热门资讯> 正文

第二季度银行盈利受益于资本市场和波动的交易

2025-07-14 04:35

Banks' earnings for the year's second quarter are expected to be supported by a capital markets rebound and strong equities trading, benefiting from tariff-induced market volatility. The season kicks off on Tuesday with JPMorgan Chase (NYSE:JPM), Citigroup (NYSE:C), Wells Fargo, State Street (STT), and BNY (BK).

Morgan Stanley analyst Betsy Graseck noted that North America equity capital markets volume ended the quarter up 49% Y/Y on June 30 after tracking as low as -33% Y/Y on April 24. Global announced M&A volume ended the quarter 30% higher from a year ago, after tracking as low as -22% Y/Y on May 1.

"As a result, we expect 2Q25 investment banking revenues to be better than expected and management teams to point to pipelines building," Graseck wrote in a note to clients. On trading, she expects Q2 2025 equities markets revenue to rise 10% Y/Y.

During JPMorgan Chase's (NYSE:JPM) investor day in May, Troy Rohrbaugh, co-CEO of its Commercial & Investment Bank, said he's seeing Q2 investment banking fees down in the mid-teens from a year ago. Market fees, meanwhile, are up mid-to-high single digits Y/Y in Q2.

J.P. Morgan analyst Vivek Juneja expects banks' Q2 results to demonstrate moderate (2-3.5% Q/Q) growth in net interest income, moderate commercial & industrial loan growth, but slowing credit card loan growth, fee income growth from markets-related revenue, controlled expenses, and stable credit quality.

Truist Securities analyst John McDonald wrote, "Mid-quarter updates suggest NII stories remain on track, with improving loan growth setting up a better 2H, although deposits sounds less exciting with some questions on 2Q seasonality and competition. Fees should feature lower IB, better trading (w/ some upside) on good volatility, and puts/take with wealth."

Last month, Citigroup's (NYSE:C) Vis Raghavan, head of banking and executive vice chair, said he expects Q2 banking fees rising in single digits Y/Y. Markets are expected up in mid-to-high single-digits and "there are a few weeks left to go," he said at a conference.

Truist's McDonald said investor expectations appear to be the lowest for Wells Fargo (NYSE:WFC), among the GSIBs, and U.S. Bancorp (USB) for the super-regionals.

Positive NII-driven guidance revisions are expected at JPMorgan (NYSE:JPM) and PNC Financial (PNC), "but with offsets for the latter on a lower fee outlook," McDonald noted. He also points to angst over higher expense guidance at Bank of America (NYSE:BAC) and Citi (NYSE:C), "although investors lean to no guidance changes at both."

Among the U.S. mega-banks, Citi's Keith Horowittz said that credit concerns have subsided. He expects stock reactions to be largely tied to net interest income outlooks. He sees Wells Fargo (NYSE:WFC) as well positioned to surprise to the upside.

For Morgan Stanley's Graseck, Goldman Sachs (NYSE:GS) and JPMorgan Chase (JPM) are preferred stocks heading into earnings. For Goldman, she expects higher investment banking revenue, asset & wealth management revenue, and equities markets revenue. For JPM, she sees higher fee income, lower provision, higher NII, lower share count, and lower expenses.

"While the market seems focused on de-reg and cap markets rebound, we see greatest upside among regionals where we expect faster TBV (tangible book value) growth and improving returns from pull-to-par of securities and swap books," Citi's Horowitz wrote in a note to clients.

His top picks in the banking sector are Ally Financial (ALLY), Citizens Financial Group (CFG), and Truist Financial (TFC) "as we don’t believe long-term earnings potential is being fully appreciated despite all key risk factors (interest rate, credit and regulatory risk) flashing green."

To be prepped for Q2, here's some of the 2025 guidance that banks have issued:

- JPMorgan Chase (JPM) 2025 net interest income, excluding Markets, ~$90B; including Markets, ~$94.5B. At JPM's investor event, CFO Jeremy Barnum said NII, ex-Markets, may come in about $1B better.

- Wells Fargo (NYSE:WFC) 2025 net interest income up 1%-3% Y/Y, implying $47.7B-$47.9B.

- Citigroup (C) 2025 net interest income, ex-Markets, up 2%-3% from 2024; full-year revenue expected to be $83.1B-$84.1B.

- Bank of America (NYSE:BAC) expects Q4 2025 net interest income ("FTE") of $15.5B-$15.7B vs. $14.6B in Q1.

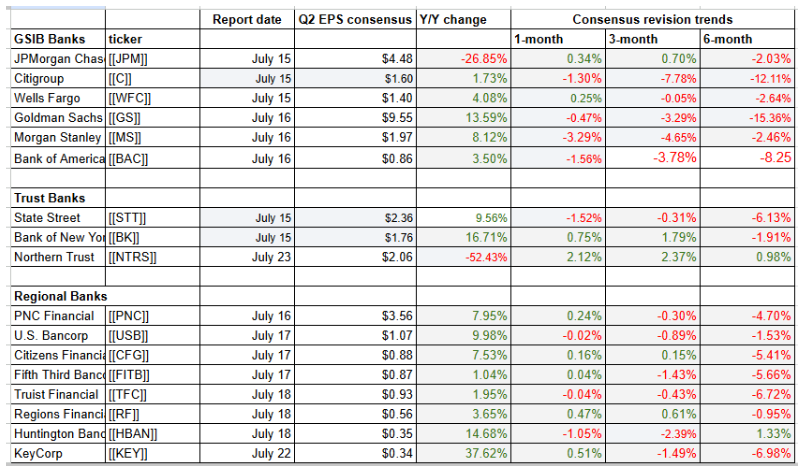

Q2 bank earnings estimates, revisions (Seeking Alpha)

More on Citigroup, Morgan Stanley

- Morgan Stanley Q2: Elevated Expectations Despite Market Turmoil In April (Earnings Preview)

- Citigroup: Expecting A Strong Q2 But Shares Aren't Cheap Here

- Bank of America: Structural Compounder, But No Urgency To Buy Today

- Citadel strikes again in market-making deal with Morgan Stanley

- Fed weighs revising framework for grading big banks as 'well-managed'

推荐文章

港股周报 | 中国大模型“春节档”打响!智谱周涨超138%;巨亏超230亿!美团周内重挫超10%

一周财经日历 | 港美股迎“春节+总统日”双假期!万亿零售巨头沃尔玛将发财报

一周IPO | 赚钱效应持续火热!年内24只上市新股“0”破发;“图模融合第一股”海致科技首日飙涨逾242%

从软件到房地产,美国多板块陷入AI恐慌抛售潮

Meta计划为智能眼镜添加人脸识别技术

危机四伏,市场却似乎毫不在意

美股机会日报 | 降息预期升温!美国1月CPI年率创去年5月来新低;净利、指引双超预期!应用材料盘前涨超10%

财报前瞻 | 英伟达Q4财报放榜在即!高盛、瑞银预计将大超预期,两大关键催化将带来意外惊喜?