热门资讯> 正文

Real estate stocks edge up amid strong start to earnings season

2025-07-27 00:00

Real estate stocks ended the week in green as a strong start to the quarterly earnings season boosted optimism.

About 67% of the S&P 500 real estate companies reporting quarterly financial results posted an earnings beat. Roughly 83% of the reporting companies posted a revenue beat.

A total of seven out of the 31 S&P 500 real estate companies have reported quarterly results so far, with four exceeding Wall Street earnings estimates and six surpassing the revenue consensus.

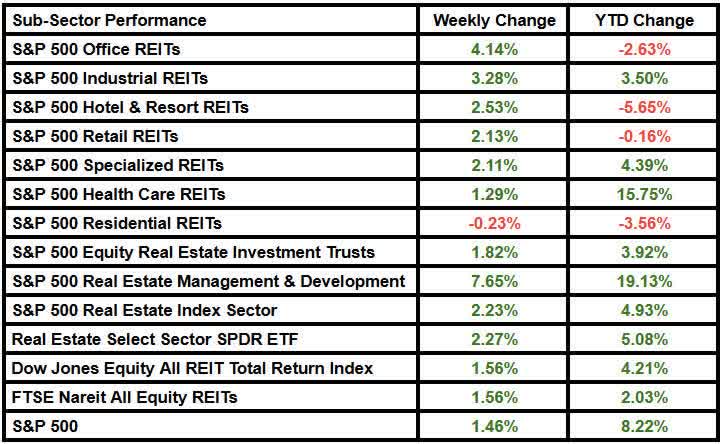

The S&P 500 Real Estate Index Sector (SP500-60) was up 2.23% from the prior week to $268.53, while the Real Estate Select Sector SPDR Fund ETF (NYSEARCA:XLRE) rose 2.27% to $42.79.

Big names set to report next week include VICI Properties (VICI) and American Tower (AMT). Options trading implies less than 7% price swings at all the reporting S&P 500 real estate companies.

Company News

- Weyerhaeuser's (WY) Q2 earnings rose from Q1 as adjusted EBITDA from its real estate, energy, and natural resources division jumped due to the timing and mix of real estate sales.

- Digital Realty's (DLR) Q2 FFO rose past the Wall Street consensus, leading the company to boost its guidance for the full year. The data center REIT also announced a partnership with Oracle to help companies accelerate hybrid IT and AI adoption.

- Alexandria Real Estate Equities (ARE) posted second-quarter revenue and adjusted funds from operations that topped Wall Street expectations.

- Essential Properties Realty Trust (EPRT) nudged up the low end of its full-year guidance range for funds from operations after posting better-than-expected Q2 revenue.

- Other significant earnings announcements came from Eastgroup Properties (EGP), Getty Realty (GTY), Brandywine Realty (BDN), Alpine Income Property Trust (PINE), Alexander & Baldwin (ALEX), and Gaming and Leisure Properties (GLPI).

- Equinix (EQIX) stock gained on a report that activist investor Elliott Investment Management boosted its stake in the data center operator.

- Omega Healthcare Investors (OHI) declared $0.67/share quarterly dividend, in line with previous.

- NETSTREIT (NTST) priced a public offering of 10.8M shares at $17.70 per share. Separately, the retail REIT raised its dividend by 2.4% to $0.215.

- Other major dividend announcements came from Farmland Partners (FPI), Community Healthcare (CHCT), JBG SMITH Properties (JBGS), and Highwoods Properties (HIW).

- LandBridge Company (LB) dropped 5% after a short report from Gotham City Research.

- Sun Communities (SUI) named Charles Young as CEO, effective October 1, 2025.

Winners & Losers

CoStar Group (CSGP) topped the S&P 500 real estate gainers, adding 9.76% during the course of the week to close at $92.97. The online real estate information and marketplace provider delivered a second-quarter beat and raised its full-year guidance.

Crown Castle (CCI) was the second-biggest sector gainer (+6.03% W/W).

CCI raised its full-year guidance as higher leasing activity led to top- and bottom-line beats for the second quarter. The telecom infrastructure REIT was upgraded at Wells Fargo after a "compelling Q2" that "makes for a compelling relative valuation story".

CBRE Group (CBRE) followed, rising 5.81% on a weekly basis.

Consequently, the S&P 500 Real Estate Management & Development index saw an increase of 7.65% from last week.

Healthpeak Properties (DOC) led the S&P 500 real estate losers, with a weekly decline of 3.93% to $17.60. The health care REIT delivered second-quarter funds from operations that matched the consensus but fell from the prior quarter.

Invitation Homes (INVH) (-1.02% W/W) and UDR (UDR) (-0.79% W/W) drove the S&P 500 Residential REITs index to the only-weekly-loser position. The property sector was down 0.23% from last week.

Office REITs topped the S&P 500 real estate subsector performances as Scotiabank upgraded SL Green Realty (SLG) on the view that New York City will remain one of the strongest office leasing markets in the U.S.

Among the other real estate stocks, City Office REIT (CIO) emerged as the top weekly gainer. The stock was up 27.78% from last week on the back of a merger news.

CIO is set to merge with MCME Carell, under which MCME Carell will acquire all outstanding shares of City Office for $7.00 per share in cash.

Uniti Group (UNIT) was the next on the list, having added 21.09% from the prior week. Uniti and Windstream have received the final regulatory approval from the California Public Utilities Commission for their planned merger.

Offerpad Solutions (OPAD) (-15.89% W/W) was a notable underperformer. The stock was losing as it announced the pricing of a $6M direct offering, concurrent private placement.

Here is a look at the subsector performances for the week:

推荐文章

港股周报 | 中国大模型“春节档”打响!智谱周涨超138%;巨亏超230亿!美团周内重挫超10%

一周财经日历 | 港美股迎“春节+总统日”双假期!万亿零售巨头沃尔玛将发财报

一周IPO | 赚钱效应持续火热!年内24只上市新股“0”破发;“图模融合第一股”海致科技首日飙涨逾242%

从软件到房地产,美国多板块陷入AI恐慌抛售潮

Meta计划为智能眼镜添加人脸识别技术

危机四伏,市场却似乎毫不在意

美股机会日报 | 降息预期升温!美国1月CPI年率创去年5月来新低;净利、指引双超预期!应用材料盘前涨超10%

财报前瞻 | 英伟达Q4财报放榜在即!高盛、瑞银预计将大超预期,两大关键催化将带来意外惊喜?