热门资讯> 正文

单一州市政债券CEF的免税收益率和资本收益

2019-08-21 14:30

- 纽文马萨诸塞市保基金(NMT) 0

- 纽文俄亥俄基金(NUO) 0

- Nuveen New York AMT-Free Quality Municipal Income Fund of Benef Interest(NRK) 0

Single-state muni bond funds are often overlooked but provide low volatility, diversification, low risk, and tax-free income.\n

Unlike stocks, active investors tend to outperform the index in municipal bonds; all but one muni bond CEF have beaten the muni bond index over the last decade.\n

Several single-state muni bond CEFs managed by Nuveen are appealing at their large discounts despite renewed strength in muni bonds.\n

Nuveen is the most prolific closed-end fund issuer, with 74 CEFs across various asset classes. This is in part thanks to the 26 single-state municipal bond CEFs, which combined have $8.7 billion in AUM among them. These are in addition to the 16 national muni funds with $17.8 billion in AUM.

The combined amount of capital Nuveen has to invest in muni markets is important, because municipal bonds are not like stocks sold on an exchange. Market access is important when investing in muni bond issuances, not unlike a stock IPO; when a municipality issues a bond, their broker or underwriter will try to offload as many bonds as quickly as possible, which means the best bonds will be reserved for the largest buyers—resulting in a few undesirable scraps being available for retail investors, even large retail investors with 8 digit portfolios.

This is why I always urge investors to buy muni bond funds over issuances: you’ll get better quality issues as well as greater liquidity (many muni bonds will trade once every few months or not at all), a more diversified portfolio, and the expertise of a manager choosing the best bonds for you.

Unlike stocks, muni bonds are a market where active management easily beats passive.

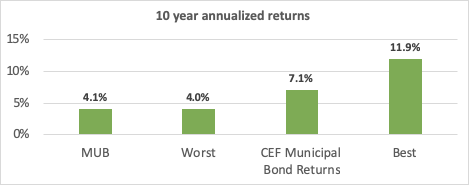

The data bears this out in no uncertain terms. CEF Insider data shows that the average annualized total return for muni bond CEFs is 7.1% over the last decade, far above the iShares National Municipal Bond ETF (MUB)’s 4% annualized return over the same period.

Only one CEF, the Nuveen Select Maturities Municipal Bond Fund (NIM), has underperformed MUB over the last decade.

Beating the index in the world of munis is easy.

In addition to institutional investors’ market access, this is also bolstered by leverage—although not in all cases, as many muni bond CEFs are unlevered. In principal, leverage is preferable for a muni bond fund, because institutional investors can get relatively low rates on borrowed money and the relatively low volatility in munis means it is almost impossible for leverage to go bad for these funds—even in a major market downturn. Many levered CEFs survived the 2007-2009 Great Recession with minimal downturns relative to other funds.

Single State versus Multi-state

Single state CEFs tend to be smaller than national muni bond CEFs, and they tend to have larger discounts. The 26 Nuveen managed single-state muni CEFs have an average discount of 10.8%, far above the 4.8% average for all muni CEFs (or 5.8% average if Pimco muni CEFs are excluded).

This larger discount is one appeal, and it tends to exist for a variety of factors. One, state muni bonds tend to be smaller, making them less liquid and attracting more risk averse retail investors who don’t fully understand the risks of muni bonds, and overcompensate by being too risk averse. They will do this by, for instance, seeing multil-state funds as more diverse and thus less prone to major downturns (although national muni bonds haven’t had significantly smaller downturns than single-state funds).

Another is due to tax considerations. A NY muni bond fund may not offer the same tax advantages for an out-of-state investor, thereby limiting demand. Additionally, investor concerns that single-state funds will have limited interest because of tax considerations simply compounds this issue.

Finally, there is the marketing problem. Single-state Pimco funds focused in California tend to do better than Pimco funds focused in New York, because Pimco has a much larger presence in California. Retail investors will trust Pimco with California muni bonds more than New York ones, and retail investors in California will buy more Pimco funds because of their local presence. This branding issue has no bearing on market performance, and it is a bad reason to choose one manager over another. For instance, the

PIMCO NY Municipal Income Fund (

)

has outperformed the

PIMCO CA Municipal Income III Fund (

)

on a NAV basis during the life of both funds by a very large margin:

Yet the NY fund’s premium is slightly smaller than PZC’s (and has been significantly smaller in recent years), and all of Pimco’s NY funds have a smaller average premium than Pimco’s CA funds.

Pricing Volatility in Nuveen Single-State Funds

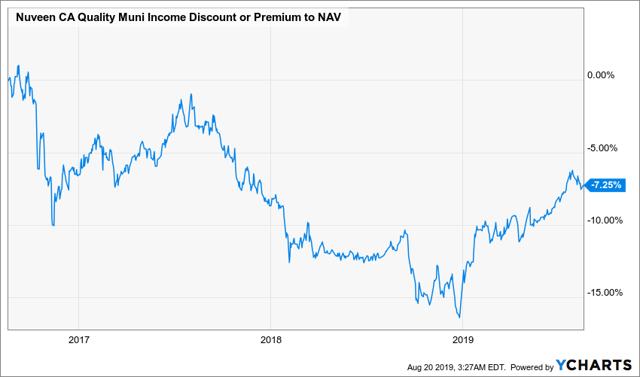

Chicago-based Nuveen is not as large or as preferred as Pimco for CEFs, yet several Nuveen funds have done very well for a very long time—and during times of inflows to CEFs (as in 2017 and this year), one can expect these discounts to shrink as investors return to the funds. So has been the case with Nuveen’s largest single-state muni bond fund, the Nuveen CA Municipal Income Fund (NAC):

In the chart above we see NAC’s discount ebb and flow with investor demand, which has made NAC a great buy both in early 2017 and throughout 2019.

This is also observant with Nuveen’s smaller single-state muni bond funds, for instance the sub-$200m AUM Nuveen Texas Quality Municipal Income Fund (NTX), whose discount has seen a similar pattern:

A simple and repeatable strategy with Nuveen’s single-state funds is to buy when their discounts fall and wait until the discounts shrink.

An Overview of Nuveen Single-State Funds

In addition to these two, there are 24 other single-state funds of varying size, yields, and discounts:

Differences in yield are small, from 3.2% to 4.5% across the board, while there is no clear correlation to discounts and yields:

This may be in large part because of the major gaps in discounts, from 0.1% premium for NXC to a 12.7% discount for NMY.

A similar lack of correlation between fund size and discount is also observable:

Demand from retirees in different states and state tax policies seem to have a bigger impact on fund pricing, which provides an opportunity for investors to take advantage of this by buying funds with very large discounts during times of weaker muni bond demand and selling at smaller discounts or premia when muni bond demand improves.

Single-state muni bond funds are an overlooked opportunity for positive carry opportunistic investing with some tax advantages that also provides investors with muni bond exposure at very little risk.

I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

推荐文章

美股机会日报 | 美国1月“小非农”不及预期!礼来绩后一度大涨10%,财报强劲超预期

华盛早报 | 辟谣!税收传闻不实;“AI抢饭碗”引抛售潮!纳指跌近1.5%;黄金、白银暴力反弹,华尔街坚定看多

全面甩卖软件股!美股爆发AI恐慌,Anthropic掀起SaaS抛售潮

财报速递 | 超微电脑盘后一度涨逾10%!强劲业绩展望预示AI需求增长

美股机会日报 | 贵金属“大逆转”!金银价再度大涨,机构建议市场回稳再进场;闪迪盘前续涨4%,年内已累涨180%

金银暴跌后“暴力”反弹!华尔街坚定看多:逻辑未破,黄金牛市仍未结束(附相关标的)

抢跑1.5万亿美元造富神话!如何在IPO前投资SpaceX?最全攻略来了

新股申购 | “全球锂电设备龙头”先导智能今起招股!引入欧万达基金等基石投资者