热门资讯> 正文

华尔街最准确的分析师对3只股息收益率超过15%的金融股给出了看法

2025-06-06 19:43

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the financial sector.

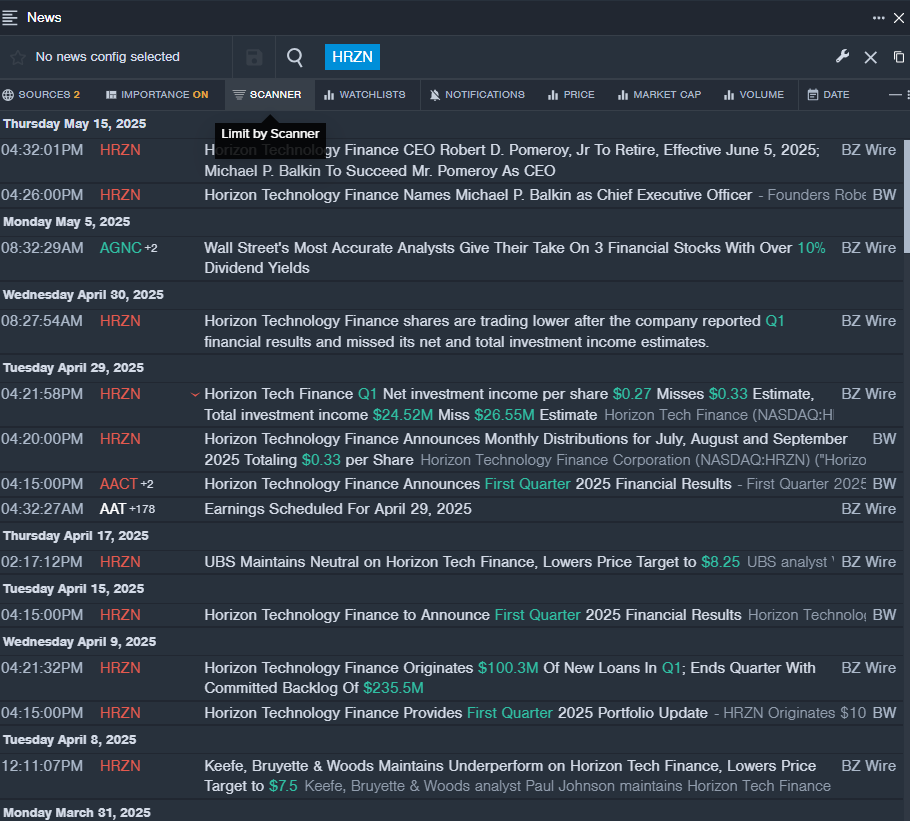

Horizon Technology Finance Corporation (NASDAQ:HRZN)

- Dividend Yield: 17.77%

- Keefe, Bruyette & Woods analyst Paul Johnson maintained an Underperform rating and cut the price target from $8 to $7.5 on April 8, 2025. This analyst has an accuracy rate of 69%.

- Compass Point analyst Casey Alexander upgraded the stock from Sell to Neutral with a price target of $8.25 on Dec. 17, 2024. This analyst has an accuracy rate of 68%.

- Recent News: On May 15, Horizon Technology Finance named Michael P. Balkin as Chief Executive Officer.

- Benzinga Pro’s real-time newsfeed alerted to latest HRZN news.

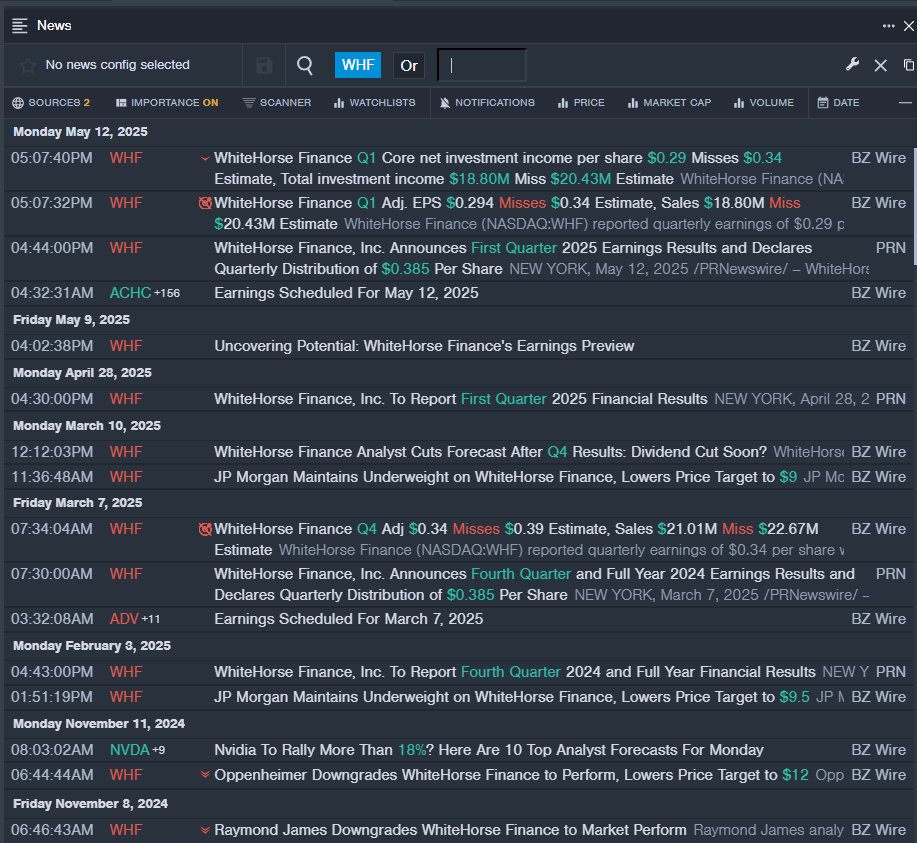

WhiteHorse Finance, Inc. (NASDAQ:WHF)

- Dividend Yield: 17.13%

- Raymond James analyst Robert Dodd downgraded the stock from Outperform to Market Perform on Nov. 8, 2024. This analyst has an accuracy rate of 64%.

- JP Morgan analyst Richard Shane maintained an Underweight rating and cut the price target from $12.5 to $11.5 on July 29, 2024. This analyst has an accuracy rate of 68%.

- Recent News: On May 12, WhiteHorse Finance posted weaker-than-expected quarterly results.

- Benzinga Pro's real-time newsfeed alerted to latest WHF news

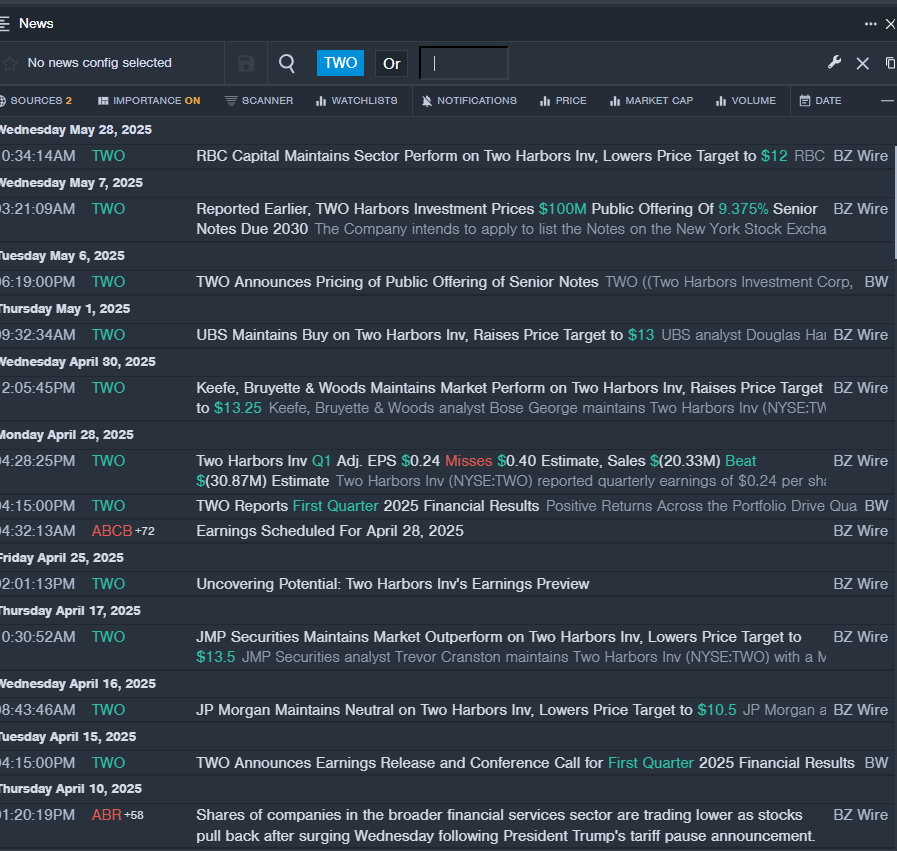

Two Harbors Investment Corp. (NYSE:TWO)

- Dividend Yield: 16.92%

- RBC Capital analyst Kenneth Lee maintained a Sector Perform rating and cut the price target from $13 to $12 on May 28, 2025. This analyst has an accuracy rate of 65%.

- UBS analyst Douglas Harter maintained a Buy rating and increased the price target from $12 to $13 on May 1, 2025. This analyst has an accuracy rate of 67%.

- Recent News: On May 6, TWO Harbors Investment priced its $100 million public offering of 9.375% senior notes due 2030.

- Benzinga Pro’s real-time newsfeed alerted to latest TWO news

Read More:

- Jim Cramer Likes Dominion Energy, But Isn’t ‘A Fan’ Of This Real Estate Stock

Photo via Shutterstock

推荐文章

港股周报 | 中国大模型“春节档”打响!智谱周涨超138%;巨亏超230亿!美团周内重挫超10%

一周财经日历 | 港美股迎“春节+总统日”双假期!万亿零售巨头沃尔玛将发财报

一周IPO | 赚钱效应持续火热!年内24只上市新股“0”破发;“图模融合第一股”海致科技首日飙涨逾242%

从软件到房地产,美国多板块陷入AI恐慌抛售潮

Meta计划为智能眼镜添加人脸识别技术

危机四伏,市场却似乎毫不在意

美股机会日报 | 降息预期升温!美国1月CPI年率创去年5月来新低;净利、指引双超预期!应用材料盘前涨超10%

财报前瞻 | 英伟达Q4财报放榜在即!高盛、瑞银预计将大超预期,两大关键催化将带来意外惊喜?

风险及免责提示:以上内容仅代表作者的个人立场和观点,不代表华盛的任何立场,华盛亦无法证实上述内容的真实性、准确性和原创性。投资者在做出任何投资决定前,应结合自身情况,考虑投资产品的风险。必要时,请咨询专业投资顾问的意见。华盛不提供任何投资建议,对此亦不做任何承诺和保证。