热门资讯> 正文

10月份公用事业股的押注下降; Alliant Energy被做空最多

2025-11-13 02:38

- 美国联合能源(LNT) 0

- 新纪元能源公司(NEE) 0

- 第一能源(FE) 0

Bets against Utilities Select Sector SPDR Fund ETF (XLU) declined in October compared to the end of September, with Alliant Energy (LNT) being the most shorted stock in the sector and NextEra Energy (NEE) taking the spot for the least shorted.

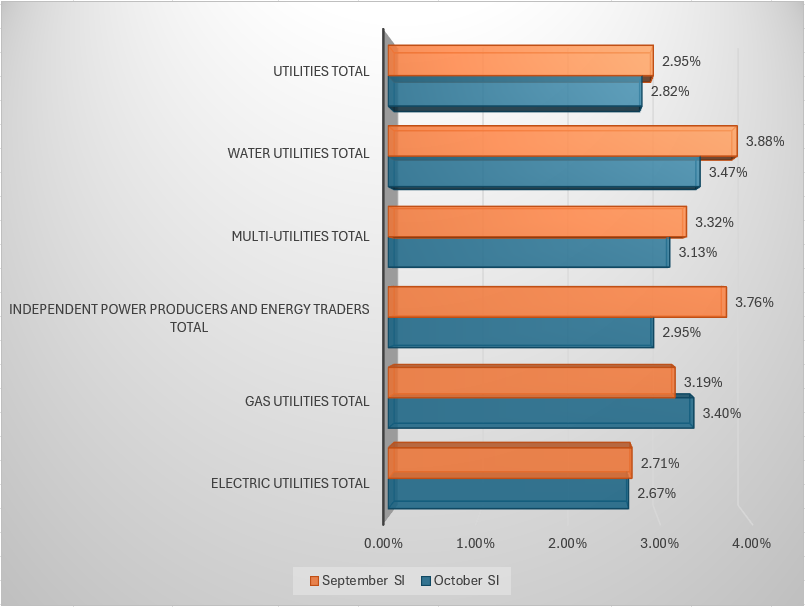

Average short interest across S&P 500 utilities stocks was 2.82% of shares float at the end of October, down from 2.95% at the end of September.

The S&P 500’s Utilities Select Sector SPDR Fund ETF (XLU) was nearly 18.5% so far this year, compared to the broader S&P500 market’s gain of 16.4% during the same period.

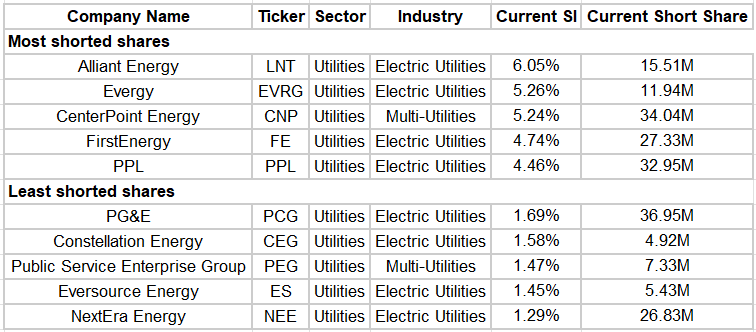

Stocks with the least and largest short positions

Average short interest as a percentage of floating shares

Seeking Alpha

Alliant Energy (LNT) had 15.51 million shares sold short as of October, or 6.05% of shares float.

Evergy (EVRG) was the second-most shorted stock with short interest of 5.26%, followed by CenterPoint Energy (CNP) with 5.24%, FirstEnergy (FE) with 4.74%, and PPL (PPL) with 4.46%.

NextEra Energy (NEE) was the least shorted stock, with 26.83 million shares sold short as of October, or 1.29% of shares float.

Eversource Energy (ES) was the second-least shorted stock, with short interest of 1.45%, followed by Public Service Enterprise Group (PEG) with 1.47%, Constellation Energy (CEG) with 1.58%, and PG&E (PCG) with 1.69%.

Industry analysis

Average short interest as a percentage of floating shares

Seeking Alpha

Water Utilities was the most shorted industry within the sector, with 3.47% short interest as of October end, which declined from 3.88% a month ago.

Gas Utilities stood at the second spot with 3.40% short interest as of the end of October, up from 3.19% at the end of September.

Multi utilities stocks took the third spot with 3.13% short interest as of October end, compared to 3.32% at the end of September.

Independent Power & Renewable Electricity Producers stood at the fourth spot with 2.95% short interest as of the end of October, down from 3.76% at the end of September.

Bets against the Electric Utilities sector as a whole have decreased to 2.67% at the end of October, compared to 2.71% a month ago.

More on The Utilities Select Sector SPDR® Fund ETF

- XLU: Cut Your Utility Investments

- XLU: Utilities Poised To Offer Blistering Returns, Strong Buy

- The XLU Buy Thesis: Cheap And Better Growth

- S&P 500 utilities stocks mostly beat Q3 estimates this week

- Bitcoin nears bear market territory as $100K level comes under pressure

推荐文章

港股周报 | 中国大模型“春节档”打响!智谱周涨超138%;巨亏超230亿!美团周内重挫超10%

一周财经日历 | 港美股迎“春节+总统日”双假期!万亿零售巨头沃尔玛将发财报

一周IPO | 赚钱效应持续火热!年内24只上市新股“0”破发;“图模融合第一股”海致科技首日飙涨逾242%

从软件到房地产,美国多板块陷入AI恐慌抛售潮

Meta计划为智能眼镜添加人脸识别技术

危机四伏,市场却似乎毫不在意

美股机会日报 | 降息预期升温!美国1月CPI年率创去年5月来新低;净利、指引双超预期!应用材料盘前涨超10%

财报前瞻 | 英伟达Q4财报放榜在即!高盛、瑞银预计将大超预期,两大关键催化将带来意外惊喜?