热门资讯> 正文

Short Seller Warns Willscot's $3.6 Billion Debt Is A Ticking Time Bomb That Could Leave Investors Empty-Handed

2025-08-11 20:35

Keith Dalrymple of DF Research has published a report alleging that Willscot Holdings Corp. (NASDAQ:WSC), a mobile office and site storage provider, is a “financial construct” with an “end-of-life fleet and a looming debt bomb” that could make its equity worthless.

Check out the WSC stock price over here.

What Happened: The report claims that the company's financial results are artificially inflated by underinvesting in its rental equipment, which is allegedly “old, decrepit, and otherwise unrentable.”

The research highlights a significant increase in the company's depreciation costs in its second-quarter 10-Q filing. Depreciation of rental equipment surged by 17% year-over-year to $88.4 million, despite a decline in leasing revenues and units on rent.

Willscot did not immediately respond to Benzinga’s request for comment.

Furthermore, the report casts doubt on the company’s ability to repay its substantial debt load. Willscot has a total of $3.6 billion in debt, with a $1.5 billion portion due in June 2027.

The report concludes that if these conditions persist, shareholders may be left with an “ancient, largely unrentable fleet, and $3.6B in debt,” in which case, the equity “could be worthless.”

See Also: Activist Short Seller NINGI Says Marex Group Uses Off Balance Sheet Funds To Inflate Results, Calls It ‘House Of Cards’ Built On Fake Profits

Why It Matters: DF Research interprets the large depreciation change as an “accounting fire-drill” and the likely outcome of “negotiations with the auditor on how to write-down the value of the fleet—one painful impairment or slowly and quietly.”

Additionally, DF Research contends that the company “cannot repay the debt with its in-place inventory,” as it has few of the newer units customers want and a vast majority of older, less-demanded units.

The report also notes the departure of WSC's Chief Accounting Officer, coinciding with this change in accounting policy.

Price Action: WSC stock fell 1.30% on Friday. It was down 26.94% year-to-date and 28.63% lower over the past year.

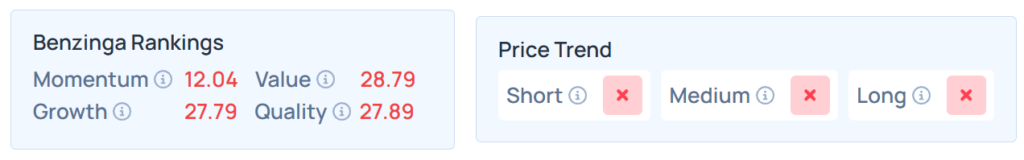

Benzinga's Edge Stock Rankings indicate that WSC maintains a weaker price trend over the long, short, and medium terms. The stock also scores poorly on growth and quality rankings. Additional performance details are available here.

Price Action: The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, were higher in premarket on Monday. The SPY was up 0.21% at $638.50, while the QQQ advanced 0.18% to $575.59, according to Benzinga Pro data.

Read Next:

- Donald Trump Blasts Paul Krugman, Calls Him ‘Wrong For Years’ As His Predictions Kept People Out Of ‘Best Market In History’

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image Via Shutterstock

推荐文章

港股周报 | 中国大模型“春节档”打响!智谱周涨超138%;巨亏超230亿!美团周内重挫超10%

一周财经日历 | 港美股迎“春节+总统日”双假期!万亿零售巨头沃尔玛将发财报

一周IPO | 赚钱效应持续火热!年内24只上市新股“0”破发;“图模融合第一股”海致科技首日飙涨逾242%

从软件到房地产,美国多板块陷入AI恐慌抛售潮

Meta计划为智能眼镜添加人脸识别技术

危机四伏,市场却似乎毫不在意

美股机会日报 | 降息预期升温!美国1月CPI年率创去年5月来新低;净利、指引双超预期!应用材料盘前涨超10%

财报前瞻 | 英伟达Q4财报放榜在即!高盛、瑞银预计将大超预期,两大关键催化将带来意外惊喜?