热门资讯> 正文

Top 3 Tech Stocks That Are Preparing To Pump This Quarter

2025-06-13 19:46

The most oversold stocks in the information technology sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

Clearone Inc (NASDAQ:CLRO)

- On June 2, ClearOne announced it authorized a 1-for-15 reverse stock split. The company's stock fell around 27% over the past month and has a 52-week low of $4.35.

- RSI Value: 17.9

- CLRO Price Action: Shares of Clearone gained 1.6% to close at $5.80 on Thursday.

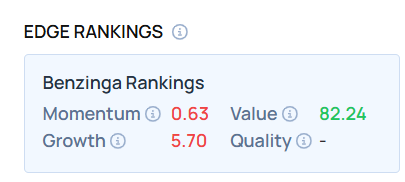

- Edge Stock Ratings: 0.63 Momentum score with Value at 82.24.

Cloudastructure Inc (NASDAQ:CSAI)

- On May 15, Cloudastructure reported $738.00 thousand in sales for the first quarter. “Cloudastructure began 2025 with substantial momentum,” said James McCormick, Chief Executive Officer of Cloudastructure. “Revenue for the quarter more than tripled year-over-year, we turned the corner on gross profit, and we secured the largest contract in our Company’s history. The demand for real time crime deterrence has never been stronger—and we are leading the charge.” The company's stock fell around 40% over the past month and has a 52-week low of $1.91.

- RSI Value: 26.6

- CSAI Price Action: Shares of Cloudastructure closed at $2.00 on Thursday.

- Benzinga Pro’s charting tool helped identify the trend in CSAI stock.

Digital Ally Inc (NASDAQ:DGLY)

- On May 21, Digital Ally reported a year-over-year decrease in first-quarter sales results. “Our first quarter financial results, which included substantial non-operating gains and losses, clearly reflect the operating leverage inherent in our business model that has resulted from substantial decreases in overhead expenses, reduced headcount, and the focus on our subscription based sales model for our video solutions segment and the successful restructuring of our law enforcement products sales organization,” stated Stanton E. Ross, Chief Executive Officer of Digital Ally, Inc. The company's stock fell around 29% over the past month and has a 52-week low of $1.93.

- RSI Value: 25.9

- DGLY Ltd Price Action: Shares of Digital Ally fell 3.2% to close at $2.84 on Thursday.

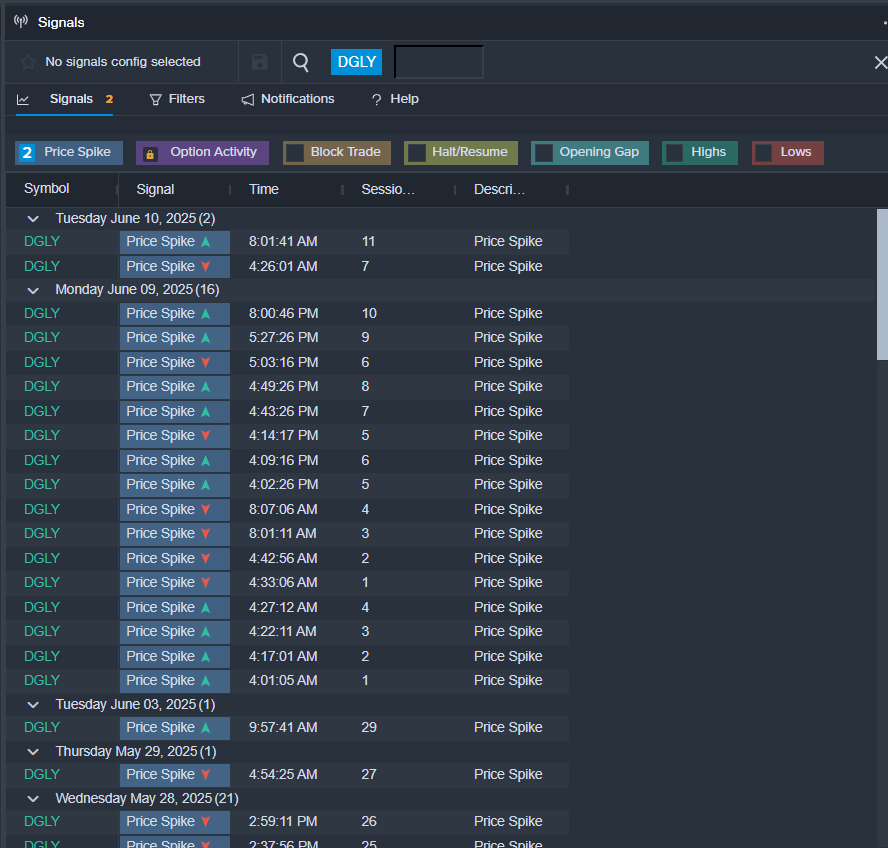

- Benzinga Pro’s signals feature notified of a potential breakout in DGLY shares.

BZ Edge Rankings: Find out where other stocks stand—explore the full comparison now.

Read This Next:

- Top 2 Defensive Stocks That May Keep You Up At Night In Q2

Photo via Shutterstock

推荐文章

美股机会日报 | 降息预期升温!美国1月CPI年率创去年5月来新低;净利、指引双超预期!应用材料盘前涨超10%

春节休市提醒 | 港股除夕下午休市,大年初四开市;美股下周一休市一日

千亿资金需求下 OpenAI本周在ChatGPT上线广告

华盛早报 | 美股、金银全线暴跌,纳指跌超2%!韩国人再度扫货中国股票,大举买入MINIMAX、澜起科技;节前央行1万亿元买断式逆回购来了

美国联邦贸易委员会:苹果新闻偏袒左翼媒体、打压保守派内容

美股机会日报 | 就业数据转弱!美国至2月7日当周初请失业金人数超预期;存储概念股盘前齐升,闪迪大涨超7%

要点速递!《跑赢美股》春节特别直播核心观点总结

道指“一枝独秀”连创新高!特朗普喊话还能翻倍,轮动行情下如何平稳“上车”价值股ETF?

风险及免责提示:以上内容仅代表作者的个人立场和观点,不代表华盛的任何立场,华盛亦无法证实上述内容的真实性、准确性和原创性。投资者在做出任何投资决定前,应结合自身情况,考虑投资产品的风险。必要时,请咨询专业投资顾问的意见。华盛不提供任何投资建议,对此亦不做任何承诺和保证。