热门资讯> 正文

CAVA Group: Back-to-Back Uncertainty Weighs On The Stock

2025-08-15 01:49

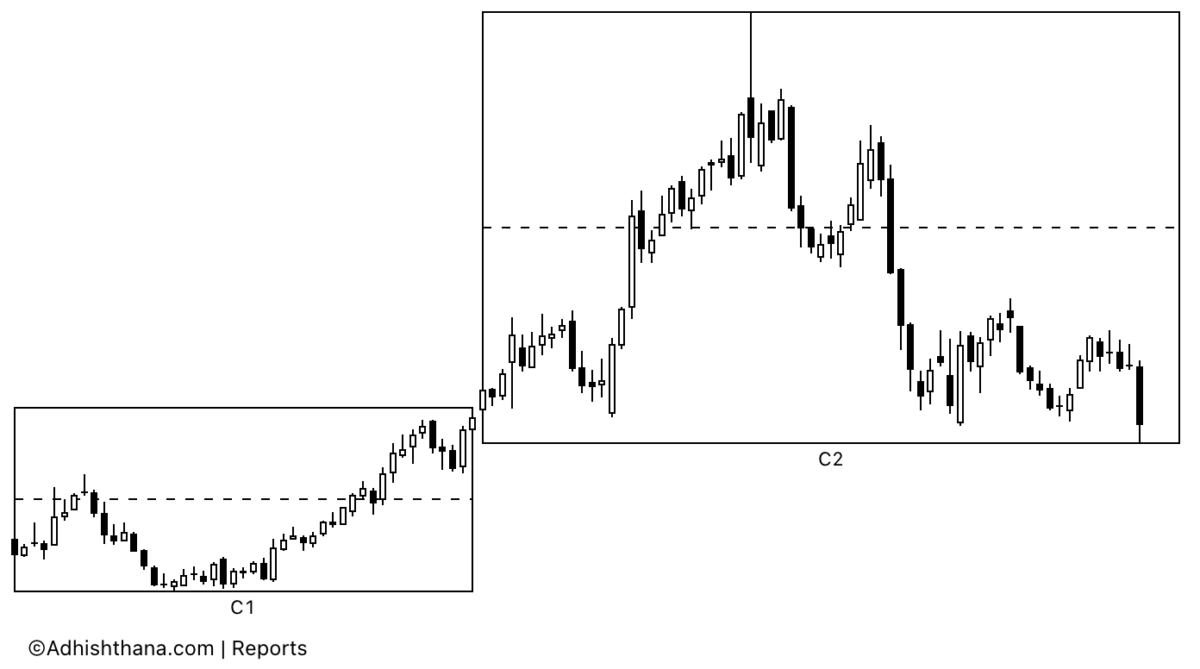

CAVA Group's (NYSE:CAVA) recent decline is not just a random market move; when viewed through the lens of the Adhishthana Principles, the weakness becomes more apparent. The stock is currently in Phase 2 of its 18-phase Adhishthana cycle on the weekly chart, and misalignment in this phase has set the stage for prolonged volatility.

Why Has CAVA Been Falling for Over 180 Days?

The Adhishthana Principles, our proprietary cyclical framework that blends quantitative signals with behavioral market patterns, outline that Phase 2 has two distinct parts.

- Sankhya Period: Typically begins with consolidation or mild bearish movement.

- Buddhi Period: Often follows with strong, sustained breakouts.

In CAVA's case, the stock did not follow this ideal structure. Instead of consolidating during the Sankhya period, it began rallying early. According to the principles, rallies in this early stage are usually unsustainable, often retracing back to their starting point. That's exactly what happened: CAVA has now given back those gains, taking investors on a full round trip.

This mirrors lessons seen in other stocks. For example, Lennar (NYSE:LEN) (read our commentary here) followed Phase 2 exactly as expected, with a proper consolidation before breaking out. CAVA, however, skipped that step, which has brought on the current selloff.

"Decisions should follow only when alignment with the Principles of Adhishthana is achieved. If Phase 2 is not executed properly, the Yajña, C5, and C6 must be observed before making a decision."

— Adhishthana: The Principles That Govern Wealth, Time & Tragedy

Investor Outlook

With Phase 2 misaligned, caution is warranted. The weekly structure shows ongoing volatility risk, while the monthly chart reveals the stock is still in Phase 1, a no-action zone in the framework. This combination means the stock could continue to trade with uncertainty in the near term.

For now, investors may want to avoid new positions until the structure realigns with the Adhishthana Principles. Similar caution applies to MP Materials (NYSE:MP), which has been rallying recently but faces a comparable Phase 2 misalignment (read our commentary here).

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga's reporting and has not been edited for content or accuracy.

推荐文章

港股周报 | 中国大模型“春节档”打响!智谱周涨超138%;巨亏超230亿!美团周内重挫超10%

一周财经日历 | 港美股迎“春节+总统日”双假期!万亿零售巨头沃尔玛将发财报

一周IPO | 赚钱效应持续火热!年内24只上市新股“0”破发;“图模融合第一股”海致科技首日飙涨逾242%

从软件到房地产,美国多板块陷入AI恐慌抛售潮

Meta计划为智能眼镜添加人脸识别技术

危机四伏,市场却似乎毫不在意

美股机会日报 | 降息预期升温!美国1月CPI年率创去年5月来新低;净利、指引双超预期!应用材料盘前涨超10%

财报前瞻 | 英伟达Q4财报放榜在即!高盛、瑞银预计将大超预期,两大关键催化将带来意外惊喜?