热门资讯> 正文

今年秋季最热门的高收益部门

2019-10-19 21:15

This high-yield sector has outperformed the market over the month, quarter, year, and so far in 2019.

We detail the top outperforming stocks within this sector for valuations, price targets, dividend coverage, and financials.

The yields range from 5% to 8%.

Looking for what's hot vs. what's not in the high-yield space? Take a gander at the performance of the four high-yield sectors. Although Utilities have a slightly higher overall yield of 2.89%, it's the Real Estate sector which has outperformed both the market and the other high-yield sectors over the past month, quarter, year, and so far in 2019.

If Gomer Pyle was here, he might just drawl his famous line, "Surprise, surprise, surprise!." There has been no shortage of media coverage on the Real Estate sector here on SA and in the financial press in 2019.

Top 10 Performance:

We drilled down to see how the top 10 high-yield companies within this sector have performed vs. the real estate and financial sectors and vs. the market. Excepting over the past year, the top 10's average price performance has bested both sectors and the market in all of these time periods. Although the top 10 trailed the overall sector over the past year, they still gained an average of 20.55%, vs. 25.17% for the real estate sector, and just 6.73% for the S&P 500.

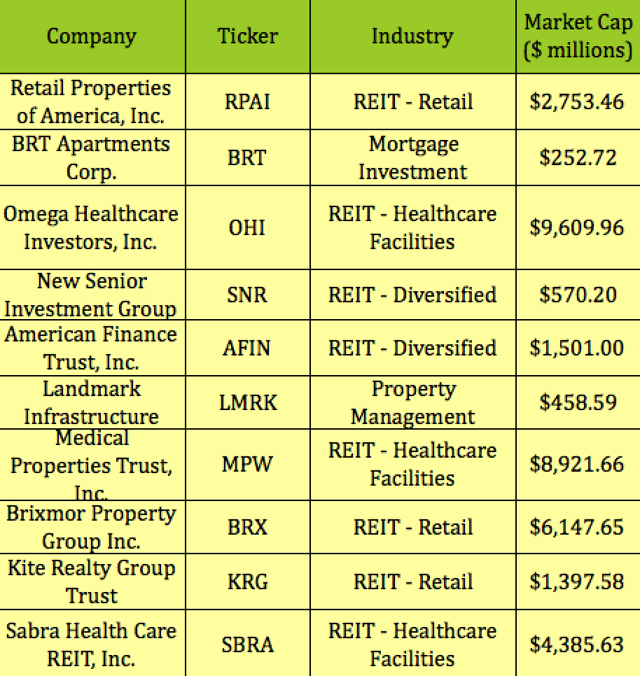

These are the companies which comprise this Top 10. It's a mixed group of small and mid-cap firms, mostly REIT's of many flavors, involved in Healthcare, Retail, Residential, and Diversified real estate holdings:

Retail Properties of America (RPAI) is the top performer over the past month, gaining 8.2%. It's closely followed by BRT Apartments (BRT), with an 8.14% gain. In contrast to the S&P 500, which has lost -.60% over the past month, all of these stocks have had solid gains, ranging from 4.27% to 8.20%.

Retail Properties of America (RPAI) is the top performer over the past month, gaining 8.2%. It's closely followed by BRT Apartments (BRT), with an 8.14% gain. In contrast to the S&P 500, which has lost -.60% over the past month, all of these stocks have had solid gains, ranging from 4.27% to 8.20%.

BRT, Medical Properties Trust (NYSE:MPW) and Omega Healthcare (OHI) have had the best one-year returns, at 39%, 37%, and 33%, respectively. On the other end of that metric are American Finance Trust (AFIN), Sabra Health Care (SBRA), and Kite Realty Group (KRG), with the lowest one-year returns.

AFIN's and KRG's lower performance over the past year isn't surprising as they are involved in retail properties, which have been under pressure due to the continuing growth of online shopping. RPAI also is a retail REIT, but its management has moved toward redeveloping its portfolio into mixed use properties - a combo of entertainment, restaurants, fitness, etc., vs. just traditional stores.

Dividends:

The yields run from 5.10% for RPAI, up to 8.18% for Landmark Infrastructure Properties (LMRK). We used trailing Funds From Operations, FFO, as the distribution sustainability metric - the FFO dividend payout ratios run from the low 60% region, up to 295% for LMRK. However, you'd be best to investigate Adjusted Funds From Operations, AFFO, which also takes into account non-recurring quarterly charges/writeoffs.

Not many of these firms have a long dividend growth record. OHI has the top spot, at 7.26%, followed by SBRA, at 5.77%, and KRG, at 5.76%:

Valuations:

Not surprisingly, the three retail

REITs

, KRG, BRX, and RPAI, have the lowest Price/FFO valuations. LMRK and BRT have the highest valuations, at 24.04 and 20.82, respectively. The only stock with a sub-1X price/book is AFIN, while KRG is the next cheapest, at 1.03X.

Analysts' Price Targets:

With all of the outperformance, it's also not surprising that only three of these stocks has upside variance vs. its average price target from analysts. At $13.04, RPAI is 8.82% below its average $14.19 price target, followed by MPW and SNR. At the other end of the spectrum, SBRA is ~12% above its average price target.

Financials:

This table is ranked by return on equity and shows LMRK leading the pack, at 26.1%, followed by MPW, at 20.5%. There's quite a drop after that, down to 12.6% for BRX, with only OHI, RPAI and SBRA also showing positive ROE ratios.

SBRA, RPAI, LMRK, MPW, and AFIN all show sub-1X Debt/Equity ratios, with New Senior Investment Group (SNR), having the highest leverage, at 8X, followed by BRT, at 4.88%.

All tables furnished by DoubleDividendStocks.com, unless otherwise noted.

Disclaimer: This article was written for informational purposes only, and is not intended as personal investment advice. Please practice due diligence before investing in any investment vehicle mentioned in this article.

I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure:

Our DoubleDividendStocks.com service features options selling for dividend stocks.

It's a separate service from our Seeking Alpha Hidden Dividend Stocks Plus service.

推荐文章

美股机会日报 | 止跌企稳!纳指期货盘前涨约0.5%,有分析称美股连遭重挫后或回升;亚马逊盘前大跌超8%

一周财经日历 | 事关降息!美国1月非农、CPI数据下周公布;恒指季检结果下周五揭晓

华尔街大多头漫谈黄金“黑天鹅”风险:马斯克实现太空采金,化身全球央行行长

避险情绪席卷市场 华尔街青睐的热门交易纷纷崩跌

华盛早报 | 无一幸免!美股、金银、加密货币与原油集体崩盘;南向资金爆买250亿港元!创约半年来新高;千问APP今日启动30亿免单

亚马逊股价盘后大跌近10%,巨额资本支出引发担忧

比特币暴跌带来124亿美元巨亏 Saylor的金融实验岌岌可危

2月6日外盘头条:比特币暴跌 亚马逊预计今年资本支出将达2000亿美元 交易员料美联储将比预期更早降息