热门资讯> 正文

PHK:看看优点和缺点

2019-10-17 22:44

PHK is offering a yield above 9%, which should entice some investors as interest rates remain at very low levels.

However, the fund\'s premium price continues to tell me to approach this investment cautiously, as it can be more volatile than many CEFs.

High-yield spreads are sitting around the average for the year, which makes forecasting the next short-term move quite challenging.

The purpose of this article is to evaluate the PIMCO High Income Fund (PHK) as an investment option at its current market price. When July started, I reviewed PHK and found a fund that had some positive attributes, but a price above what I would want to pay. Now that we have pushed in to Q4, an updated review of PHK offers a similar story. The fund is sporting a very attractive yield, close to double digits, and has kept its distribution consistent post the April income cut. Further, high-yield debt remains in favor with investors, as low interest rates and robust U.S. employment figures are keeping many investors in a "risk-on" mode.

However, there are clear risks to buying PHK at these levels. As usual, the premium to own the fund is very high, making it the fifth most expensive CEF in PIMCO's universe. While the high-yield could justify a premium, its current level is a bit too rich for my blood. Furthermore, while high-yield spreads have room to tighten, they are below year-to-date highs. This suggests plenty of potential downside in bond prices if investor demand wanes and spreads widen, rather than tighten. As we look ahead to 2020, I want to position my portfolio to earn above-average income, but with minimal downside risk. While certainly challenging in this environment, PHK offers a trade-off that could be suitable for an aggressive investor, but likely not for fixed-income investors also looking to preserve capital.

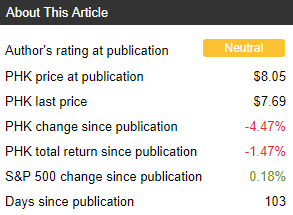

First, a little about PHK. It is a closed-end fund whose investment objective is "to seek high current income as a primary focus and capital appreciation as a secondary objective." It invests a substantial portion of assets in a variety of mortgage-related securities and also high-yield credit. Currently, the fund trades at $7.69/share and pays a monthly distribution of $.061331/share, which translates to an annual yield of 9.57%. My most recent review of PHK was in early July, when I held a "neutral" rating on the fund, as I felt the premium price was a bit too rich. In hindsight, this was a reasonable call, as PHK has declined about 1.5% in the interim, as shown below:

Source: Seeking Alpha

Source: Seeking Alpha

Given the volatility we have seen in the market over the past few months, coupled with PHK's slight decline, I wanted to reassess the fund to see if it makes sense to change my rating. After review, I continue to believe a "neutral" rating is appropriate, and I will explain why in detail below.

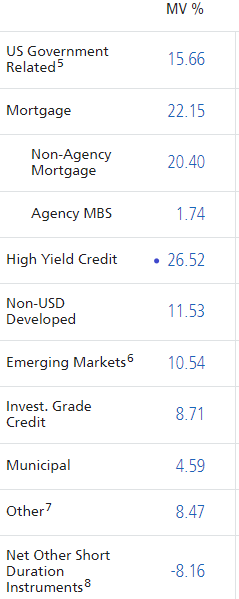

To start, I want to discuss the largest sector within PHK's portfolio, which is the high-yield credit market. In fact, it makes up over 26% of total fund assets, as shown below:

Source: PIMCO

Source: PIMCO

Clearly, what is going on in the high-yield market has an important impact on PHK, so understanding the current climate is critical to evaluating the fund.

When considering the macro-environment for this year, looking at the high-yield spread gives us some insight in to the premium investors are willing to pay for this asset class at the moment. When we look at current spreads, we see that they are right around the average for the year. While spreads had widened considerably in August, they narrowed just as aggressively in September, only to start to widen again in the short-term, as shown below:

As you can see, high-yield spreads have been quite volatile in 2019, but that comes with the territory when investing in this asset class. However, the current level gives me pause, primarily because it is difficult to see where the next move will be. With spreads sitting around their average for the year, it does not seem to indicate a clear buy or sell signal. There are reasons to be optimistic, such as low levels of defaults and declining interest rates. But there are areas for concern as well, such as a slowing global economy and high levels of corporate debt across all ratings classes. Therefore, my takeaway here is the "neutral" rating seems quite appropriate. While this may sound like I am taking both sides, it is primarily because I am. I see a scenario for investors who want to capture high-yield to put some money to work, but I also see the potential for widening spreads, which tells me overall total return will probably be limited. In sum, I do not see a reason to flee this asset class entirely, but also believe investors should be mindful of their individual risk tolerance and approach new positions cautiously.

My next point continues to present a mixed bag, as it relates to PHK's valuation. Historically, PHK has often traded at a premium price, and often a premium well-above what other PIMCO CEFs are trading at. At the time of this review, this story is consistent, with PHK being the fifth most expensive PIMCO CEF (in terms of premium), with a premium to NAV above 25%. On the surface, this is quite high, although it is important to mention that this level is not uncommon for PHK in particular. To illustrate, the following chart details a few relevant metrics with regard to the fund's premium price:

As you can see, while PHK appears quite expensive right now, its premium is actually in-line with where it has traded all year. In fact, the current level is below the average for the year, and actually sits just about 3% above its low for the year. Therefore, investors could see this an an opportunity to buy PHK, as the current market price seems to offer a reasonable value. However, I would hesitate to call this a "value opportunity". With a premium above 25%, even with a trading history supporting it, I simply see quite a bit of downside risk if the market decides PHK is not worth such a lofty price. While there is certainly support for this premium remaining in-tact for quite a while, it is not a gamble I personally would want to take.

On a positive note, one of the reasons why PHK's premium has not moved higher has been because of appreciation to the underlying assets within the fund. Throughout 2019, while returning income to shareholders near the 10% range, PHK has seen its NAV increase modestly, as shown below:

My takeaway here is investors who are comfortable taking on the risk that comes with a large premium, PHK's underlying NAV move paints a positive picture. With gains to the funds underlying assets, and some short-term stability in the distribution, PHK does offer risk-taking investors a chance to buy a high-yield fund below its year-to-date average. However, while PHK may look like a relative value in isolation, investors need to understand this 25% premium is high by pretty much any other standard, and would set investors up for significant loss in principle if the market no longer decides to support that very high figure.

My next point centers around PHK's distribution, specifically the fund's income cushion to prevent further distribution cuts. This is especially relevant for PHK, as the fund saw a steep distribution cut back in April, which sent the share price spiraling downward. In the interim, PHK has paid out the new, lower distribution rate for the past seven months, which provides some assurance that the new rate is sustainable. However, with the recent cut still likely in investor's minds, evaluating whether another one could occur in the near future is especially relevant.

On this backdrop, it is important to put PHK's figures in perspective. According to PIMCO's most recent UNII report, PHK may not look too attractive, with a negative UNII balance and a short-term coverage ratio below 90%. However, this actually represents considerable improvement in the short-term, as the chart below illustrates:

As you can see, PHK has shown improvement, which helps give investors comfort the fund is moving in the right direction. As long as these metrics, especially the UNII balance, continue to improve, a distribution cut in the near-term is unlikely. PIMCO does not often cut distribution rates so soon after a prior cut, so it would take a much worse UNII picture to suggest another one is forthcoming. However, it is also clear this improvement is not quite enough to completely rule out longer term problems. The fact remains the UNII balance is negative, and PHK's coverage ratios suggest this balance will struggle to improve consistently going forward. Therefore, I see a long road ahead of PHK in order to convince long-term investors the distribution won't be cut again, which brings in to question the justification for the lofty valuation.

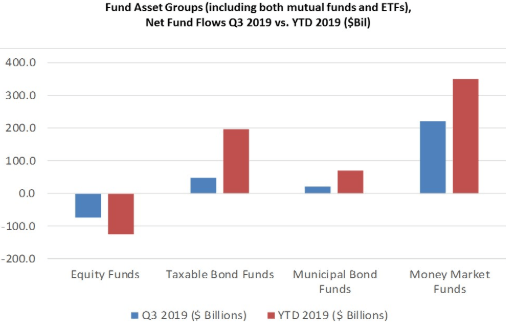

My final point considers a more macro-outlook, and how this might impact PHK and similar high-yield funds. Specifically, it considers recent fund flows from investors, which measures where investors are pulling money from and where they are putting those funds. With Q3 wrapped up, we can gain some insight in to how investors have positioned themselves to wrap up the year. It seems, for now, investors are getting cautious, with equity funds seeing large outflows, and money market funds being the primary recipient of those funds, as shown in the graphic below:

Source: Lipper

Source: Lipper

As you can see, while bond funds saw some inflows, it was at a level consistent with the inflows for the year. Investors appear to be taking some risk off the table, by moving away from equities, but they do not appear confident enough in fixed-income assets to put that money to work there. Instead, they are shifting to risk-free money market funds, which offer very little (if any) return.

My takeaway here is that investors seem to be in the middle of an important rotation right now, and the story appears to signal an upcoming "risk-off" mode. While investor flows can change quickly, this could serve as a cautionary tale for investors looking to add risk to their portfolio right now, whether via PHK or another fund. With investors signalling they are getting more risk-averse, I would forecast when they do decide to put that money to work, it will not be in the form of high-yield, leveraged CEFs. Rather, I would forecast those funds flowing to more quality fixed-income assets, such as treasuries or investment-grade bonds. This is simply because I would not expect a dramatic shift in sentiment in the short-term, but instead a staggered return back to the market. This view helps support my "neutral" rating on PHK, because these fund flow metrics do not signal a market ready to push high-yield prices markedly higher any time soon.

PHK is a fund I rarely recommend, although I do see merit in owning it for the yield if an investor can withstand volatile share price swings and the potential for capital depreciation. As we look to wrap up 2019, my outlook remains consistent. While I find PHK's value proposition unattractive for me personally, improvement in income metrics and a market price premium below its year-to-date average could interest the right buyer. However, I view the premium price as much too high, especially when coupled with the negative UNII balance and the potential for further spread widening for the high-yield sector. Therefore, I continue to believe a "neutral" rating is best suited for PHK, and recommend investors carefully consider their risk tolerance before making any purchases at this time.

I am/we are long PMF, PCI.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

推荐文章

华盛早报 | “AI威胁”波及华尔街!财富管理公司全线暴跌;豆包官宣“参战”!春节AI红包战愈演愈烈

美股机会日报 | 科技巨头迎利好?特朗普政府拟结构性豁免芯片关税;台积电1月销售额创历史新高,盘前股价涨近3%

一图看懂 | 净利大增60.7%!中芯国际Q4营收24.9亿美元,同比增长12.8%

美股机会日报 | 市场风格趋变?美银称接下来是小盘股的天下;金价重回5000美元上方,贵金属板块盘前齐升

新股暗盘 | 乐欣户外飙升超70%,中签一手账面浮盈4345港元;爱芯元智微涨超0.2%

高盛预计英伟达Q4营收达673亿美元 给出250美元目标股价

财报大跌背后:微软正在进行一场昂贵但精准的“利润置换”

港股IPO持续火热!下周6股排队上市,“A+H”占比一半