热门资讯> 正文

Waste Management Analysts Increase Their Forecasts After Strong Q2 Earnings

2025-07-31 03:14

Waste Management Inc (NYSE:WM) reported better-than-expected earnings for the second quarter, after the closing bell on Monday.

The company posted quarterly earnings of $1.92 per share which beat the analyst consensus estimate of $1.89 per share. The company reported quarterly sales of $6.430 billion which beat the analyst consensus estimate of $6.369 billion.

“As we described at our recent Investor Day, WM is building distinctive platforms to drive competitive differentiation and fuel a powerful, long-term growth engine to create shareholder value. Our second quarter results are a strong demonstration of our progress on all fronts,” said Jim Fish, WM’s CEO. “Our Collection and Disposal business produced robust organic revenue growth and margin expansion, achieving the Company’s best-ever operating expense margin. We also grew operating EBITDA by double digits in both our Recycling Processing and Sales and WM Renewable Energy segments, as the earnings contributions from investments we have made in our sustainability businesses accelerate. Additionally, we continue to integrate our newest segment, WM Healthcare Solutions, and benefit from the impact of WM’s culture and operational excellence on customer relationships, cost efficiency, and financial results.”

Waste Management lowered its FY2025 sales guidance from $25.550 billion-$25.800 billion to $25.275 billion-$25.475 billion.

Waste Management shares fell 0.7% to trade at $233.95 on Wednesday.

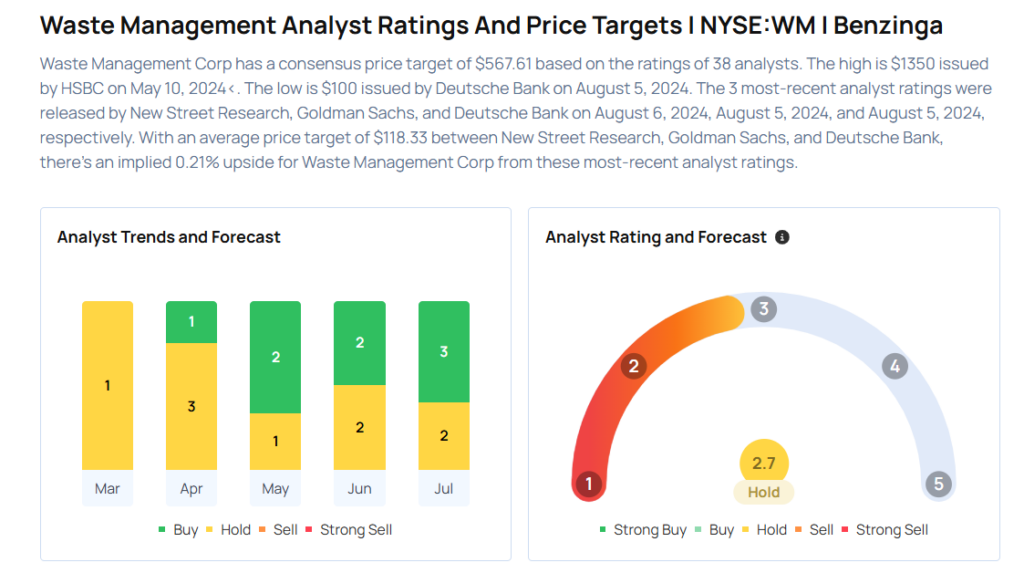

These analysts made changes to their price targets on Waste Management following earnings announcement.

- Oppenheimer analyst Noah Kaye maintained Waste Management with an Outperform rating and raised the price target from $260 to $265.

- UBS analyst Jon Windham maintained the stock with a Neutral and raised the price target from $260 to $265.

- BMO Capital analyst Devin Dodge maintained Waste Management with a Market Perform rating and raised the price target from $245 to $248.

Considering buying WM stock? Here’s what analysts think:

Read This Next:

- Jim Cramer Prefers This Financial Stock Over Brighthouse Financial

Photo via Shutterstock

推荐文章

港股周报 | 中国大模型“春节档”打响!智谱周涨超138%;巨亏超230亿!美团周内重挫超10%

一周财经日历 | 港美股迎“春节+总统日”双假期!万亿零售巨头沃尔玛将发财报

一周IPO | 赚钱效应持续火热!年内24只上市新股“0”破发;“图模融合第一股”海致科技首日飙涨逾242%

从软件到房地产,美国多板块陷入AI恐慌抛售潮

Meta计划为智能眼镜添加人脸识别技术

危机四伏,市场却似乎毫不在意

美股机会日报 | 降息预期升温!美国1月CPI年率创去年5月来新低;净利、指引双超预期!应用材料盘前涨超10%

财报前瞻 | 英伟达Q4财报放榜在即!高盛、瑞银预计将大超预期,两大关键催化将带来意外惊喜?