热门资讯> 正文

Coinbase (COIN) Stock Slides Amid Crypto Crash

2025-11-21 03:34

Coinbase Global Inc (NASDAQ:COIN) shares sank 6.4% Thursday afternoon, caught in a steep selloff that hammered the broader cryptocurrency sector. Here’s what investors need to know.

- COIN is encountering selling pressure. Track the latest developments here.

What To Know: The decline coincided with a hotter-than-expected U.S. jobs report, which slashed the probability of a December Federal Reserve interest rate cut, sending investors fleeing from speculative assets.

The downturn was led by Bitcoin (CRYPTO: BTC), which plummeted over 6.5% to approximately $86,800, while Ethereum (CRYPTO: ETH) shed roughly 7.2%, dropping to around $2,800. Popular altcoin XRP (CRYPTO: XRP) meanwhile fell 7.55% below the $2-level Thursday afternoon.

Coinbase's sharp decline underscores the stock's high sensitivity to Bitcoin’s price action. The exchange’s business model is intrinsically linked to the health of the crypto market for two specific reasons:

- Revenue Correlation: Coinbase relies heavily on transaction fees. When asset prices crash, the gross value of every trade decreases, directly reducing the percentage-based fees Coinbase collects.

- Volume Contraction: Steep drops in Bitcoin often trigger fear and massive trader liquidations. This dampens investor sentiment and drives retail traders out of the market, causing the trading volume, Coinbase's primary revenue engine, to evaporate.

With the broader Nasdaq-100 down 1.8% Thursday afternoon, Coinbase faces dual pressure from both macroeconomic headwinds and a retreating crypto market.

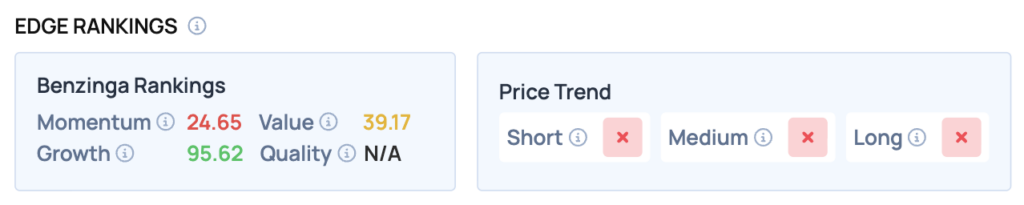

Benzinga Edge Rankings: Reflecting the intense selling pressure, Benzinga Edge analytics assign the stock a Momentum score of just 24.65, reinforcing the bearish outlook despite a strong Growth rating of 95.62.

COIN Price Action: Coinbase Global shares were down 5.89% at $242.14 at the time of publication on Thursday, according to Benzinga Pro data.

Read Also: Michael Saylor Says Strategy Will Continue To Create Shareholder Value As Long As Bitcoin Grows By This Much Annually

How To Buy COIN Stock

By now you're likely curious about how to participate in the market for Coinbase – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

In the case of Coinbase, which is trading at $242.02 as of publishing time, $100 would buy you 0.41 shares of stock.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock

推荐文章

资金复盘 | 北水净买入港股超48亿港元,逾7亿港元抢筹腾讯

华盛早报 | “AI威胁”波及华尔街!财富管理公司全线暴跌;豆包官宣“参战”!春节AI红包战愈演愈烈

美股机会日报 | 科技巨头迎利好?特朗普政府拟结构性豁免芯片关税;台积电1月销售额创历史新高,盘前股价涨近3%

一图看懂 | 净利大增60.7%!中芯国际Q4营收24.9亿美元,同比增长12.8%

美股机会日报 | 市场风格趋变?美银称接下来是小盘股的天下;金价重回5000美元上方,贵金属板块盘前齐升

新股暗盘 | 乐欣户外飙升超70%,中签一手账面浮盈4345港元;爱芯元智微涨超0.2%

高盛预计英伟达Q4营收达673亿美元 给出250美元目标股价

港股IPO持续火热!下周6股排队上市,“A+H”占比一半