熱門資訊> 正文

U.S. June Nonfarm Payroll Preview: Labour Market May Continue to Cool, but Mid-Term Optimism for U.S. Stocks Persists

2025-07-02 09:52

TradingKey - The U.S. is set to release June non-farm payroll data on 3 July 2025, with market consensus forecasting a 120,000 job gain, down from May’s figures. The expected softening in June’s employment data stems from three key factors: First, the ongoing deceleration in recent non-farm payrolls. Second, rising jobless claims signal a high probability of subdued employment growth. Third, the persistent slowdown in U.S. macroeconomic activity has curtailed corporate hiring appetite and capacity. Looking forward, we anticipate further weakening in the U.S. labour market over the next few months. A softening jobs market is likely to spur the Federal Reserve to resume interest rate cuts. This shift toward looser monetary policy, alongside expansionary fiscal measures like tax reductions, should mitigate the effects of economic deceleration, bolstering our bullish mid-term outlook for U.S. equities. Consequently, should a weakening labour market trigger a near-term correction in U.S. stocks as expected, it may present investors with a strategic entry point for future market gains.

Source: Mitrade

The U.S. Bureau of Labour Statistics is scheduled to release June non-farm payroll data on 3 July 2025. Market consensus projects a job gain of 120,000, a decline from May’s 139,000 (Figure 1). Additionally, the unemployment rate is expected to rise slightly by 0.1 percentage points to 4.3%. We concur with this consensus outlook.

Figure 1:U.S. Labour Market Consensus Forecasts

Source: Refinitiv, TradingKey

The expected softening of June’s non-farm payroll data stems from three key factors:

First, the persistent downward trend in non-farm employment. Since March 2025, job gains have steadily decreased from 228,000 (Figure 2). Without significant external catalysts, it is unlikely that June’s figures will surpass May’s results.

Second, higher-frequency data from Continuing Jobless Claims reveals a consistent rise since early June 2025. Claims increased from 1.904 million on 5 June to 1.974 million by 26 June, a rise of 70,000 (Figure 3). This upward trend underscores ongoing softness in the U.S. labour market, making a subdued non-farm payroll outcome highly probable.

Third, the sustained U.S. macroeconomic slowdown has curtailed corporate hiring intentions. Prolonged weakness in domestic demand has further limited firms’ ability to expand their workforce. These dynamics create additional downward pressure on June’s non-farm payroll figures.

Figure 2: U.S. Nonfarm Payrolls (000)

Source: Refinitiv, TradingKey

Figure 3: U.S. Continue Jobless Claims (000)

Source: Refinitiv, TradingKey

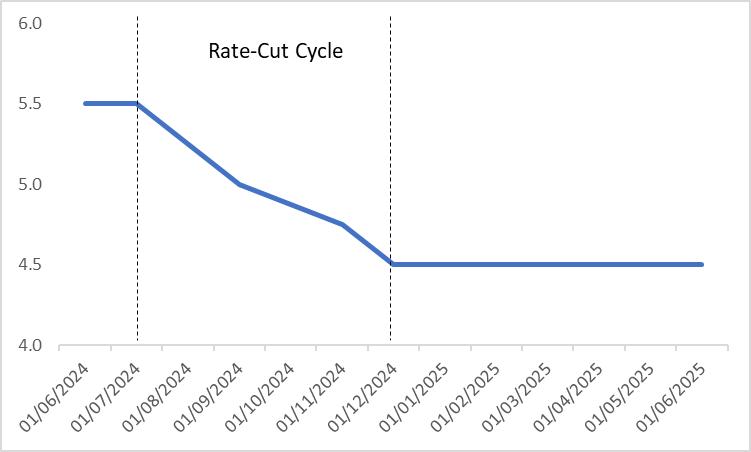

Looking forward, we anticipate sustained weakness in the U.S. labour market over the next few months, reinforcing the downward trajectory of non-farm payroll data. A weakening labour market will reduce household incomes, constraining private sector spending. This self-reinforcing labour-consumption cycle will hinder U.S. economic growth. While high tariffs may elevate imported goods prices, subdued domestic demand will limit inflationary pressures. In this environment of low growth and low inflation, the Federal Reserve is likely to initiate a new rate-cutting cycle in the near term (Figure 4).

In the equity markets, the combination of looser monetary policy and expansionary fiscal measures, such as tax reductions, is expected to mitigate the effects of economic deceleration, bolstering our bullish mid-term outlook for U.S. stocks. Consequently, should a weakening labour market, as projected, lead to a near-term market correction, it would present investors with a strategic opportunity to position for future gains.

Figure 4: Fed Policy Rate (%)

Source: Refinitiv, TradingKey

推薦文章

美股機會日報 | 估值8500億美元!傳OpenAI最新融資規模將破千億美元;黃仁勛稱將發佈幾款世界前所未見的新芯片

美股機會日報 | 凌晨3點!美聯儲將公佈1月貨幣政策會議紀要,納指期貨漲近0.5%;13F大曝光!巴菲特連續三季減持蘋果

美股機會日報 | 阿里發佈千問3.5!性能媲美Gemini 3;馬斯克稱Cybercab將於4月開始生產

港股周報 | 中國大模型「春節檔」打響!智譜周漲超138%;鉅虧超230億!美團周內重挫超10%

一周財經日曆 | 港美股迎「春節+總統日」雙假期!萬億零售巨頭沃爾瑪將發財報

從軟件到房地產,美國多板塊陷入AI恐慌拋售潮

Meta計劃為智能眼鏡添加人臉識別技術

危機四伏,市場卻似乎毫不在意