热门资讯> 正文

担保看涨策略可能会在未来几年超越市场

2019-08-22 21:54

Over the last 10 years, covered call strategies have underperformed the S&P 500.

Covered call strategies only outperform the market in troubled times, like one could expect are coming up in the coming years.

The strategy provides investors with a few advantages.

More volatile stocks do not need to be sold off, as they will earn the investor a higher call premium.

The strategy can easily generate 2.5% cash inflow on a monthly basis, which could come in handy during market downturns.

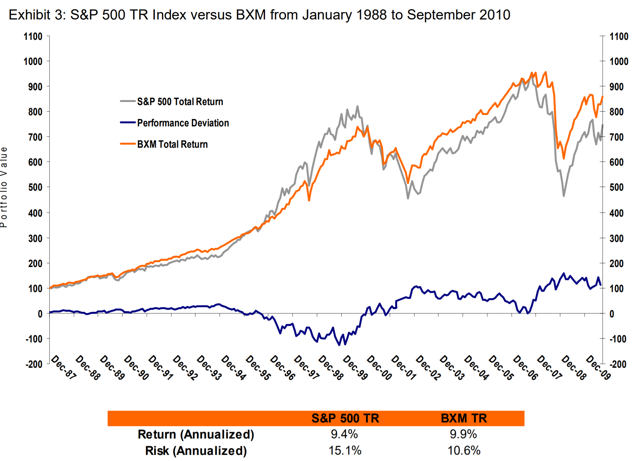

During the period 1987- 2009, a strategy of buying the S&P500 index while at the same time selling 1 month-ATM call on it, tracked by BXM (BXMX), outperformed the market by 70 basis points a year. This while only having two-thirds of the market's volatility. You can see the results for yourself in the following graph, the covered-call strategy is in orange:

However, since 2010, the strategy has underperformed the market. And quite drastically (covered call is in orange, SPY in grey):

This is simply because since 2010, there has not been a market drop large enough for the Covered-Call strategy to catch up with the SPY. One of the characteristics of assets with low volatility, is that they tend to go down less than other, higher volatility, assets. As the S&P is in a bull run since 2010, the covered call strategy has underperformed the broad market.

However, things might be about to change.

(pardon my language) IPO's, inverse yield curves, a looming trade war, negative growth of some big economies, Brexit, Italian banks... Several elements are pointing to an end of the bull market, or at least to a lot of volatility being on its way.

Let's compare the results of our covered-call strategy with the S&P500 during the last two crises (2001 and 2008):

While you would have lost around 12% with the covered index writing strategy over 2-2002, your losses would have been far bigger if you would have had just invested in the S&P 500, at around -40%...

The same goes for the financial crisis in 2008. You would have

gained

1.54% over the period from the first of January 2008 to the first of January 2010 with covered index writing. At the same time, you would have lost more than 16.5% if you had just invested in the S&P 500.

Now, it might be exactly the right time to switch to a covered-call strategy, as it bears only two-thirds of volatility and suffers less from a possible market downturn.

Most fundamentally, it is still about stock picking. I will not go too deep into this section as it is out of the scope of this article, but try to pick stocks you believe will beat the market over the coming years. However, it is important that you buy stocks that fit two criteria: 1. you can trade options on the stock; 2. you are willing to keep the stock for a long time; and potentially 3. the stock yields at least a small dividend, which cashflow allows you to buy back a written call if you don't feel like having your stock called. The risk of the stock (volatility, beta) is less important than in a normal buy-and-hold portfolio. I will come back to this.

The volatility of a stock determines the time value of an option on that stock, if the stock price does not change until maturity, the time value is the net profit you will have made. The higher the volatility, the higher the time value, but also the higher your risk.

The risk consists out of two possibilities: 1. the risk that the stock drops. If the drop is larger than the call premium you have received for that period, you make a net loss; 2. the risk that the stock goes up more than the strike price. In this case, you will get your stock called. However, you will make a profit in this case, as you pocket both the call premium and the capped profit on the stock.

The higher the volatility, the higher the chance that one of both possibilities occurs. By far, a drop that is not covered by the call premium is the worst-case-scenario. I will write in my follow-up article how one could minimize this risk.

In theory, the call premium (time value) should go up proportionally with the volatility of the stock. However, in practice, we see that the premium often is a tad bit higher than it theoretically should be.

In short, writing calls on high-volatility stocks brings along more risk, but is also rewarded better. This is the reason why you can still keep the high-volatility stocks in your portfolio, even now volatile times are coming: you are rewarded for them via the higher call premiums.

As you might have spotted in the picture above, the current stock price of Aperam (OTC:APEMY) (OTC:APMSF) is 20.49 euros. Its volatility is at 37.3% on a yearly basis. If we sell a call option with a strike price of 5% above the current stock price, at 21.50, we receive a premium of 0.46-0.55 euros. This is around a whopping 2.5%!

For Royal Dutch Shell, the volatility stands at 23%. Here, selling an option 5% above the current spot price returns at least 0.92%. Low-volatility stocks, with 15% volatility for example, "only" return 0.3% per month.

These earnings have two advantages:

1. A drop in the share price hurts less and can even be neutralized

For example, if Aperam drops 10% in a month, your net loss will be at around 7.5%. Furthermore, you can then write another call option, for 5% higher. This will pocket you another 2.5%. If the stock goes back up by more than 5%, it gets called and you are at break-even, while the stock can still be down by as much as 5%.

2. You are provided with a monthly cash-injection

When markets tumble, buying stocks on the cheap is a guarantee for long-term success. However, you need to have the cash to be able to do so. Writing calls can provide you with a monthly 0.5%-2.5% cash injection, which could come in very handy during such distressing times.

While covered call strategy most likely underperformed the S&P 500 over the last 10 years, it is set to beat the market over the coming years. It has beaten the S&P in both the last two market crashes and suffers way less from volatility. At the same time, it gives investors the possibility to keep volatile stocks in their portfolio, as writing calls 5% above the spot price generates a monthly return of 2.5%.

I am/we are long APEMY, RDS.A.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

推荐文章

美股机会日报 | 止跌企稳!纳指期货盘前涨约0.5%,有分析称美股连遭重挫后或回升;亚马逊盘前大跌超8%

一周财经日历 | 事关降息!美国1月非农、CPI数据下周公布;恒指季检结果下周五揭晓

华尔街大多头漫谈黄金“黑天鹅”风险:马斯克实现太空采金,化身全球央行行长

避险情绪席卷市场 华尔街青睐的热门交易纷纷崩跌

华盛早报 | 无一幸免!美股、金银、加密货币与原油集体崩盘;南向资金爆买250亿港元!创约半年来新高;千问APP今日启动30亿免单

亚马逊股价盘后大跌近10%,巨额资本支出引发担忧

比特币暴跌带来124亿美元巨亏 Saylor的金融实验岌岌可危

2月6日外盘头条:比特币暴跌 亚马逊预计今年资本支出将达2000亿美元 交易员料美联储将比预期更早降息