熱門資訊> 正文

What is BNB? Can CZ's Return to Binance Propel It to $2700?

2025-09-19 06:07

TradingKey – On September 18, 2025, rumors swirled that Changpeng Zhao (CZ) may be returning to lead Binance, sparking a surge in BNB’s price past the $1,000 mark and setting a new all-time high. The news not only captured global investor attention but also reignited interest in BNB’s long-term potential — making Standard Chartered’s bullish forecast seem increasingly plausible.

Previously, Standard Chartered predicted that BNB could reach $2,775 by the end of 2028. But what exactly is BNB? Why is the bank so optimistic? And what underlying strengths does BNB possess? Let’s dive deeper.

What Is BNB?

BNB is the native cryptocurrency issued by Binance, one of the world’s largest crypto exchanges. It was launched in 2017 via an initial coin offering (ICO), originally built on Ethereum’s ERC-20 standard before migrating to Binance Smart Chain (BSC) and Binance Chain (BNB Chain).

Unlike non-platform tokens like ETH or BTC, BNB serves as a utility token within the Binance ecosystem, offering a wide range of use cases:

Use Case |

Description |

Trading Fee Discounts |

Users get reduced fees when trading on Binance using BNB |

On-Chain Gas Fees |

BNB powers transactions on BSC |

Launchpad Participation |

Used for token sales and auctions, enabling passive income opportunities |

Liquidity Mining & Staking |

Earn rewards by providing liquidity or staking BNB |

Payment Utility |

Accepted via Binance Pay, Binance Card, Alpha, and even outside Binance’s ecosystem |

Accepted via Binance Pay, Binance Card, and external merchants

BNB’s Market Position

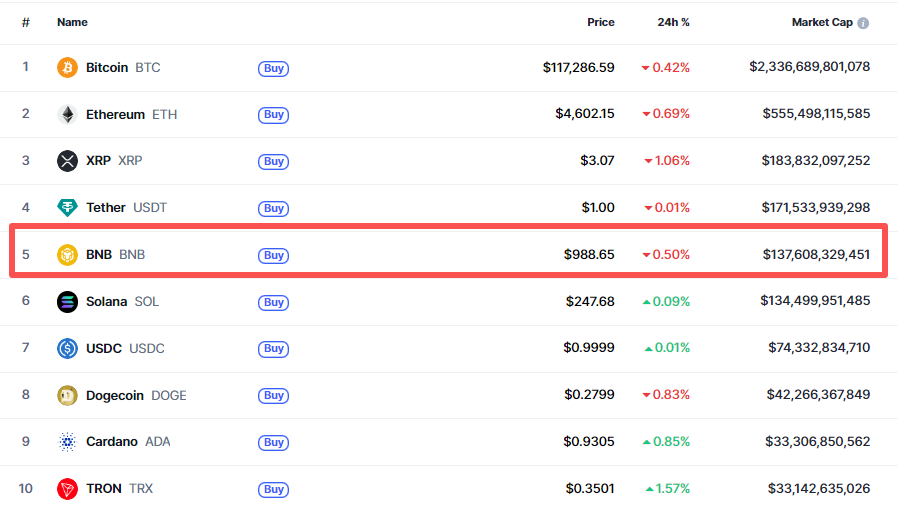

According to CoinMarketCap data as of September 19, BNB has a total supply of 200 million tokens, with 139 million in circulation — yielding a 69% circulation rate. Its market cap exceeds $130 billion, accounting for 2.52% of the total crypto market, ranking fourth (excluding stablecoins), behind BTC, ETH, and XRP.

[Top 10 Crypto Market Caps – Source: CoinMarketCap]

[Top 10 Crypto Market Caps – Source: CoinMarketCap]

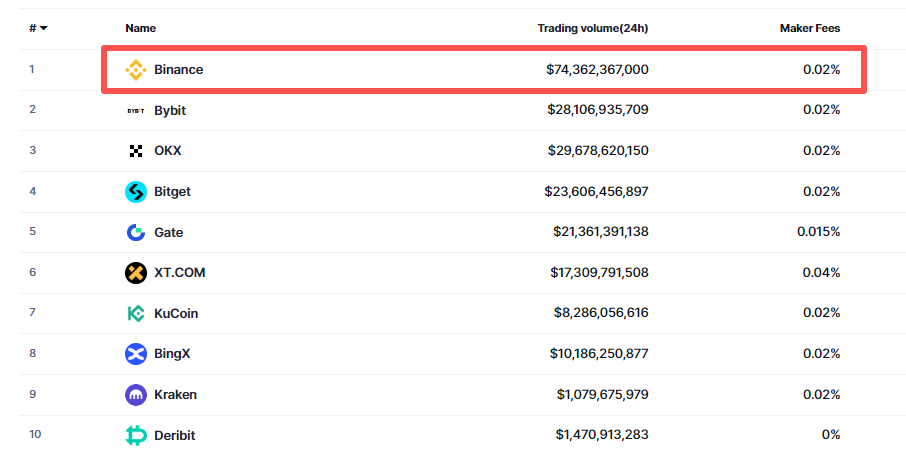

Binance consistently leads in both spot and derivatives trading volume. Its decentralized exchange PancakeSwap also dominates. Latest figures show Binance’s 24-hour spot volume exceeds $20 billion, far ahead of runner-up Bybit’s $4.2 billion. Derivatives volume hits $74 billion, again outpacing Bybit’s $28.1 billion.

[Binance Derivatives Volume – Source: CoinMarketCap]

[Binance Derivatives Volume – Source: CoinMarketCap]

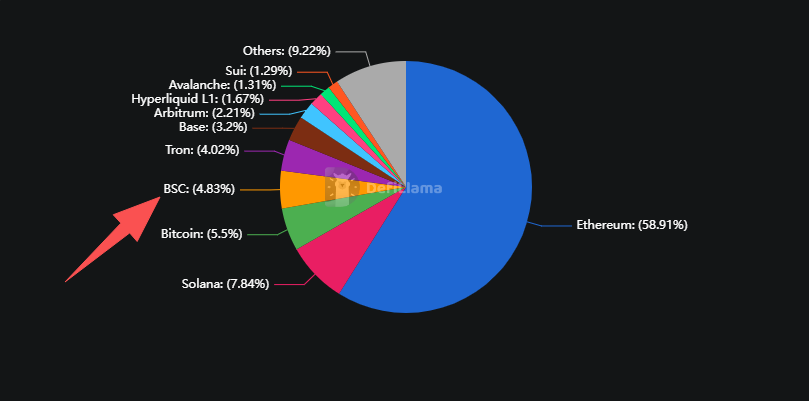

On the DeFi front, BSC ranks third in total value locked (TVL) at $7.7 billion, behind Ethereum and Solana, according to DefiLlama.

[BSC Network TVL – Source: DefiLlama]

[BSC Network TVL – Source: DefiLlama]

BNB’s Price History: Five Key Phases

Since its inception, BNB has completed one full bull-bear cycle and is now entering its second bull run. Its development can be divided into five distinct phases: Genesis, Transformation, Breakout, Consolidation, and Expansion.

[BNB Price Chart – Source: TradingView]

[BNB Price Chart – Source: TradingView]

Genesis Phase (2017–2018): Rise and Early Challenges BNB launched in July 2017 at $0.10. At the time, Binance was a fledgling platform, and the token drew little attention. Within five months, Binance’s user base surpassed 2 million, and BNB climbed to $2.50, peaking at $24.46 in January 2018. However, the crypto bear market dragged it down to around $4 by year-end — a drop of over 80%.

Transformation Phase (2019–2020): Strategic Leap In April 2019, Binance launched its own blockchain, Binance Chain, giving BNB a stronger foundation. The September 2020 debut of Binance Smart Chain (BSC) further boosted BNB, lifting it from a pandemic low of $8 to $30.

Breakout Phase (2021): Explosive Growth Fueled by the DeFi summer and BSC ecosystem boom, BNB soared from $40 in early 2021 to an all-time high of $686 in May — a gain of over 1,500%. It saw a secondary rally later that year but didn’t surpass its previous peak.

Consolidation Phase (2022–2023): Stress Test 2022 was turbulent for BNB, impacted by black swan events like the LUNA collapse and FTX bankruptcy. Prices bottomed at $183. In 2023, regulatory pressures eased and markets recovered, helping BNB rebound to around $350.

Expansion Phase (2024–Present): New Momentum In 2024, BNB regained strength, breaking past $700 in June and reaching $793 by year-end. On September 18, 2025, BNB surged past $1,000, setting a new record high.

Can BNB Reach $2,775 by 2028?

On May 3, 2024, Geoff Kendrick, Head of Asset Research at Standard Chartered, projected BNB could hit $2,775 by the end of 2028. But how realistic is that target?

From a supply perspective, BNB has a capped supply of 200 million tokens and follows a deflationary model. The BNB Foundation reports 32 quarterly burns to date, eliminating over 1.59 million tokens worth more than $1 billion.

[BNB Burn Data – Source: X (@BNBCHAIN)]

Institutional demand is also rising. On July 28, Nasdaq-listed Nano Labs (NA) disclosed holdings of 128,000 BNB worth $108 million. Other firms like Liminatus Pharma, Windtree Therapeutics (WINT), and CEA Industries have also announced BNB reserves. CZ stated on July 9, 2024, that over 30 teams are preparing BNB treasury reserves.

On September 10, Binance announced a partnership with Franklin Templeton to explore compliant tokenized securities. If successful, tokenizing traditional equities could significantly boost Binance’s competitiveness and revenue. Meanwhile, rumors suggest Binance is close to a settlement with the U.S. Department of Justice, potentially easing regulatory restrictions and paving the way for CZ’s return — signaling growing regulatory acceptance.

Additionally, the Federal Reserve’s 25 bp rate cut on September 17 marks the start of a dovish cycle, injecting liquidity into crypto markets and supporting BNB’s upward trajectory.

It’s also worth noting that 2028 marks Bitcoin’s fifth halving — a historically bullish catalyst. If past cycles repeat, BNB could ride the wave to new highs. Considering macroeconomic trends, supply dynamics, CZ’s potential return, and the next bull market, Standard Chartered’s target seems increasingly plausible.

Conclusion

As the native token of Binance — the world’s largest crypto exchange — BNB benefits from a robust ecosystem and optimized supply-demand mechanics. Its expanding use cases (payments, NFTs, DeFi), consistent token burns, and growing institutional adoption all support its long-term value. With favorable macro conditions and strategic developments underway, BNB reaching $2,775 within the next three years is far from impossible.

推薦文章

美股機會日報 | 凌晨3點!美聯儲將公佈1月貨幣政策會議紀要,納指期貨漲近0.5%;13F大曝光!巴菲特連續三季減持蘋果

美股機會日報 | 阿里發佈千問3.5!性能媲美Gemini 3;馬斯克稱Cybercab將於4月開始生產

港股周報 | 中國大模型「春節檔」打響!智譜周漲超138%;鉅虧超230億!美團周內重挫超10%

一周財經日曆 | 港美股迎「春節+總統日」雙假期!萬億零售巨頭沃爾瑪將發財報

從軟件到房地產,美國多板塊陷入AI恐慌拋售潮

Meta計劃為智能眼鏡添加人臉識別技術

危機四伏,市場卻似乎毫不在意

財報前瞻 | 英偉達Q4財報放榜在即!高盛、瑞銀預計將大超預期,兩大關鍵催化將帶來意外驚喜?