热门资讯> 正文

宏观因素、房地产市场疲软,房地产股下跌

2025-06-22 00:00

Real estate stocks were down amid rising geopolitical tensions, the Federal Reserve's wait-and-see approach to interest rates, and a weak housing market.

Bearish sentiment among individual investors fell this week as simmering tensions in the Middle East continued to worry global markets.

Meanwhile, Federal Reserve Chair Jerome Powell said at his post-decision press conference on Wednesday, after the central bank kept its policy rate unchanged at 4.25%-4.50%, that the Fed "is well-positioned to wait" to learn more about how the economy unfolds before acting.

On the other side, the housing market continued to show weaknesses as home sale prices hit an all-time high of $396,500 in the four weeks ended June 15.

Housing starts plunged more than expected in May and building permits also dropped.

The S&P 500 Real Estate Index Sector (SP500-60) fell 0.34% from the prior week to 260.71, while the Real Estate Select Sector SPDR Fund ETF (NYSEARCA:XLRE) closed 0.14% lower at 41.83.

FTSE Nareit All Equity REITs index retreated by 0.10%. However, Dow Jones Equity All REIT Total Return Index ended in green.

Next week, housing market data will again take the spotlight. The existing home sales report will be released on Monday, and the new home sales report on Wednesday.

The S&P/Case-Shiller House Price Index, a key update for the housing market, will be released on Tuesday.

Equinix (EQIX) will host an analyst day event on Wednesday, and the stock prices could be impacted. Focus will also be on a Thursday virtual meeting, which sees Barrington hosting Host Hotels & Resorts (HST).

As the annual Russell Index reconstitution becomes effective, investors should prepare for increased volatility and potential price dislocations in stocks added to or removed from the indexes. The real estate stocks that could be impacted can be found here and here.

Company News

- Iron Mountain (IRM) has commenced work on a recently awarded contract by the U.S. Department of the Treasury.

- Digital Realty (DLR) has priced a €850M offering of 3.875% guaranteed notes due 2034 at 99.137% of the principal amount. Separately, Kimco Realty (KIM) priced a $500M public offering of 5.300% notes due February 1, 2036.

- Prologis (PLD) said its chief investment officer, Joseph Ghazal, will "step away" from his role as an executive officer as of July 1.

- VICI Properties (VICI), with a dividend yield of 5.38%, found its place in a curated list of the top 10 U.S.-listed stocks with a strong track record across key dividend metrics.

- Camden Property Trust (CPT) declared a $1.05/share quarterly dividend, while BXP (BXP) declared a $0.98/share quarterly dividend.

- Orion Properties (ONL) received an unsolicited offer from Kawa Capital Management to acquire the outstanding shares of the company it doesn't already own for $2.50 per share.

- Postal Realty Trust (PSTL) said Robert Klein intends to resign as CFO in order to accept a position with a privately-held real estate company. Jeremy Garber, the company's president, treasurer and secretary, will serve as an interim CFO.

Winners & Losers

Among the individual S&P 500 real estate stocks, Extra Space Storage (EXR) stood out as the biggest loser for the week, retreating 2.36% on a weekly basis to $146.07. The self-storage REIT is down by almost the same rate year-to-date.

EXR operates in a highly fragmented market in the U.S., and competition affects its power to raise rents. The company is likely to face headwinds from lower new customer rates, according to a report by Zacks Equity Research.

However, the sell-side analysts, Seeking Alpha authors, as well as the Quant Rating system see the stock as Buy.

Timber giant, Weyerhaeuser (WY), was the next on the list, logging a weekly fall of 2.31% to $26.18. This week, Weyerhaeuser, which is looking to increase production in the U.S. amid potential tariff increases on Canadian lumber, broke ground on a $500M TimberStrand facility in south Arkansas.

Ventas (VTR) was the third major loser (-2.21% W/W). The health care REIT has been on a downward trajectory after pricing $500M of 5.1% senior notes due 2032 at an issue price equal to 99.391% of the principal amount of the notes.

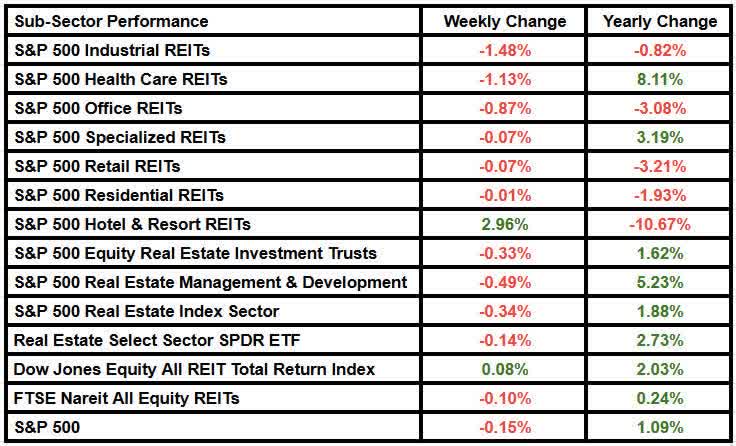

For the S&P 500 subsectors, industrial REITs led the weekly losers (-1.48% W/W), followed by health care REITs (-1.13% W/W).

Host Hotels & Resorts (HST) was an outlier, gaining 2.96% from last week to close at $15.67. Options traders are pricing in a big move for the hotel REIT stock in one direction or the other, according to a recent report by Zacks.

Host Hotels & Resorts is set to be hosted by Barrington in a virtual meeting on June 26, and the session is expected to provide insights into the company's recent performance and future prospects.

Industrial Logistics Properties Trust (ILPT), Sotherly Hotels (SOHO), Fathom Holdings (FTHM), and Anywhere Real Estate (HOUS) were the other notable names with significant price movements.

Here is a look at the subsector performances for the week:

More on Real Estate

- XLRE: Downgrade To Sell, As 5-Year Rough Patch Continues

- Long-term mortgage rates reach four-week low, estimated to fall further in 2025

- Short interest across S&P 500 real estate stocks decrease in May

推荐文章

美股机会日报 | 降息预期升温!美国1月CPI年率创去年5月来新低;净利、指引双超预期!应用材料盘前涨超10%

春节休市提醒 | 港股除夕下午休市,大年初四开市;美股下周一休市一日

千亿资金需求下 OpenAI本周在ChatGPT上线广告

华盛早报 | 美股、金银全线暴跌,纳指跌超2%!韩国人再度扫货中国股票,大举买入MINIMAX、澜起科技;节前央行1万亿元买断式逆回购来了

美国联邦贸易委员会:苹果新闻偏袒左翼媒体、打压保守派内容

美股机会日报 | 就业数据转弱!美国至2月7日当周初请失业金人数超预期;存储概念股盘前齐升,闪迪大涨超7%

要点速递!《跑赢美股》春节特别直播核心观点总结

道指“一枝独秀”连创新高!特朗普喊话还能翻倍,轮动行情下如何平稳“上车”价值股ETF?