热门资讯> 正文

Auto tariffs: TSLA, RIVN, LCID produce their vehicles in U.S., F better positioned than GM

2025-03-28 03:04

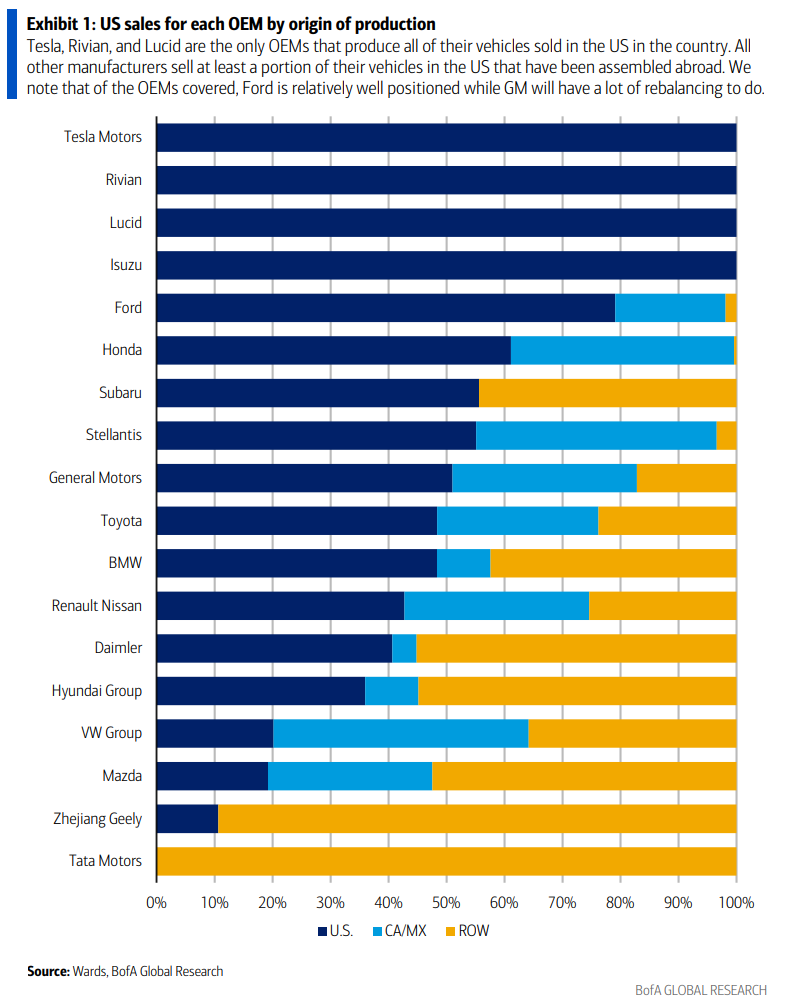

Tesla (NASDAQ:TSLA), Rivian (NASDAQ:RIVN) and Lucid (NASDAQ:LCID) could see minimal effect from President Donald Trump's new round of auto tariffs as the three electric vehicle makers produce all of their cars sold in the U.S. domestically.

According to Bank of America, apart from these three firms, all other car manufacturers sold at least some of their vehicles in the U.S. that have been produced elsewhere.

Trump on Wednesday announced a 25% tariff that will be imposed on all vehicles not made in the U.S., effective on April 2. The tariffs will initially start at 2.5% and gradually increase to 25%.

Looking at U.S. legacy carmakers, "Ford (NYSE:F) is relatively less affected and may even benefit as it only imports a few models, which account for a modest 20% of its total volumes. GM (NYSE:GM) appears relatively exposed to the tariffs as it imports 49% of its vehicles," BofA Securities analysts led by John Murphy said in a research note on Thursday.

See the table BofA shared below:

Wards, BofA Global Research

As per the chart, the top five automakers with the most import exposure to the U.S. include, in descending order of exposure: Jaguar and Land Rover parent Tata Motors, Geely (OTCPK:GELYF)(OTCPK:GELYY), Mazda (OTCPK:MZDAY)(OTCPK:MZDAF), Volkswagen (OTCPK:VWAGY)(OTCPK:VLKAF), and Hyundai (OTCPK:HYMTF).

Murphy and the other analysts also believe that vehicle prices could increase as much as $10K if the carmakers pass on the tariffs in full to consumers in impacted vehicles.

Auto stocks saw mixed reactions on Thursday. GM (NYSE:GM) and Ford (NYSE:F) were -7% and -3.7%, respectively, while U.S.-listed shares of French-Italian firm Stellantis (STLA) were -1.2%.

On the other hand, shares of Tesla (NASDAQ:TSLA) were +1.7%. Additionally, used car retailers Hertz (HTZ) and Avis Budget (CAR) were +23.5% and +21.1%, respectively, on expectations that used car prices could rise in response to the tariffs.

Here are some exchange-traded funds of interest tied to the automotive industry: (NASDAQ:CARZ), (BATS:FDRV), (CARU), (NYSEARCA:EVAV), and (CARD).

Related stories

- Tesla: This Pullback Won't Matter In 2027 - Why I Loaded Up Shares

- Ford Motor Company: Tariffs Pose Pain But Also Offer Opportunity

- Inverse Leveraging Tesla's Decline With TSLZ: A Bear Vehicle Worth Considering Now

- Biggest stock movers Thursday: GM, GME, SLNO, ME, and more

- Top 10 global automakers by SA Quant rating as Trump tariffs roil industry

推荐文章

港股周报 | 中国大模型“春节档”打响!智谱周涨超138%;巨亏超230亿!美团周内重挫超10%

一周财经日历 | 港美股迎“春节+总统日”双假期!万亿零售巨头沃尔玛将发财报

一周IPO | 赚钱效应持续火热!年内24只上市新股“0”破发;“图模融合第一股”海致科技首日飙涨逾242%

从软件到房地产,美国多板块陷入AI恐慌抛售潮

Meta计划为智能眼镜添加人脸识别技术

危机四伏,市场却似乎毫不在意

美股机会日报 | 降息预期升温!美国1月CPI年率创去年5月来新低;净利、指引双超预期!应用材料盘前涨超10%

财报前瞻 | 英伟达Q4财报放榜在即!高盛、瑞银预计将大超预期,两大关键催化将带来意外惊喜?