热门资讯> 正文

由于15%的关税受到打击,美国饮酒者将为欧洲葡萄酒和烈酒支付更多费用

2025-08-29 01:16

US drinkers will pay more for European wine and spirits as President Trump's trade deal with the European Union (EU) hits winemakers, vendors, and consumers on both sides of the Atlantic.

The trade deal, initiated on August 1, locked in a maximum 15% tariff on most EU exports to the US. Despite lobbying by major exporters, such as France and Italy, the EU's nearly €30 billion wine and spirits industry was not granted an exemption.

President Trump previously referred to the idea of tariffs on EU wine and spirits exports as "great for the Wine and Champagne businesses in the US" in a March 13 Truth Social post.

However, producers and importers warn that US consumers will not escape the damaging economic blow these levies could inflict. The US Chamber of Commerce has warned about the influence of tariffs, particularly on small businesses and households.

"Tariffs are having a real and devastating impact on thousands of small businesses across the nation — and on all Americans — as uncertainty, rising costs, and cancellations are hitting home," they said in a report on August 7.

The association estimated the tariffs imposed so far will cost the typical household about $4,000 per year.

French Vineyards Brace for US Tariffs

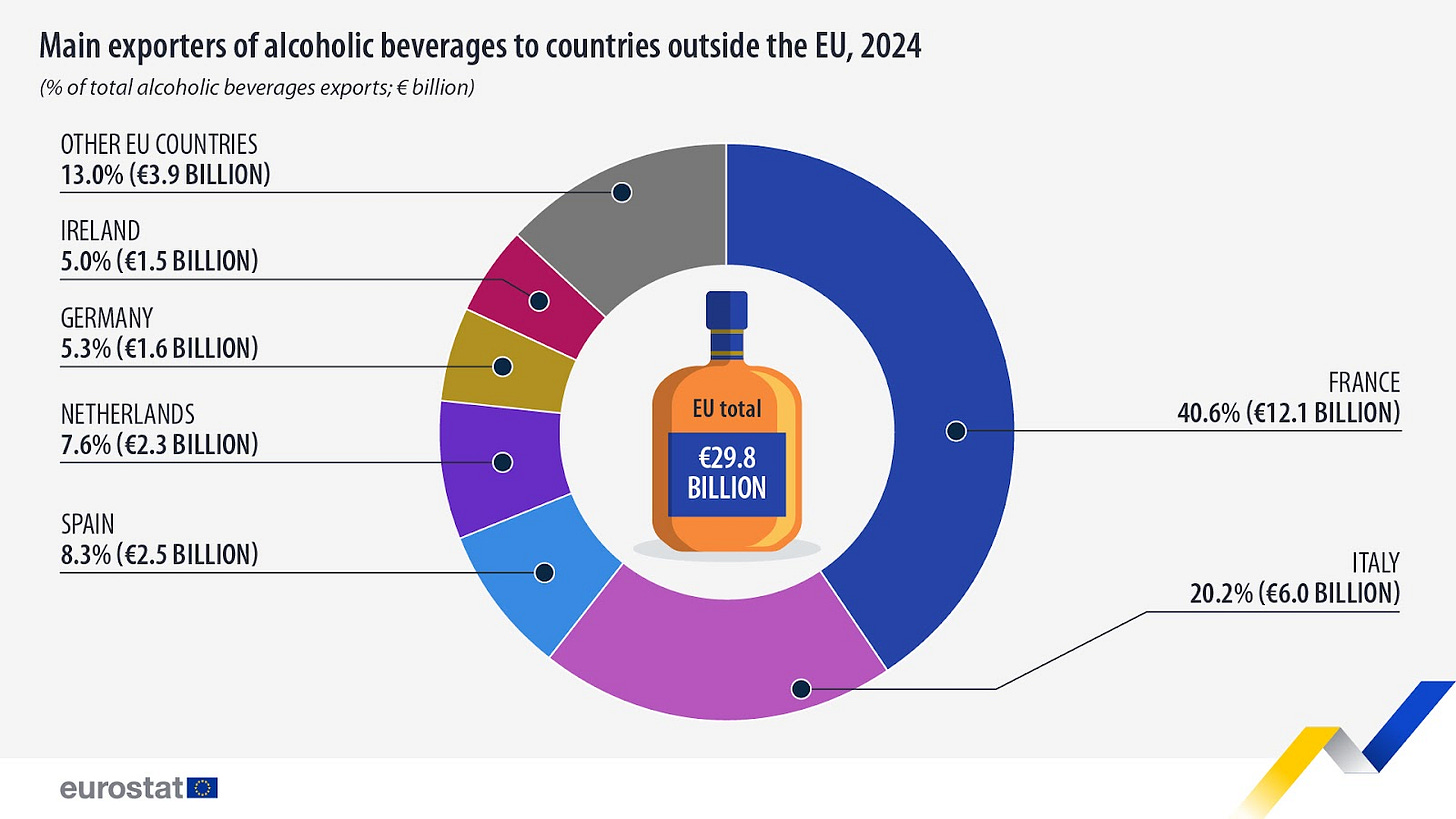

France is the world's largest exporter of wine and spirits. The EU's second-largest economy exported €12.1 billion worth of wine and spirits, €8.1 billion (66.7%) in wine and €3.8 billion (31.8%) in spirits in 2024.

French wine exports amounted to nearly 41% of the EU's total yearly wine and spirits exports, according to data from Eurostat.

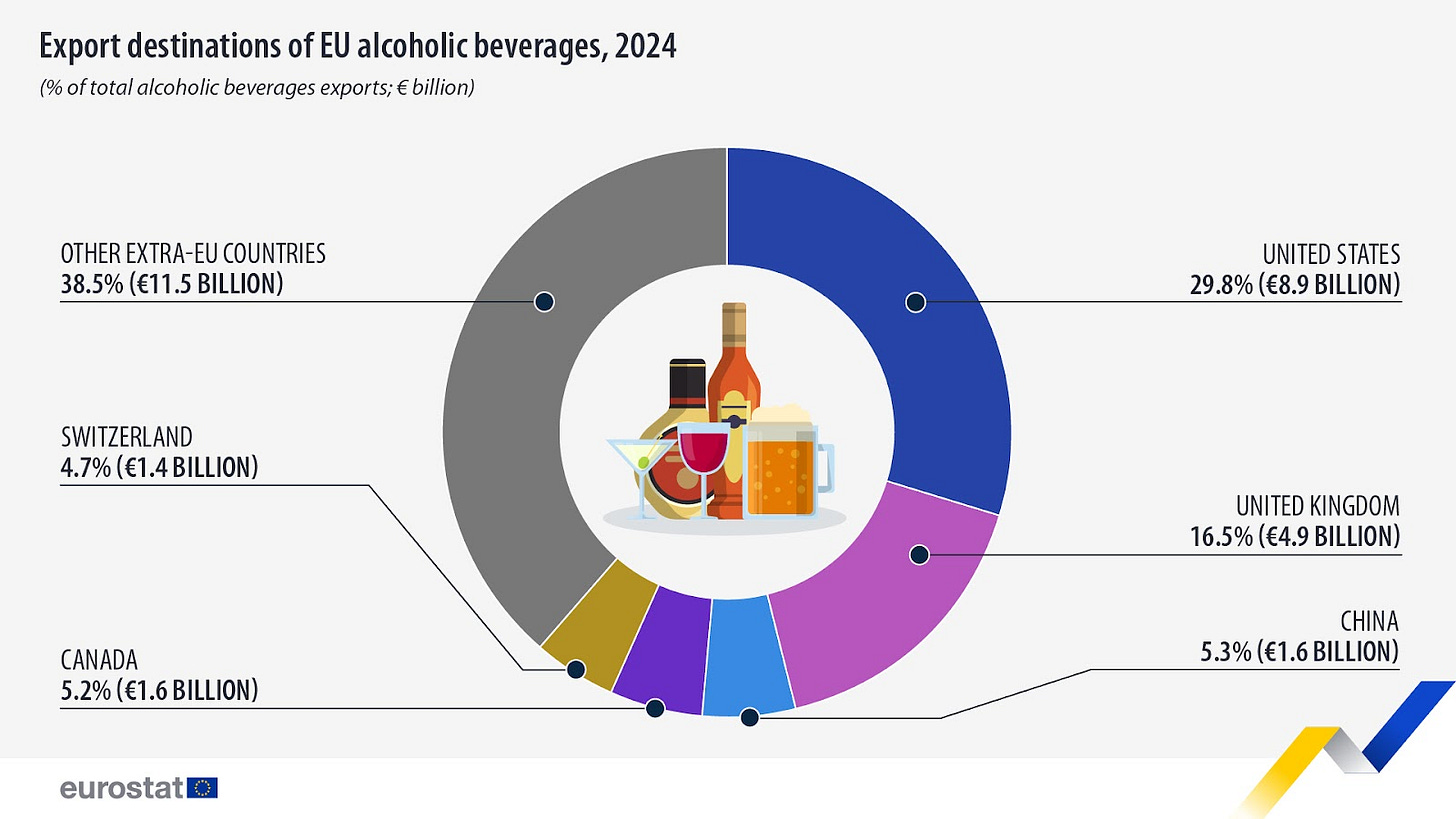

In Bordeaux, one of France's premier regions for viticulture, winemakers have started bracing for impact. The US is the EU's biggest wine and spirits market, importing around 30% (€8.9 billion) of the bloc's products in 2024.

Americans consume 20% (€400 million) of Bordeaux's total annual output.

The region, which has produced many of the world's most prestigious wines for centuries, has encountered a series of challenges.

"It's bad news, yet again," Laurent Dubois, part of the ninth generation to head Château Les Bertrands, in the Reignac region to the north of Bordeaux, told Agence France-Presse (AFP) on August 22.

"We had to reduce our area by about 10 percent (130 hectares)," the 57-year-old winemaker said. "And then we see a number of companies, winegrowers who are shutting down or are in receivership. It's scary. We say to ourselves: ‘The next one will be me.'"

Château Les Bertrands exports 10% of its yearly output to the US. Dubois said the tariffs have already impacted his US exports as importers look to the suppliers to help shoulder the extra financial burden. "But I'm French, I didn't vote for Trump," he explained. "So it's not up to me to pay, knowing that our margins are very narrow."

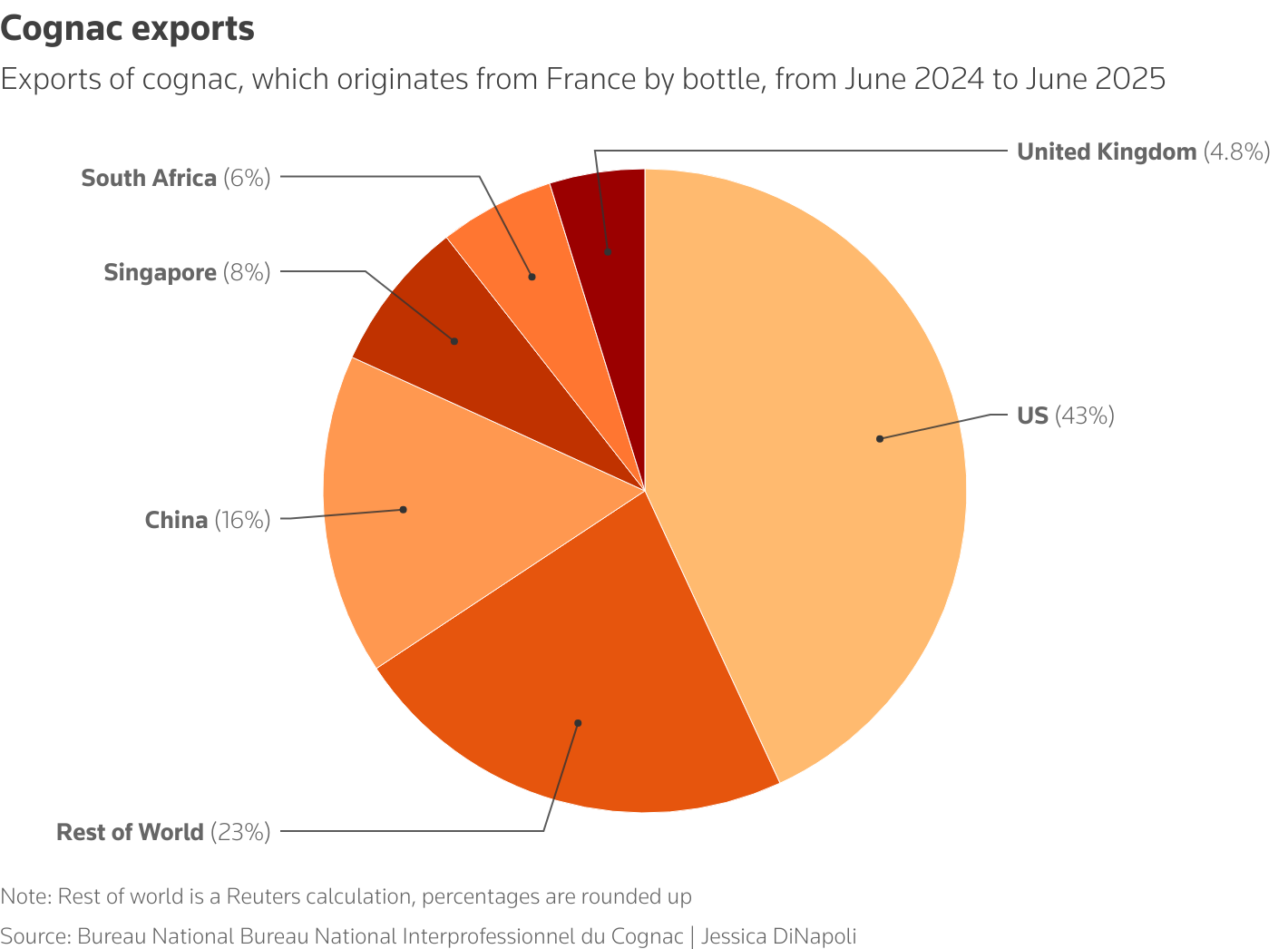

France's Cognac Producers Face Similar Tariff Exposure

The vineyards of Cognac, just north of Bordeaux, are facing similar issues. The 98% export-reliant region has already suffered under previous levies and price hikes, most notably in China, its second-largest market.

Bertrand de Witasse, a grower who supplies the Rémy Martin [RCOP.PA] distillery, told AFP he experienced a 25% decrease in orders from the major Cognac producer in anticipation of tariffs during a May contract renegotiation.

US Importers to Pay High Domestic Wine Prices

EU producers aren't the only ones set to bear the brunt of the increased duties. US importers will experience losses.

"The tariffs will make every sip of wine more expensive," Wine and Beverage Director of the Day Off Group, Kyle Davidson, told Wine Enthusiast on August 21. "If importers have to pay more, they will charge more. If demand increases for domestic supply, that will increase prices as well."

Nicole Nowlin, managing director of Able Brown Augusta, a fine-dining restaurant in Georgia, warned that the tariffs will impact the food and beverage sector.

"There are a lot of faces we aren't thinking about who will be impacted," Nowlin told Forbes in May. "Not to be bleak, but small producers, importers, distributors, retailers, and restaurants will not exist."

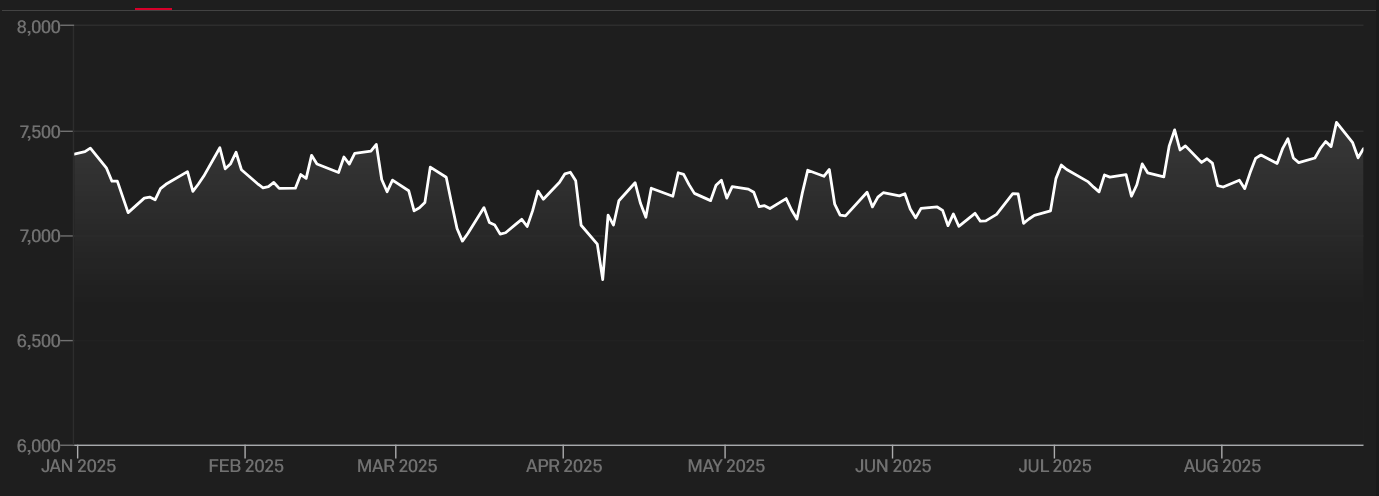

Liv-ex Fine Wine 100 Index, the industry benchmark for fine wine prices, has fallen 5.2% year-to-date (YTD). The index traces 100 of the most sought-after fine wines on the secondary market. The broader Liv-ex Fine Wine 1000 Index has dropped 5.4% YTD.

Wine and Spirits Wholesalers Warn of Tariff Pain

The DC-based Wine and Spirits Wholesalers of America (WSWA) warned that tariffs would hurt US businesses and consumers.

"The imposition of tariffs on imported wine and spirits only hurts American businesses and consumers," WSWA said in April. "Many foreign products are single-origin, as such they are desirable because of the unique characteristics imparted by where they are made."

One contributing factor to the negative sentiment regarding price increases is the inherent nature of wine itself.

"Wine is non-fungible," Travis Perez, Wine and Spirits Education Trust Diploma and former wine sales associate, told Forbes. "You cannot replicate specific communes of Burgundy that were formed over millennia by planetary evolution. The more a wine reflects terroir, the harder it is to replicate."

Despite the concerns, the Dow Jones U.S. Food & Beverage Index (^DJUSFB) has climbed 7.85% YTD. The S&P Food & Beverage Select Industry Index (^SPSIFB) has gained just 0.35% YTD.

US Imports Will Pay More for Supply Chain Inputs

Furthermore, American wine and spirits production relies on the global supply chain. US consumers will pay more when prices of EU products increase, even if they buy a California Cleret.

"Not everything can be hyper-local," CEO of Virginia Distillery, Gareth Moore, told Wine Enthusiast in a February 27 interview. "We live in a global economy. Things come from everywhere."

Moore explained that while his American single malt whiskey is made from US grain, the milling equipment is imported from the UK. From there, fermented yeast from France is added, and the mixture is distilled in Scottish stills equipped with a cooling system sourced from China. Even the wastewater unit of the boiler system comes from Canada.

Likewise, many US winemakers rely on imported French oak barrels and corks from Portugal. Given that these products are subject to the same 15% duties, it stands to reason that the "Made in the USA" label may not be enough to shield local producers from tariff-fueled price hikes.

"The margins are so small and the ripple effects are huge," Nowlin said. "It can take years to recover. Subtext: It Sucks."

Disclaimer:

Any opinions expressed in this article are not to be considered investment advice and are solely those of the authors. European Capital Insights is not responsible for any financial decisions made based on the contents of this article. Readers may use this article for information and educational purposes only.

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

推荐文章

港股周报 | 中国大模型“春节档”打响!智谱周涨超138%;巨亏超230亿!美团周内重挫超10%

一周财经日历 | 港美股迎“春节+总统日”双假期!万亿零售巨头沃尔玛将发财报

一周IPO | 赚钱效应持续火热!年内24只上市新股“0”破发;“图模融合第一股”海致科技首日飙涨逾242%

从软件到房地产,美国多板块陷入AI恐慌抛售潮

Meta计划为智能眼镜添加人脸识别技术

危机四伏,市场却似乎毫不在意

美股机会日报 | 降息预期升温!美国1月CPI年率创去年5月来新低;净利、指引双超预期!应用材料盘前涨超10%

财报前瞻 | 英伟达Q4财报放榜在即!高盛、瑞银预计将大超预期,两大关键催化将带来意外惊喜?