热门资讯> 正文

9月份可能大涨的三大科技和电信股

2025-09-12 20:45

The most oversold stocks in the communication services sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

Trade Desk Inc (NASDAQ:TTD)

- On Sept. 10, Morgan Stanley downgraded the stock from Overweight to Equal-Weight and cut its price target from $80 to $50. The company's stock fell around 13% over the past five days and has a 52-week low of $42.96.

- RSI Value: 24.3

- TTD Price Action: Shares of Trade Desk fell 2% to close at $45.24 on Thursday.

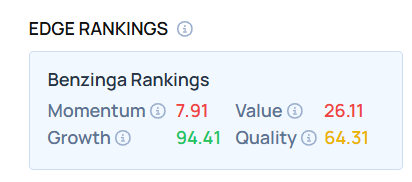

- Edge Stock Ratings: 7.91 Momentum score with Value at 26.11.

Iridium Communications Inc (NASDAQ:IRDM)

- On Sept. 11, Raymond James analyst Ric Prentiss downgraded Iridium Communications from Strong Buy to Outperform and lowered the price target from $39 to $26. The company's stock fell around 25% over the past five days and has a 52-week low of $17.08.

- RSI Value: 25.2

- IRDM Price Action: Shares of Iridium Communications gained 2.4% to close at $18.39 on Thursday.

- Benzinga Pro’s charting tool helped identify the trend in IRDM stock.

Kuke Music Holding Ltd – ADR (NYSE:KUKE)

- On Aug. 7, WEY and KUKE Music officially signed an in-depth cooperation agreement. The company's stock fell around 24% over the past five days and has a 52-week low of $1.45.

- RSI Value: 29.6

- KUKE Ltd Price Action: Shares of Kuke Music closed at $1.50 on Thursday.

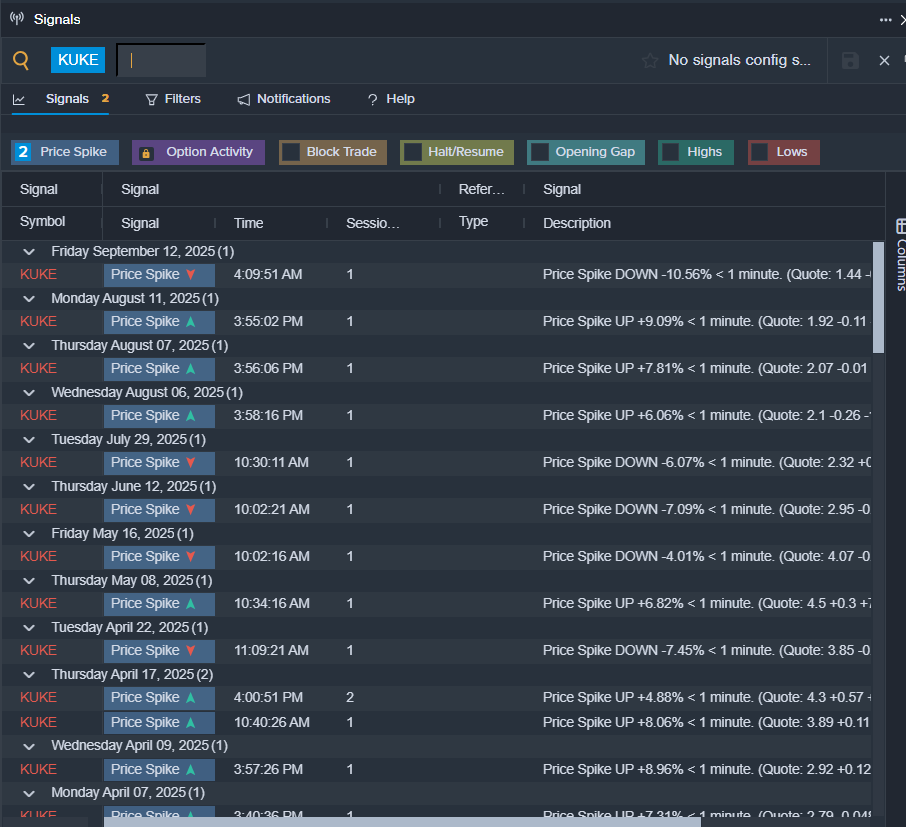

- Benzinga Pro’s signals feature notified of a potential breakout in KUKE shares.

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Read This Next:

- Top 3 Tech Stocks You’ll Regret Missing In Q3

Photo via Shutterstock

推荐文章

港股周报 | 中国大模型“春节档”打响!智谱周涨超138%;巨亏超230亿!美团周内重挫超10%

一周财经日历 | 港美股迎“春节+总统日”双假期!万亿零售巨头沃尔玛将发财报

一周IPO | 赚钱效应持续火热!年内24只上市新股“0”破发;“图模融合第一股”海致科技首日飙涨逾242%

从软件到房地产,美国多板块陷入AI恐慌抛售潮

Meta计划为智能眼镜添加人脸识别技术

危机四伏,市场却似乎毫不在意

美股机会日报 | 降息预期升温!美国1月CPI年率创去年5月来新低;净利、指引双超预期!应用材料盘前涨超10%

财报前瞻 | 英伟达Q4财报放榜在即!高盛、瑞银预计将大超预期,两大关键催化将带来意外惊喜?