热门资讯> 正文

Which subsectors to own and which to avoid – Wolfe Research

2024-12-11 02:33

Wolfe Research is bullish on U.S. stocks (NYSEARCA:SPY), (SP500) in 2025 and expects U.S. GDP growth to be solid, as well as financial conditions to remain loose and consumer spending to stay resilient, according to their 2025 Market Outlook report.

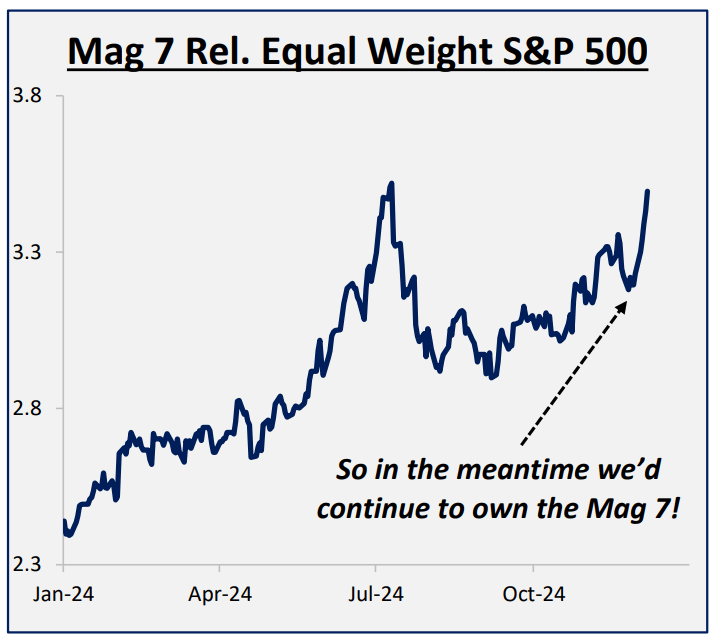

Analysts expect three interest rates cuts by the Fed in 2025, inflation to trend down towards 2% by 2025’s year-end, 2.5% real GDP growth, S&P 500 (SP500) earnings at $250 in 2025 and $305 in 2026, 22x 2026 EPS, and for the Magnificent seven stocks – Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL), Amazon (AMZN), Nvidia (NVDA), Meta Platforms (META), Tesla (TSLA) – to resume their leadership and outperformance.

Credits to Wolfe Research Portfolio Strategy.

“Market concentration remains very elevated, with the top five companies in the S&P 500 (SP500) comprising 26% of the index,” wrote Chris Senyek, chief investment strategist at Wolfe Research. “We don’t see this dynamic changing until either the other side of the next recession and/or if AI enthusiasm substantially wanes.”

Here are other sector/style preferences:

- The Mag 7 (MAGS) over equal weight (RSP)

- Cyclicals (GMAEX), (PEZ) over quality (QUAL)

- Early cyclicals over defensives

- U.S. (SPY) over rest of the world (DBAW), (DFAX)

- Growth (SCHG), (SPYG), (IWF) over value (IWN), (IWD), (IWS), (IVE), (IJS), (SPYV)

- SMID (SDVY), (SMOT) over large (SP500)

Subsectors to own and their top quant-rated stocks:

- Semis (SMH), (SOXX) – Credo Technology (CRDO); Rigetti Computing (RGTI); TSM (TSM)

- Interactive media – (SOCL), (ESPO) – Travelzoo (TZOO); Bilibili (BILI); Outbrain (OB)

- Online retail, (IBUY), (ONLN) – JD.com (JD); Global-E Online (GLBE); Amazon (AMZN)

- Home improvement (ITB) – The Home Depot (HD); Lowe’s Co. (LOW); Floor & Décor Holdings (FND)

- Banks (KBE), (KBWB) – Grupo Supervielle (SUPV); Wells Fargo (WFC); Mizuho Financial (MFG)

- Rail transport (IYT), (XTN) – Norfolk Southern (NSC); Union Pacific (UNP); CSX Corp. (CSX)

Subsectors to avoid and their lowest quant-rated stocks:

- Pharmaceuticals (PJP), (XPH), (PPH) – PainReform (PRFX); NLS Pharma (NLSP); Traws Pharma (TRAW)

- Chemicals (FSCHX) – Mativ Holdings (MATV); Tronox Holdings (TROX); Orion (OEC)

- Integrated oil (PXJ) – Repsol (OTCQX:REPYY); Ecopetrol (EC); Cenovus Energy (CVE)

- Food (PBJ), (FTXG) – Grocery Outlet Holding (GO); BRC (BRCC); Westrock Coffee (WEST)

More on SPDR S&P 500 ETF Trust:

- Qualitative And Contrarian Outlook For 2025

- S&P 500: Overshoot In Q1 2025 And Ending With Double-Digit Upside Potential

- S&P 500: Accumulating In A Year Of Likely Consolidation Ahead

- S&P 500 sector weekly ETF flows: inflow resumes, bitcoin gains on higher inflows

- Wall Street 'froth' marks weekly win, record high for S&P and bitcoin piercing $100K

推荐文章

春节休市提醒:港股除夕下午休市,大年初四开市;美股下周一休市一日

千亿资金需求下 OpenAI本周在ChatGPT上线广告

华盛早报 | 美股、金银全线暴跌,纳指跌超2%!韩国人再度扫货中国股票,大举买入MINIMAX、澜起科技;节前央行1万亿元买断式逆回购来了

美国联邦贸易委员会:苹果新闻偏袒左翼媒体、打压保守派内容

美股机会日报 | 就业数据转弱!美国至2月7日当周初请失业金人数超预期;存储概念股盘前齐升,闪迪大涨超7%

要点速递!《跑赢美股》春节特别直播核心观点总结

道指“一枝独秀”连创新高!特朗普喊话还能翻倍,轮动行情下如何平稳“上车”价值股ETF?

华盛早报 | 非农数据大超预期!首次降息或延至7月;AI恐慌交易蔓延至房地产服务板块, CBRE暴跌12%;智谱发布新模型