热门资讯> 正文

A Look Into Sumitomo Mitsui Finl Gr Inc's Price Over Earnings

2025-12-05 23:00

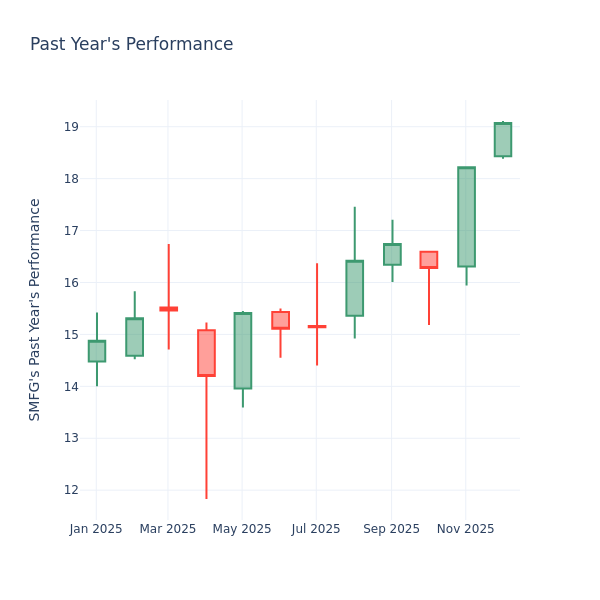

In the current session, the stock is trading at $19.05, after a 1.65% increase. Over the past month, Sumitomo Mitsui Finl Gr Inc. (NYSE:SMFG) stock increased by 16.99%, and in the past year, by 27.13%. With performance like this, long-term shareholders are optimistic but others are more likely to look into the price-to-earnings ratio to see if the stock might be overvalued.

Evaluating Sumitomo Mitsui Finl Gr P/E in Comparison to Its Peers

The P/E ratio is used by long-term shareholders to assess the company's market performance against aggregate market data, historical earnings, and the industry at large. A lower P/E could indicate that shareholders do not expect the stock to perform better in the future or it could mean that the company is undervalued.

Compared to the aggregate P/E ratio of the 15.11 in the Banks industry, Sumitomo Mitsui Finl Gr Inc. has a lower P/E ratio of 13.5. Shareholders might be inclined to think that the stock might perform worse than it's industry peers. It's also possible that the stock is undervalued.

In summary, while the price-to-earnings ratio is a valuable tool for investors to evaluate a company's market performance, it should be used with caution. A low P/E ratio can be an indication of undervaluation, but it can also suggest weak growth prospects or financial instability. Moreover, the P/E ratio is just one of many metrics that investors should consider when making investment decisions, and it should be evaluated alongside other financial ratios, industry trends, and qualitative factors. By taking a comprehensive approach to analyzing a company's financial health, investors can make well-informed decisions that are more likely to lead to successful outcomes.

推荐文章

春节休市提醒:港股除夕下午休市,大年初四开市;美股下周一休市一日

千亿资金需求下 OpenAI本周在ChatGPT上线广告

华盛早报 | 美股、金银全线暴跌,纳指跌超2%!韩国人再度扫货中国股票,大举买入MINIMAX、澜起科技;节前央行1万亿元买断式逆回购来了

美国联邦贸易委员会:苹果新闻偏袒左翼媒体、打压保守派内容

美股机会日报 | 就业数据转弱!美国至2月7日当周初请失业金人数超预期;存储概念股盘前齐升,闪迪大涨超7%

要点速递!《跑赢美股》春节特别直播核心观点总结

道指“一枝独秀”连创新高!特朗普喊话还能翻倍,轮动行情下如何平稳“上车”价值股ETF?

华盛早报 | 非农数据大超预期!首次降息或延至7月;AI恐慌交易蔓延至房地产服务板块, CBRE暴跌12%;智谱发布新模型