热门资讯> 正文

这些分析师在第二季度业绩公布后下调了对Newell品牌的预测

2025-08-05 01:45

- 纽威乐柏美(NWL) 0

- 纳比特(NA) 0

- 盛大科技(SDA) 0

Newell Brands Inc. (NASDAQ:NWL) reported in-line earnings for the second quarter on Friday.

The Paper Mate maker reported adjusted earnings per share of 24 cents, in line with the analyst consensus. Quarterly sales of $1.935 billion (down 4.8% year over year) missed the analyst consensus estimate of $1.947 billion.

Chris Peterson, Newell Brands President and Chief Executive Officer, said, “As part of our journey to become a world class consumer products company, we took another important step forward by delivering net sales, core sales, normalized operating margin and normalized EPS all within the guidance ranges we provided last quarter. In a challenging macroeconomic environment, our team has demonstrated tremendous agility and our strategy gives us confidence that we are on the right track to continue to improve our rate of core sales growth, drive margin improvement and generate strong cash flow.”

Newell Brands now expects third-quarter adjusted EPS of 16 to 19 cents, below the 26-cent consensus. Its full-year 2025 adjusted EPS guidance was lowered to 66 to 70 cents from 70 to 76 cents, citing higher tariff-related inventory costs.

Newell Brands shares gained 5.4% to trade at $5.01 on Monday.

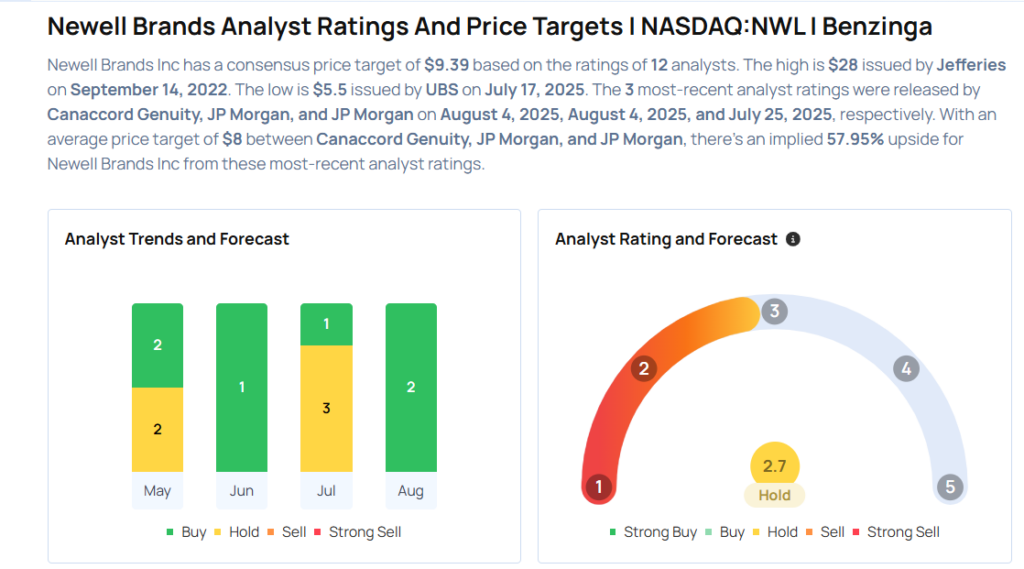

These analysts made changes to their price targets on Newell Brands following earnings announcement.

- JP Morgan analyst Andrea Teixeira maintained Newell Brands with an Overweight rating and lowered the price target from $8 to $7.

- Canaccord Genuity analyst Brian McNamara maintained the stock with a Buy and lowered the price target from $11 to $9.

Considering buying NWL stock? Here’s what analysts think:

Read This Next:

- Top 2 Financial Stocks That May Collapse This Month

Photo via Shuttersock

推荐文章

港股周报 | 中国大模型“春节档”打响!智谱周涨超138%;巨亏超230亿!美团周内重挫超10%

一周财经日历 | 港美股迎“春节+总统日”双假期!万亿零售巨头沃尔玛将发财报

一周IPO | 赚钱效应持续火热!年内24只上市新股“0”破发;“图模融合第一股”海致科技首日飙涨逾242%

从软件到房地产,美国多板块陷入AI恐慌抛售潮

Meta计划为智能眼镜添加人脸识别技术

危机四伏,市场却似乎毫不在意

美股机会日报 | 降息预期升温!美国1月CPI年率创去年5月来新低;净利、指引双超预期!应用材料盘前涨超10%

财报前瞻 | 英伟达Q4财报放榜在即!高盛、瑞银预计将大超预期,两大关键催化将带来意外惊喜?