热门资讯> 正文

Top Wall Street Forecasters Revamp Kinder Morgan Expectations Ahead Of Q2 Earnings

2025-07-15 20:46

Kinder Morgan, Inc. (NYSE:KMI) will release earnings results for the second quarter, after the closing bell on Wednesday, July 16.

Analysts expect the Houston, Texas-based company to report quarterly earnings at 27 cents per share, up from 25 cents per share in the year-ago period. Kinder Morgan projects to report quarterly revenue of $3.75 billion, compared to $3.57 billion a year earlier, according to data from Benzinga Pro.

On April 16, Kinder Morgan reported first-quarter revenue of $4.24 billion, missing the consensus estimate of $4.08 billion, according to Benzinga Pro. The energy infrastructure company reported adjusted quarterly earnings of 34 cents per share, missing analyst estimates of 35 cents per share.

Kinder Morgan shares gained 1.7% to close at $28.32 on Monday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

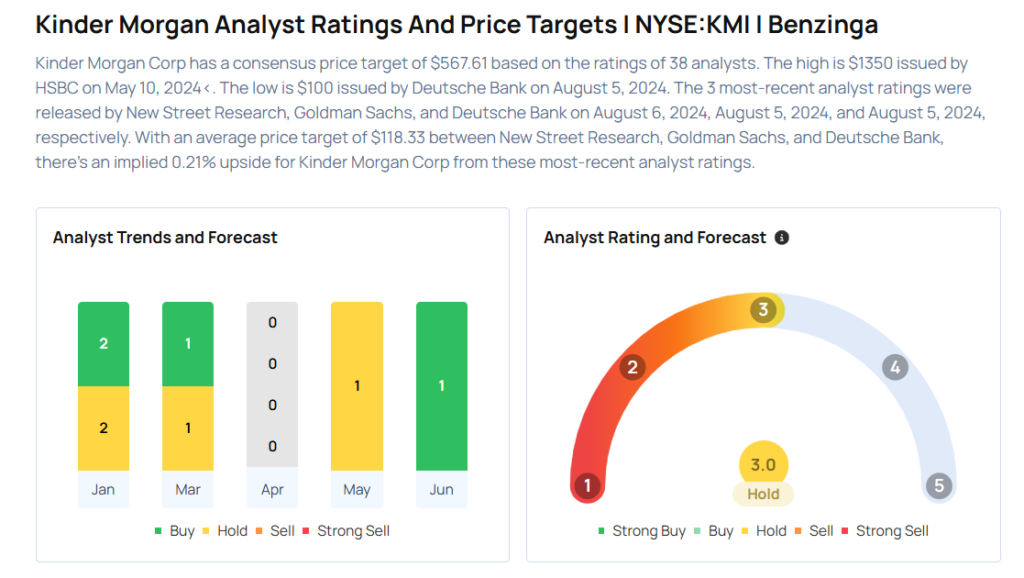

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Barclays analyst Theres Chen maintained an Overweight rating and raised the price target from $31 to $32 on June 23, 2025. This analyst has an accuracy rate of 76%.

- Stifel analyst Selman Akyol maintained a Hold rating and raised the price target from $27 to $28 on June 3, 2025. This analyst has an accuracy rate of 71%.

- Citigroup analyst Spiro Dounis maintained a Neutral rating and boosted the price target from $25 to $28 on Jan. 29, 2025. This analyst has an accuracy rate of 76%.

- Wells Fargo analyst Michael Blum maintained an Overweight rating and raised the price target from $30 to $33 on Jan. 23, 2025. This analyst has an accuracy rate of 66%.

Considering buying KMI stock? Here’s what analysts think:

Read This Next:

- JPMorgan, Wells Fargo And 3 Stocks To Watch Heading Into Tuesday

Photo via Shutterstock

推荐文章

港股周报 | 中国大模型“春节档”打响!智谱周涨超138%;巨亏超230亿!美团周内重挫超10%

一周财经日历 | 港美股迎“春节+总统日”双假期!万亿零售巨头沃尔玛将发财报

一周IPO | 赚钱效应持续火热!年内24只上市新股“0”破发;“图模融合第一股”海致科技首日飙涨逾242%

从软件到房地产,美国多板块陷入AI恐慌抛售潮

Meta计划为智能眼镜添加人脸识别技术

危机四伏,市场却似乎毫不在意

美股机会日报 | 降息预期升温!美国1月CPI年率创去年5月来新低;净利、指引双超预期!应用材料盘前涨超10%

财报前瞻 | 英伟达Q4财报放榜在即!高盛、瑞银预计将大超预期,两大关键催化将带来意外惊喜?