热门资讯> 正文

比特币在110,000美元以下可以购买吗?了解为什么“奇妙先生”凯文·奥利里喜欢投资比特币基础设施

2025-08-27 21:59

Bitcoin has dipped below $110,000 as macro conditions cool its recent all-time run, which topped $124,000 per coin earlier this month. Even at current levels the price is up more than 40% over the past six months and more than 105% from a year ago. Some investors are chasing the Bitcoin price action. Kevin O'Leary isn't.

He's investing in the infrastructure behind it.

"I like to always be invested in the picks and shovel," O'Leary said. "And Bitzero is exactly that."

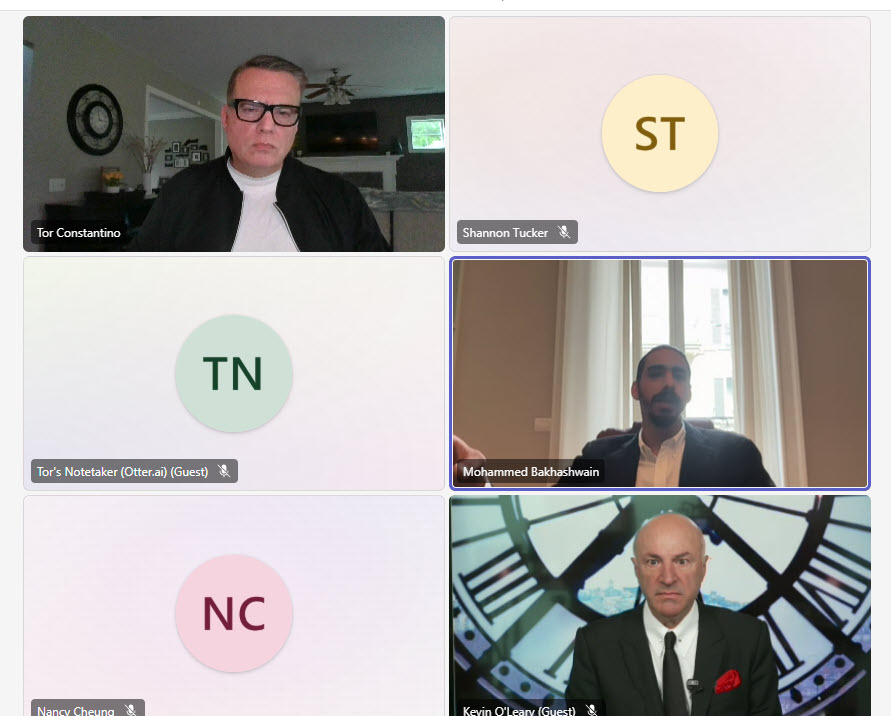

The "Shark Tank" investor and outspoken entrepreneur didn't hedge his words during a recent interview about why he's backing Bitzero, a bitcoin mining and energy-infrastructure firm led by Mohammed “Mo” Bakhashwain, a Saudi entrepreneur with roots in both real estate and crypto.

O'Leary sees Bitzero as a two-way bet: a margin-heavy miner today and a data center powerhouse for AI tomorrow.

Real Estate Plus Revenue

Bakhashwain studied real estate development in London while building a crypto portfolio on the side. That intersection—real assets plus emerging tech—eventually led to the formation of Bitzero.

Today the company operates a 40-megawatt mining facility in Norway powered entirely by hydroelectric energy. It's expanding another 70 megawatts at the same site and recently acquired three more locations, including one in Finland running on nuclear and one in North Dakota built inside a Cold War–era nuclear missile silo.

"We build our infrastructure with [AI] in mind," Bakhashwain said. "If it's the right time to take on an AI client, we're able to do that very quickly."

Right now, though, mining bitcoin still pencils out.

"Our break-even today floats around $60,000," he said. "Our EBITDA is more or less 50% of our revenues."

Many miners are struggling to stay profitable at current prices. Some are reporting break-evens above $100,000. Bitzero is already generating cash and, Bakhashwain said, gearing up to go public.

Why O'leary Invested in Bitcoin & AI Infrastructure

O'Leary said his involvement dates back to Bitzero's original plans to develop a mining facility in upstate New York, before shifting to more favorable political and economic conditions in Norway.

"New York has great restaurants," he said, "but you don't have to invest there."

His reasons for backing Bitzero are direct: it's a real estate play. It's an energy play. And it's led by someone he trusts.

"I concern myself on political risk, permitting risk, pricing risk," O'Leary said. "But the trend is your friend on all of those right now. Bitzero has power. Bitzero has a great CEO."

He sees the AI data center opportunity as a real estate problem masquerading as a compute problem. "If you don't have the power, you have nothing," he said.

AI, Power, and the Problem of Supply

The U.S. has more than 5,400 data centers. That won't be enough.

"AI data centers demand internationally is about 225 gigawatts. Domestically in the U.S., 45 gigawatts. But there's only five gigs under construction," O'Leary said.

The bottleneck? Power.

"There’s no power left on the grid," he said. "And the demand for AI is now."

That's why O'Leary is also backing a 7.4-gigawatt data center project in Grand Prairie, Alberta. It sits atop the largest stranded natural gas reserve in North America. "This is the most complex real estate I've ever been involved in," he said.

Bakhashwain sees a similar opportunity for Bitzero.

"I'd like it to be like a hybrid of the largest data center developers—let's say Equinix and Marathon," he said. "That way we have exposure to the best of both worlds."

Not Betting on Decentralization—Yet

Both O'Leary and Bakhashwain are bullish on bitcoin and AI. But decentralized AI? Not in the near-term.

"I haven't had a single tenant ask me about it," O'Leary said. "The concurrent latency is not ready for the highest level of AI compute."

Bakhashwain agreed. "No one will spend that kind of CapEx to create the decentralized network," he said.

For now, Bitzero is mining with cheap power, laying pipes for future AI workloads, and staying focused on tenants' demands.

And with bitcoin above $109,000, Bitzero's break-even around $60,000, and a potential IPO in the works, O'Leary's infrastructure bet looks well-timed.

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

推荐文章

美股机会日报 | 估值8500亿美元!传OpenAI最新融资规模将破千亿美元;黄仁勋称将发布几款世界前所未见的新芯片

美股机会日报 | 凌晨3点!美联储将公布1月货币政策会议纪要,纳指期货涨近0.5%;13F大曝光!巴菲特连续三季减持苹果

美股机会日报 | 阿里发布千问3.5!性能媲美Gemini 3;马斯克称Cybercab将于4月开始生产

港股周报 | 中国大模型“春节档”打响!智谱周涨超138%;巨亏超230亿!美团周内重挫超10%

一周财经日历 | 港美股迎“春节+总统日”双假期!万亿零售巨头沃尔玛将发财报

从软件到房地产,美国多板块陷入AI恐慌抛售潮

Meta计划为智能眼镜添加人脸识别技术

危机四伏,市场却似乎毫不在意