热门资讯> 正文

2只造船商股票即将起飞:增长大幅飙升

2025-09-11 17:46

Two boat designers and manufacturers are turning heads in Benzinga’s Edge Stock Rankings, with big spikes in their Growth scores.

Two Boatmakers That Are Now ‘Growth’ Stocks

In Benzinga’s Edge rankings, scores are assigned to stocks based on Value, Momentum, Growth and Quality. The Growth metric is calculated primarily using the pace at which revenue and earnings have grown, with equal importance given to both long-term trends as well as the immediate performance.

See Also: 3 Real Estate Stocks Flash Strong Momentum Signals As Fed Is Expected To Cut Rates

The sector is largely immune to the tariffs, rising interest rates and cost pressures resulting from the same, given the demand inelasticity of its primary clientele.

1. MasterCraft Boat Holdings

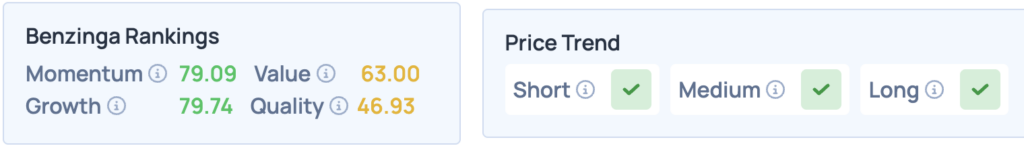

The Tennessee-headquartered designer, manufacturer and marketer of recreational powerboats, Mastercraft Holdings Inc. (NASDAQ:MCFT), is seeing a sharp spike in its Growth metrics in Benzinga’s Edge Rankings, rising from 14.06 to 79.7 within just a week.

This can primarily be attributed to its recent fourth-quarter results, with net sales up 46% year-over-year, alongside no debt and a robust balance sheet.

According to Benzinga’s Edge Stock Rankings, the stock scores high on Momentum and Growth, with a favorable price trend in the short, medium and long terms. Click here for deeper insights into the stock, its peers and competitors.

2. Malibu Boats Inc.

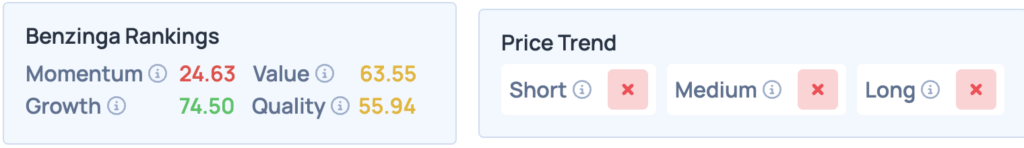

Malibu Boats Inc. (NASDAQ:MBUU) makes recreational boats based in Loudon, Tennessee, and the stock witnessed a sharp increase in its Growth metrics over the past week, rising 47.96 points from 26.49 to 74.45.

Here again, the primary driving factor is the company’s robust fourth quarter performance, with sales up 30.4% year-over-year. The company swung from a net loss of $19.6 million last year to a profit of $4.8 million this quarter, leading to increased optimism in the markets.

The stock scores high on Growth in Edge Rankings, but does poorly elsewhere, with an unfavorable price trend in the short, medium and long terms. Click here for deeper insights into the stock, its peers and competitors.

Read More:

- 2 Steel Stocks Just Saw A Big Growth Spike

Photo courtesy: Shutterstock

推荐文章

美股机会日报 | 阿里发布千问3.5!性能媲美Gemini 3;马斯克称Cybercab将于4月开始生产

港股周报 | 中国大模型“春节档”打响!智谱周涨超138%;巨亏超230亿!美团周内重挫超10%

一周财经日历 | 港美股迎“春节+总统日”双假期!万亿零售巨头沃尔玛将发财报

一周IPO | 赚钱效应持续火热!年内24只上市新股“0”破发;“图模融合第一股”海致科技首日飙涨逾242%

从软件到房地产,美国多板块陷入AI恐慌抛售潮

Meta计划为智能眼镜添加人脸识别技术

危机四伏,市场却似乎毫不在意

财报前瞻 | 英伟达Q4财报放榜在即!高盛、瑞银预计将大超预期,两大关键催化将带来意外惊喜?