热门资讯> 正文

Galaxy Digital Ramps Up Solana Bet, Pours $283 Million In Crypto, But Stock Drops Pre-Market

2025-09-15 17:58

Galaxy Digital Inc. (NASDAQ:GLXY) shares are trading lower in Monday's pre-market trading, coinciding with the cryptocurrency-focused company's purchase of over $280 million in Solana (CRYPTO: SOL).

Galaxy Bags Heaps Of SOL

Galaxy Digital bought 1.2 million SOL, worth $283.87 million at current prices, over the last 24 hours, reported on-chain analytics firm Lookonchain.

With the latest grab, the company's total SOL purchases in the last five days have reached 6.5 million, totaling $1.53 billion.

However, investors didn't seem too impressed with the accumulation drive, as the company's shares slipped 1.72% in pre-market trading.

It was unclear whether the slide could be linked to SOL’s decline of more than 5% in the recent 24 hours.

See Also: Dogecoin Pumped 20% And Bonk Hit 13%, But This Sam Altman-Linked Coin Crushed Them Both Last Week: Here’s Why

The Strategic Bet On Solana

Galaxy Digital, which operates in the digital asset and data center infrastructure sectors, has lately made strategic bets on Solana.

Earlier this month, it invested in Forward Industries, Inc. (NASDAQ:FORD) through a private investment in public equity to fund a SOL-focused treasury. The private placement, which ended up raising $1.65 billion in cash and stablecoin commitments, also included Jump Crypto and Multicoin Capital as leading investors.

The company also announced a partnership to tokenize its own shares on the Solana blockchain, marking the first time a publicly traded U.S. company let its equity be held directly on a major blockchain.

Price Action: At the time of writing, SOL was exchanging hands at $233.17, down 5.15% in the last 24 hours, according to data from Benzinga Pro.

Galaxy shares were down 1.68% in pre-market trading after closing 2.87% higher at $29.70 on Friday. Year-to-date, the stock has soared over 71%.

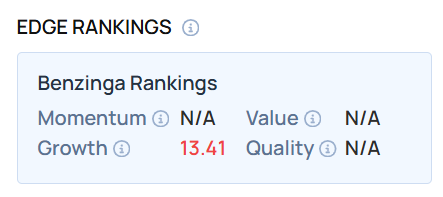

As of this writing, the stock exhibited a low Growth score. Visit Benzinga Edge Stock Rankings and compare it with other popular cryptocurrency-focused stocks such as Strategy Inc. (NASDAQ:MSTR) and Coinbase Global Inc. (NASDAQ:COIN).

Read Next:

- Peter Schiff Asks Why Bitcoin Is Selling Off While Stocks, Gold Trade At Record Highs — Arthur Hayes Wants Investors To ‘Readjust’ Perspective

Photo courtesy: Postmodern Studio / Shutterstock.com

推荐文章

美股机会日报 | 阿里发布千问3.5!性能媲美Gemini 3;马斯克称Cybercab将于4月开始生产

港股周报 | 中国大模型“春节档”打响!智谱周涨超138%;巨亏超230亿!美团周内重挫超10%

一周财经日历 | 港美股迎“春节+总统日”双假期!万亿零售巨头沃尔玛将发财报

一周IPO | 赚钱效应持续火热!年内24只上市新股“0”破发;“图模融合第一股”海致科技首日飙涨逾242%

从软件到房地产,美国多板块陷入AI恐慌抛售潮

Meta计划为智能眼镜添加人脸识别技术

危机四伏,市场却似乎毫不在意

财报前瞻 | 英伟达Q4财报放榜在即!高盛、瑞银预计将大超预期,两大关键催化将带来意外惊喜?