热门资讯> 正文

Top 3 Energy Stocks Which Could Rescue Your Portfolio For July

2025-07-10 18:54

- Rush Street Interactive, Inc. Class A(RSI) 0

- Antero Resources Corporation(AR) 0

- Informatica Inc.(NYSE) 0

The most oversold stocks in the energy sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

Antero Resources Corp (NYSE:AR)

- Antero Resources will issue its second quarter earnings release on Wednesday, July 30, after the close of trading on the New York Stock Exchange. The company's stock fell around 7% over the past five days and has a 52-week low of $24.53.

- RSI Value: 28.4

- AR Price Action: Shares of Antero Resources fell 2.9% to close at $35.56 on Wednesday.

- Edge Stock Ratings: 43.15 Momentum score with Value at 59.89.

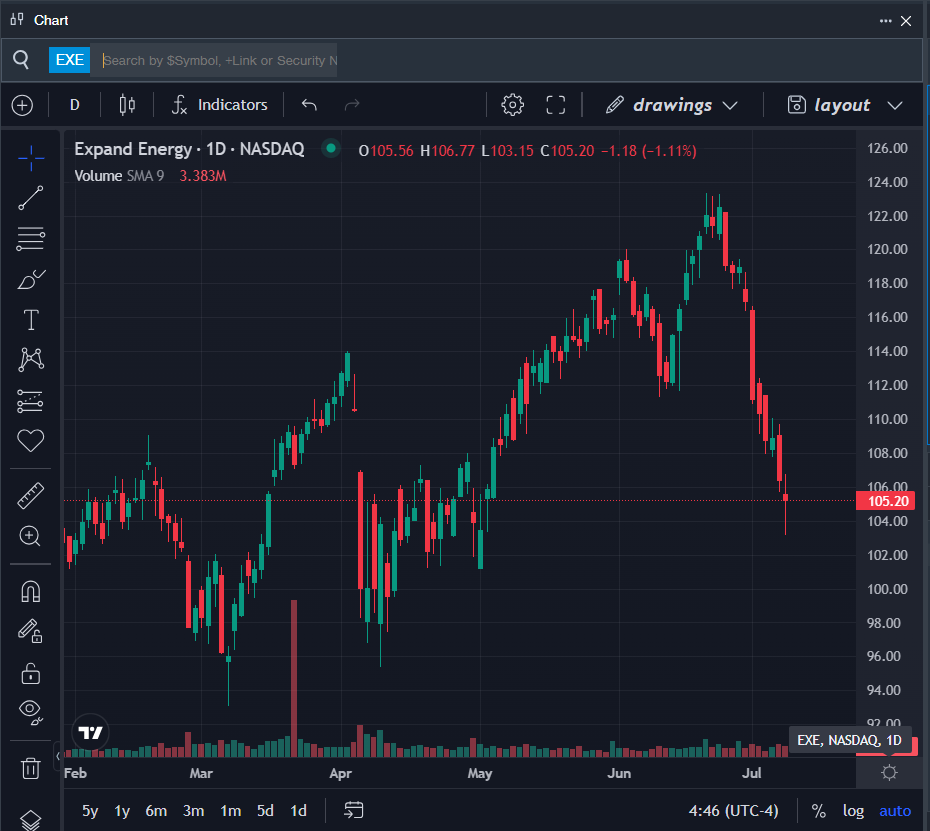

Expand Energy Corp (NASDAQ:EXE)

- On July 1, Mizuho analyst Nitin Kumar maintained Expand Energy with an Outperform rating and raised the price target from $141 to $142, while UBS analyst Josh Silverstein maintained the stock with a Buy and raised the price target from $144 to $145. The company's stock fell around 6% over the past five days and has a 52-week low of $69.12.

- RSI Value: 27.8

- EXE Price Action: Shares of Expand Energy fell 1.1% to close at $105.20 on Wednesday.

- Benzinga Pro’s charting tool helped identify the trend in EXE stock.

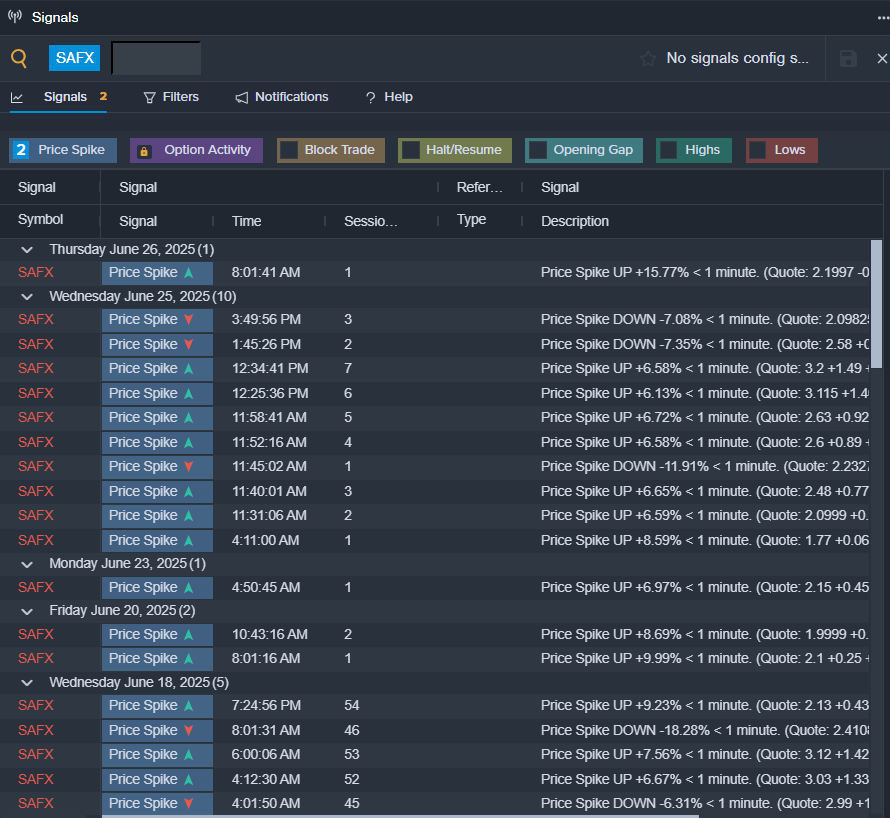

XCF Global Inc (NASDAQ:SAFX)

- On July 8, XCF Global said it produced over 2.5 million gallons of SAF, renewable diesel, and naphtha at New Rise Reno Facility during ramp-up phase. “This update is simple but important: New Rise is producing renewable fuels” said Mihir Dange, Chief Executive Officer and Board Chair of XCF. “We’ve already produced over 2.5 million gallons of SAF, renewable diesel, and renewable naphtha, proving that our model works. Further, this is a testament to the dedication and expertise of our team, who are focused on executing our strategy and driving the clean fuel transition.” The company's stock fell around 94% over the past month and has a 52-week low of $1.42.

- RSI Value: 2.3

- SAFX Ltd Price Action: Shares of XCF Global fell 6.8% to close at $1.50 on Wednesday.

- Benzinga Pro’s signals feature notified of a potential breakout in SAFX shares.

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Read This Next:

- Top 3 Risk Off Stocks That May Rocket Higher In Q3

Photo via Shutterstock

推荐文章

美股机会日报 | 市场风格趋变?美银称接下来是小盘股的天下;金价重回5000美元上方,贵金属板块盘前齐升

新股暗盘 | 乐欣户外飙升超70%,中签一手账面浮盈4345港元;爱芯元智微涨超0.2%

高盛预计英伟达Q4营收达673亿美元 给出250美元目标股价

财报大跌背后:微软正在进行一场昂贵但精准的“利润置换”

港股IPO持续火热!下周6股排队上市,“A+H”占比一半

港股周报 | “AI红包大战”厮杀!腾讯周内暴跌近10%、阿里重挫8%,南下资金出手560亿港元大举抄底

美股机会日报 | 止跌企稳!纳指期货盘前涨约0.5%,有分析称美股连遭重挫后或回升;亚马逊盘前大跌超8%

一周财经日历 | 事关降息!美国1月非农、CPI数据下周公布;恒指季检结果下周五揭晓

风险及免责提示:以上内容仅代表作者的个人立场和观点,不代表华盛的任何立场,华盛亦无法证实上述内容的真实性、准确性和原创性。投资者在做出任何投资决定前,应结合自身情况,考虑投资产品的风险。必要时,请咨询专业投资顾问的意见。华盛不提供任何投资建议,对此亦不做任何承诺和保证。