热门资讯> 正文

英伟达在全球股市指数中的排名现已超过中国和日本:4美元万亿芯片巨头的贡献压垮了整个国家--“历史性的说法很轻描淡写”

2025-07-17 14:05

Chip giant Nvidia Corp. (NASDAQ:NVDA) has reached a new milestone in the global equity markets, now standing as the single-largest contributor to the MSCI All Country World Index (ACWI).

Check out the current price of NVDA stock here.

What Happened: On Wednesday, in a post on X, The Kobeissi Letter highlighted Nvidia’s impressive standing among global equity markets, with a weightage of 4.73%, which now exceeds the weight of Japan’s entire stock market, the third largest in the world, at 4.65%.

The MSCI ACWI tracks large and mid-cap stocks across 23 developed and 24 emerging markets, representing approximately 85% of global equity market capitalization. Nvidia, whose valuation recently touched $4 trillion, now stands as the single-largest contributor to this benchmark.

See Also: Nvidia’s China Revenue ‘Is Far From Gone’, But It Outmaneuvered US For Rare Earth In Exchange For AI Chips, Says Craig Shapiro

“Nvidia's weight ALONE is now larger than Japan's 4.65% share,” the post says, calling this “incredible,” while listing other countries that now trail the chipmaker, with the U.K., China and Canada accounting for “3.28%, 2.97%, and 2.87%, respectively.”

It further notes that the company is now tied with the combined weight of France and Germany, two of Europe’s largest economies.

The post concludes by saying that the term “Historic is an understatement” for the stock and its performance over the past couple of years.

Why It Matters: Last week, Nvidia became the first company in history to be valued at more than $4 trillion, within just two years of joining the $1 trillion club. The stock is up 1,580% over the past five years.

With President Donald Trump greenlighting shipments of Nvidia’s H20 AI chips to China after a months-long ban, leading the stock to surge higher, as it stands to regain its lost $15 billion in China sales.

Recently, Benzinga readers predicted that the company will be the first to reach the $5 trillion mark as well, beating both Microsoft Corp. (NASDAQ:MSFT) and Apple Inc. (NASDAQ:AAPL).

Price Action: Nvidia shares were up 0.39% on Wednesday, trading at $171.37, and are down 0.09% after hours.

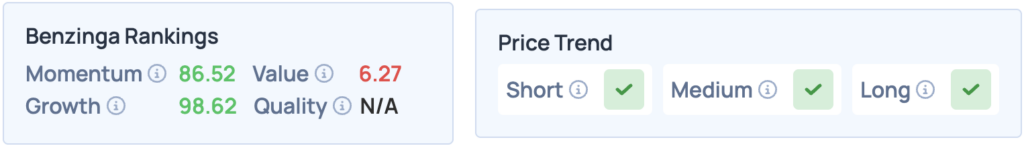

The stock scores high on Momentum and Growth according to Benzinga’s Edge Stock Rankings, and has a favorable price trend in the short, medium and long terms. Click here to see how it compares with competitors Broadcom Inc. (NASDAQ:AVGO) and Advanced Micro Devices Inc. (NASDAQ:AMD).

Photo: Hepha1st0s On Shutterstock.com

Read More:

- Nvidia’s Jensen Huang: China Doesn’t Need US Chips

推荐文章

港股周报 | 中国大模型“春节档”打响!智谱周涨超138%;巨亏超230亿!美团周内重挫超10%

一周财经日历 | 港美股迎“春节+总统日”双假期!万亿零售巨头沃尔玛将发财报

一周IPO | 赚钱效应持续火热!年内24只上市新股“0”破发;“图模融合第一股”海致科技首日飙涨逾242%

从软件到房地产,美国多板块陷入AI恐慌抛售潮

Meta计划为智能眼镜添加人脸识别技术

危机四伏,市场却似乎毫不在意

美股机会日报 | 降息预期升温!美国1月CPI年率创去年5月来新低;净利、指引双超预期!应用材料盘前涨超10%

财报前瞻 | 英伟达Q4财报放榜在即!高盛、瑞银预计将大超预期,两大关键催化将带来意外惊喜?