains one of our favorite preferred issues, yielding almost 7.7%, it is supported by a strong portfolio of premium hotel properties. Additionally, RLJ.PA

cannot be called

. It can be converted to common equity, but conversion can only be forced if the common share price exceeds $89.

Recessions inevitably put significant pressure on hotel REITs as the hotel industry is heavily reliant on voluntary consumer spending, and hotel REITs operate the hotels through a subsidiary. It is very likely that, in a recession, RLJ is forced to cut their common dividend. The preferred dividend is far more secure, and if things really get bad, it is cumulative.

We have also taken advantage of dips in the preferred markets to invest in diversified REITs such as

Global Net Lease

(

GNL.PA

),

Brookfield Property Partners

(

BPYPP

), and

Colony Capital

(

CLNY.PH

) (

CLNY.PI

) (

CLNY.PJ

). In a recession, all three companies might be at risk of cutting their common dividend. However, due to the REIT 90% rule, and the large amounts of cash flow these REITs have, the preferred dividends have a

very high probability of being paid without interruption

.

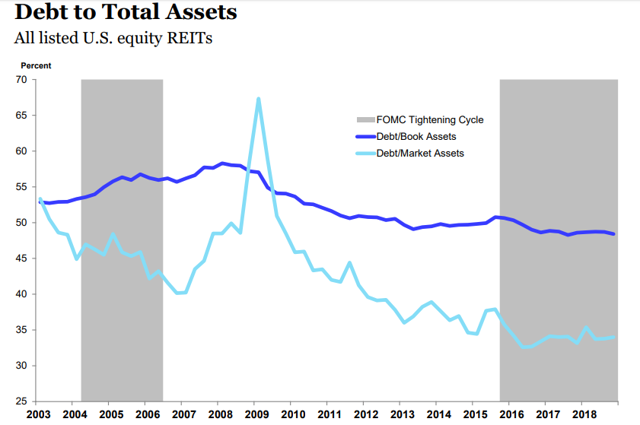

The impact of 2007-2009 is still with REITs today. The reckless enthusiasm of using increasing levels of leverage to chase returns has not developed like it did last cycle.

Source: NAREIT TTracker

Leading up to late 2007/2008, REITs were increasing their debt levels. When property values declined, they were forced to deleverage at a time when capital was difficult to access. To deleverage, many REITs cut their dividends and even issued equity at multi-year low prices.

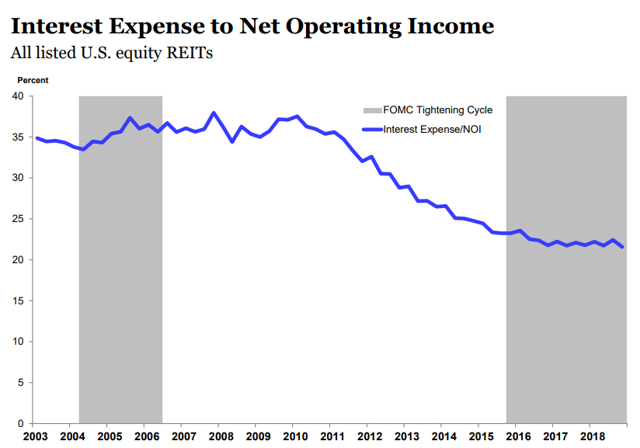

As a group, REITs have leverage levels at all-time lows, despite their average interest rates being lower than ever. As a portion of their cash flow, interest expense is substantially lower than it was prior to the last recession.

Source: NAREIT TTracker

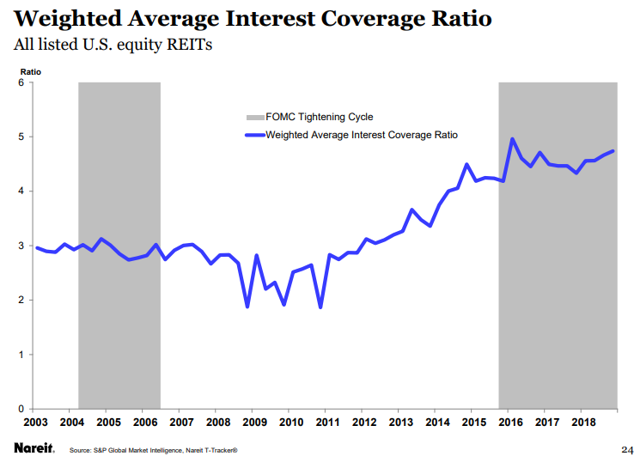

In turn, this has led REITs to have much stronger average coverage ratios.

Source: NAREIT TTracker

As a group, it is clear that REITs learned a lesson last cycle and are taking a much more conservative approach. We believe that if these good habits are maintained, REITs as a group will fare much better through the next recession than they did the last one. The lower leverage and the larger cushions in covering interest payments will reduce the number of REITs that will be forced to cut their dividends.

Naturally, when we are looking at averages, we have to be aware that there are some REITs out there with balance sheets that look more like pre-2007 REITs. So, we still have to do our due diligence and make sure we are not getting trapped into REITs that use excessive leverage.

For retirees and income investors, receiving a high level of current income is often the primary goal. Due to their structure and legal requirements, REITs are well-suited to provide retirees with a steady stream of income, without having to worry about the current share price and potentially having to sell when there is a temporary decline.

Looking at history, we are reminded that there is always a risk of dividend cuts in a recession. While it is likely impossible to perfectly predict which REITs will cut and which will sail through, we can take steps to minimize that risk.

First, we are turning our focus to sectors that have historically performed better, while avoiding the common equity in sectors which have historically been particularly prone to dividend cuts. While we still have a few higher risk/higher reward picks like Washington Prime Group (NYSE:

WPG

) common, the majority of our common equity portfolio is in picks that we believe will maintain or even raise their dividend in a recession.

Second, when we are investing in those "higher-risk" sectors, we move up the capital ladder and invest at the preferred equity level. This will provide better safety for the dividend payments, as even if the common dividend is cut by 50%, 60% or even 90%, the preferred dividend will continue being paid in full.

Finally, we believe that the REIT sector, in general, is better prepared for a downturn today than it was in 2007. Despite low interest rates and easy capital being available, REITs have maintained a more conservative approach to leverage and have substantially higher coverage ratios. This will provide a larger cushion to absorb any downswings in NOI.

By being aware of which sectors are likely to come under pressure and making some prudent moves into preferred equity while prices are still reasonable, we can position our portfolio to weather a recession with

minimal impact

on income. We consider the overall sector, the individual REIT's cash flow, leverage levels, history, and future goals. We are making an extra effort to find opportunities at the preferred equity level, which is

even more resistant

to dividend reductions.

Combining these efforts with appropriate diversification, we are creating a portfolio with a dividend yield of +9% that will be able to provide significant levels of cash flow so that nothing will have to be sold at bad prices. When the rest of the market loses their heads and scrambles to sell everything, we want to be there waiting with are excess dividends to snap up the once-in-decades-type deals.

I am/we are long UMH.PC, BPYPP, CLNY.PI CLNY.PJ, RLJ.PA, GNL.PA.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

推薦文章

美股機會日報 | 阿里發佈千問3.5!性能媲美Gemini 3;馬斯克稱Cybercab將於4月開始生產

港股周報 | 中國大模型「春節檔」打響!智譜周漲超138%;鉅虧超230億!美團周內重挫超10%

一周財經日曆 | 港美股迎「春節+總統日」雙假期!萬億零售巨頭沃爾瑪將發財報

一周IPO | 賺錢效應持續火熱!年內24只上市新股「0」破發;「圖模融合第一股」海致科技首日飆漲逾242%

從軟件到房地產,美國多板塊陷入AI恐慌拋售潮

Meta計劃為智能眼鏡添加人臉識別技術

危機四伏,市場卻似乎毫不在意

財報前瞻 | 英偉達Q4財報放榜在即!高盛、瑞銀預計將大超預期,兩大關鍵催化將帶來意外驚喜?