热门资讯> 正文

Top 2 Tech Stocks That Could Sink Your Portfolio In June

2025-06-20 20:25

As of June 20, 2025, two stocks in the information technology sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered overbought when the RSI is above 70, according to <a href=”https://pro.benzinga.com/”> Benzinga Pro</a>.

Here's the latest list of major overbought players in this sector.

Arqit Quantum Inc (NASDAQ:ARQQ)

- On May 27, Arqit Quantum announced it will acquire Ampliphae’s technology IP. “Encryption Intelligence is a vital choice for organisations looking to understand and reduce their encryption risk,” said Andy Leaver, CEO of Arqit. “By combining our quantum encryption expertise with Ampliphae’s analytics technologies, we can deliver unmatched protection and advisory services on a global scale.” The company's stock jumped around 54% over the past month and has a 52-week high of $52.79.

- RSI Value: 82

- ARQQ Price Action: Shares of Arqit Quantum gained 22.4% to close at $37.97 on Wednesday.

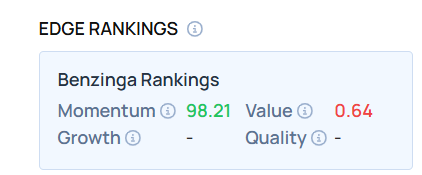

- Edge Stock Ratings: 98.21 Momentum score with Value at 0.64.

Silicon Motion Technology Corp. (NASDAQ:SIMO)

- On June 17, Roth Capital analyst Suji Desilva maintained Silicon Motion Technology with a Buy and raised the price target from $70 to $90. The company's stock gained around 10% over the past month and has a 52-week high of $85.87.

- RSI Value: 78.4

- SIMO Price Action: Shares of Silicon Motion Technology gained 4.5% to close at $71.49 on Wednesday.

Don't miss out on the full BZ Edge Rankings—compare all the key stocks now.

Read This Next:

- Top 2 Industrials Stocks That May Fall Off A Cliff In Q2

Photo via Shutterstock

推荐文章

港股周报 | 中国大模型“春节档”打响!智谱周涨超138%;巨亏超230亿!美团周内重挫超10%

一周财经日历 | 港美股迎“春节+总统日”双假期!万亿零售巨头沃尔玛将发财报

一周IPO | 赚钱效应持续火热!年内24只上市新股“0”破发;“图模融合第一股”海致科技首日飙涨逾242%

从软件到房地产,美国多板块陷入AI恐慌抛售潮

Meta计划为智能眼镜添加人脸识别技术

危机四伏,市场却似乎毫不在意

美股机会日报 | 降息预期升温!美国1月CPI年率创去年5月来新低;净利、指引双超预期!应用材料盘前涨超10%

财报前瞻 | 英伟达Q4财报放榜在即!高盛、瑞银预计将大超预期,两大关键催化将带来意外惊喜?