热门资讯> 正文

七分之五的公司本周报告每股收益获胜:盈利记分卡

2025-09-26 21:15

Stock index futures rose on Friday as discussions on rate cuts continued to be in focus, amid the release of a key inflation gauge.

This was after Wall Street finished lower in a roller coaster session on Thursday, observing selling pressure after jobless claims fell and GDP was revised higher in the third estimate.

“Markets continued to struggle yesterday, with a broad-based selloff that saw the S&P 500 post a third consecutive decline. The main catalyst was a strong batch of U.S. data, which meant investors dialed back their expectations for rapid Fed rate cuts and pushed front-end Treasury yields higher,” Deutsche Bank's Henry Allen said.

U.S. data was the big market driver yesterday, as it painted a more resilient economic picture than previously thought, which undercut some calls for faster rate cuts.

On tariff news, President Donald Trump announced sweeping new tariffs, including 100% on branded and patented pharmaceutical drugs, to take effect on October 1, with an exemption if the company is actively building a new manufacturing facility in the U.S.

Earnings Roundup:

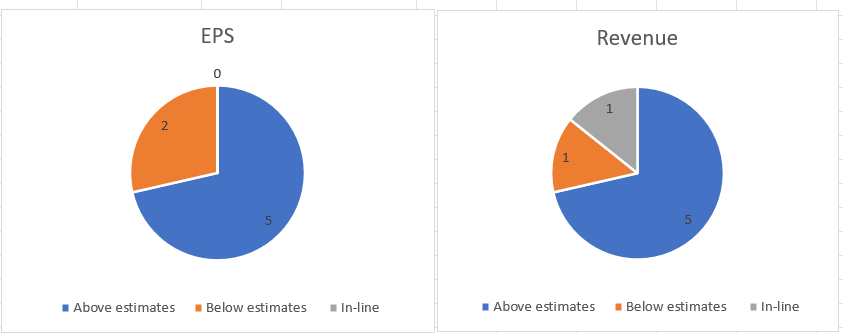

Out of the seven companies that reported earnings this week, five of them beat EPS estimates and surpassed revenue expectations.

Let’s take a look at some of the companies that reported earnings this week.

Micron Technology (MU) reported its fourth quarter fiscal 2025 financial results this week, and artificial intelligence data center growth propelled revenue well past estimates.

For the quarter ended August 28, the memory and data storage company reported adjusted earnings per share of $3.03 compared to the consensus estimate of $2.86. GAAP EPS was $2.83 versus the consensus of $2.69.

Revenue totaled $11.32B, which was more than the estimate of $11.16B.

Costco's (COST) fourth-quarter results beat Wall Street’s expectations on nearly every metric, including profit and sales.

However, comparable sales in the U.S. were slightly below expectations, and overall company comp sales decelerated from the previous quarter, an unexpected development given the lingering inflationary and tariff environment that favors value positioning among consumers.

For the fiscal fourth quarter ending August 31, Costco earned a profit of $5.87 per share, up 11% from a year ago and 7 cents better than expected. Meanwhile, total sales increased 8.1% to $86.16B and beat $86.06B estimates.

Accenture (ACN) reported better-than-expected quarterly results, but said it expects growth to slow amid U.S. federal spending cuts. Looking to fiscal 2026, Accenture expects to earn between $13.52 and $13.90 per share on an adjusted basis, with the midpoint of $13.71 slightly below the $13.78 per share estimate.

Revenue is expected to grow between 2% and 5% in local currency; however, that excludes an impact of 1% to 1.5% from the U.S. federal business, Accenture said. Analysts had forecast 5.28% year-over-year revenue growth, or $18.52B.

AutoZone (AZO) missed profit estimates with its fourth-quarter earnings report. The auto retailer said that its same-store sales rose 4.5% during the quarter to top the consensus estimate of 4.4%. Domestic same-store sales were up 4.8% vs. 4.3% consensus, and international same-store sales rose 2.1% vs. -1.3% consensus.

Gross profit as a percentage of sales fell 98 basis points during the quarter to 51.5% of sales. The decrease in gross margin was driven by a 128 basis point non-cash LIFO impact, partially offset by higher merchandise margins.

Cintas (CTAS) reported fiscal first-quarter 2026 results that topped Wall Street estimates but delivered only a modest guidance raise.

The uniform and business services provider posted revenue of $2.72 billion for the quarter ended Aug. 31, up 8.7% from a year earlier and in line with the $2.7 billion analysts anticipated.

Net income rose 8.7% year over year to $491.1 million, with earnings per share climbing 9.1% to $1.20, matching the consensus estimate

Earnings next week:

Several companies are set to report earnings next week, such as Carnival Corp. (CCL) and Jefferies Financial (JEF) on Monday, with Nike (NKE), Paychex (PAYX), and Lamb Weston Holdings (LW) reporting earnings on Tuesday.

Wednesday will see the earnings reports from Acuity Brands (AYI), Levi Strauss (LEVI), Conagra Brands (CAG), Cal-Maine (CALM), and Rezolve AI (RZLV), with VinFast (VFS), Penguin Solutions (PENG), and Tilray (TLRY) reporting on Thursday.

More on related stocks:

- Carnival: Looking For The Next Level Up

- Penguin Solutions: Momentum Building Beyond The Noise

- NIKE Q1 Preview: Market Underestimates The Turnaround

- Levi Strauss attracts a bull rating from Needham with the denim trend still strong

- Rezolve AI secures $200M oversubscribed financing

推荐文章

港股周报 | 中国大模型“春节档”打响!智谱周涨超138%;巨亏超230亿!美团周内重挫超10%

一周财经日历 | 港美股迎“春节+总统日”双假期!万亿零售巨头沃尔玛将发财报

一周IPO | 赚钱效应持续火热!年内24只上市新股“0”破发;“图模融合第一股”海致科技首日飙涨逾242%

从软件到房地产,美国多板块陷入AI恐慌抛售潮

Meta计划为智能眼镜添加人脸识别技术

危机四伏,市场却似乎毫不在意

美股机会日报 | 降息预期升温!美国1月CPI年率创去年5月来新低;净利、指引双超预期!应用材料盘前涨超10%

财报前瞻 | 英伟达Q4财报放榜在即!高盛、瑞银预计将大超预期,两大关键催化将带来意外惊喜?