热门资讯> 正文

SA Sentiment: What's next for the S&P 500 in 2025?

2025-08-05 22:08

- 海桥黄金(SA) 0

- SP Plus(SP) 0

- 多伦多道明银行(TD) 0

Despite some fears that Wall Street may be headed for a pullback in the near term, given high equity valuations and concerning economic data, the S&P 500 (SP500) index rebounded at the start of this week.

This was after Friday's selloff triggered by data showing that jobs growth had been worse than previously thought. Adding to concerns are an uptick in inflation, President Donald Trump's latest tariff blitz, and the looming deadline for trade negotiations with China.

It's important to note that August and September are historically weaker months for the stock market. The S&P 500 (SP500) has gained nearly 8% YTD and saw three straight monthly gains, but what could be in store for the benchmark stock index for the rest of the year?

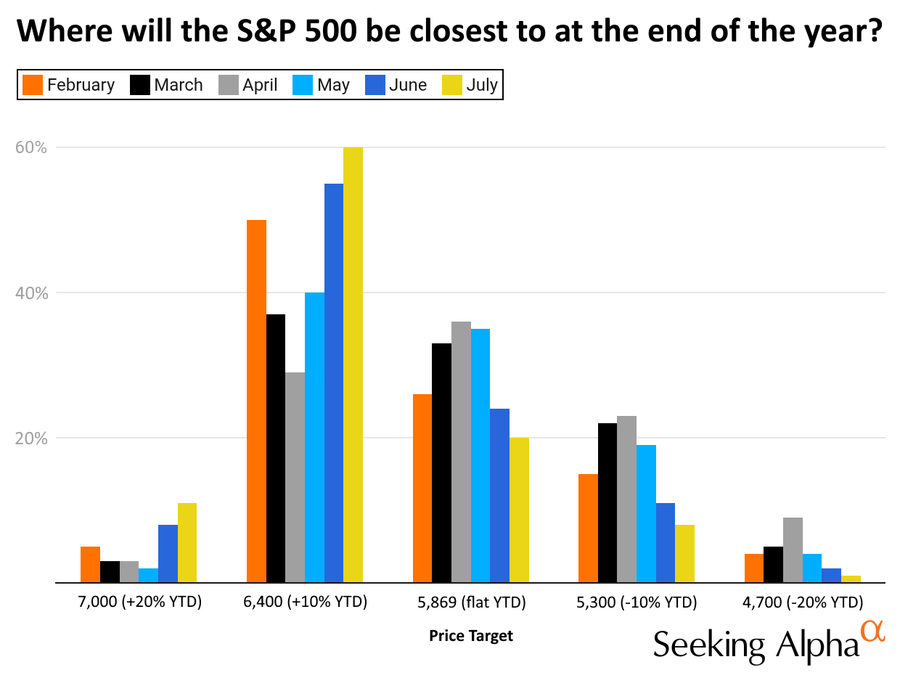

According to July's Sentiment Survey, which received around 1,000 responses, Seeking Alpha subscribers continued to be bullish on the market trajectory.

The percentage of survey respondents expecting the S&P 500 to rise 10% this year increased 5 percentage points M/M and 33 pp since April. Interestingly, the percentage expecting the index to fall 10% by year-end declined 15 pp since April.

Take a look at S&P 500 (SP500) expectations for the year:

Seeking Alpha survey by Wall Street Breakfast

More on S&P 500

- Bull Streak Ends As August Begins

- S&P 500: Maybe They Did Just Ring A Bell At The Top

- Market Faces Major Turning Point After Shocking Jobs Miss

- 3 Market Predictions For August

- I'm Buying This Market Dip With Leverage

推荐文章

港股周报 | 中国大模型“春节档”打响!智谱周涨超138%;巨亏超230亿!美团周内重挫超10%

一周财经日历 | 港美股迎“春节+总统日”双假期!万亿零售巨头沃尔玛将发财报

一周IPO | 赚钱效应持续火热!年内24只上市新股“0”破发;“图模融合第一股”海致科技首日飙涨逾242%

从软件到房地产,美国多板块陷入AI恐慌抛售潮

Meta计划为智能眼镜添加人脸识别技术

危机四伏,市场却似乎毫不在意

美股机会日报 | 降息预期升温!美国1月CPI年率创去年5月来新低;净利、指引双超预期!应用材料盘前涨超10%

财报前瞻 | 英伟达Q4财报放榜在即!高盛、瑞银预计将大超预期,两大关键催化将带来意外惊喜?