热门资讯> 正文

Seeking Alpha Quant warned about Fiserv months before crash

2025-10-31 19:27

With too many headlines to digest in markets this week, a notable fintech blowup flew under the radar. Fiserv (FI), the company behind the Clover point-of-sale terminals seen in many stores, crashed 44% after its earnings on Wednesday, and slid another 7.6% yesterday to lose nearly half of its value across only two sessions. This shocked the nearly three dozen analysts on Wall Street (except for lone bear Dominic Ball), triggering a flurry of immediate downgrades and rating reassessments.

What happened? The company slashed its guidance after third-quarter results severely missed expectations, while fears over management took hold of investors. Prior CEO Frank Bisignano left in May to head up the Social Security Administration under the Trump administration (and later the IRS too). However, his successor, Mike Lyons, just called prior sales forecasts "objectively difficult to achieve," setting up dueling narratives of who is to blame for the underperformance.

"One of the most hated companies in finance," writes SA premium subscriber Kansas King. "They have the worst customer service given the services they provide and they charge an insane amount for what they offer. Fiserv can be a great long-term company, but they have to fix some fundamental issues. They also have to somehow navigate the massive ship through potential crypto/stablecoin disruption." Other concerns center around competitors and cheaper alternatives, such as Toast (TOST) or Block's (XYZ) Square systems.

Looking to reassure investors, Fiserv (FI) has outlined a reset starting with leadership at the top. There will be new co-presidents to drive "execution, collaboration and accountability," as well as a new CFO to "add domain expertise and experience." Governance will also be strengthened with three new directors, including new audit and independent chairs. "The action plan, in my view, just worsens the situation," said SA analyst Julia Ostian, who notes total long-term debt of $25.6B, which is now about the size of the fintech's current market cap.

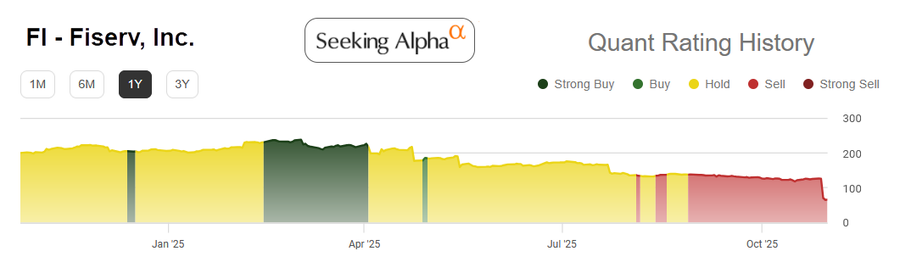

Red flags: Seeking Alpha's Quant ratings first flashed Sell signals on Fiserv (FI) in early August, before permanently setting a Sell rating on the stock later that month. At the time, the stock was still trading near $140/share, which was two months before the implosion this week that saw shares crater to $65. Discover more about Seeking Alpha Quant ratings performance here, as well as the PRO Quant Portfolio.

Seeking Alpha

More on Fiserv

- Fiserv: Don't Miss The Dip Buying Opportunities Amid The Bloodshed

- Fiserv Q3: A Brutal Selloff That Shocked Everyone

- Fiserv, Inc. (FI) Q3 2025 Earnings Call Transcript

- Fiserv stock extends decline as details of strategy overhaul, guidance reset emerge

- Fiserv downgraded to Hold-equivalent at Morgan Stanley, Goldman Sachs, BTIG

推荐文章

港股周报 | 中国大模型“春节档”打响!智谱周涨超138%;巨亏超230亿!美团周内重挫超10%

一周财经日历 | 港美股迎“春节+总统日”双假期!万亿零售巨头沃尔玛将发财报

一周IPO | 赚钱效应持续火热!年内24只上市新股“0”破发;“图模融合第一股”海致科技首日飙涨逾242%

从软件到房地产,美国多板块陷入AI恐慌抛售潮

Meta计划为智能眼镜添加人脸识别技术

危机四伏,市场却似乎毫不在意

美股机会日报 | 降息预期升温!美国1月CPI年率创去年5月来新低;净利、指引双超预期!应用材料盘前涨超10%

财报前瞻 | 英伟达Q4财报放榜在即!高盛、瑞银预计将大超预期,两大关键催化将带来意外惊喜?