热门资讯> 正文

PGP:仍是好坏参半,但高收益应支撑股价

2019-08-08 23:46

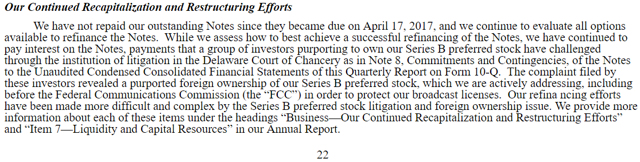

PGP is down almost 20% since I cautioned against the fund in April.

The fund was a victim of a recent distribution cut, and its income metrics are still less than stellar.

While the fund\'s premium remains a key risk for the share price, it sits below its annual average, and the underlying value has risen in 2019.

One of PGP\'s top holdings currently yields 12.5%, and that receivable continues to be a strong source of profits for the fund.

The purpose of this article is to evaluate the PIMCO Global StocksPLUS & Income Fund (PGP) as an investment option at its current market price. PGP has had a rocky 2019, experiencing a free fall drop after moving higher to start the year. This was primarily due to a distribution cut in April. However, the fund's underlying value remained stable, driven by continued demand for fixed-income products and declining interest rates. This has had the effect of markedly lowering the fund's premium, to the point where it sits at about half the level it did during my April review.

With this in mind, PGP could offer risk-taking investors a decent entry point. While the fund's premium suggests those interested in preserving capital should probably avoid it, investors driven primarily for high current income could find some value. The fund's yield sits above 9%, which should continue to draw interest. Furthermore, while the premium is rich, PGP has a history of trading much higher than its current value. This tells me the yield will probably support the share price for the time being. Finally, PGP is currently receiving interest of 12.5% on notes through the Spanish Broadcasting System, Inc. (OTCQB:SBSAA). While this receivable continues to be contested in court, SBSAA's most recent earnings report indicates the company plans to continue paying the interest on a monthly basis going forward.

First, a little about PGP. The fund's objective is "to seek a total return comprised of current income, current gains, and long-term capital appreciation. The fund attempts to achieve this objective by building a global equity and debt portfolio and investing at least 80% of the fund's net assets in a combination of securities and instruments that provide exposure to stocks and/or produce income". Currently, the fund trades at $11.93/share and pays a monthly distribution of $.0939/share, translating to an annual yield of 9.45%. I cautioned investors against PGP when I reviewed the fund in April. In hindsight, that turned out to be a correct call, as the fund has seen an abysmal return since that time, shown below:

Source: Seeking Alpha

Source: Seeking Alpha

As you can see, this short-term drop has been quite painful, and provides confirmation that this fund is only suitable for the risk-taking investor. However, on this backdrop, I wanted to review PGP again to see if the fund is now offering a reasonable value, after seeing such a large fall. While I still view PGP as a proposition that is a bit too expensive, and therefore risky, for me personally, the fund does have some positive characteristics. Therefore, for those investors who are mainly interested in high yield and can withstand loss of

principal

, the fund may offer a decent entry point at these levels, and I will explain why in detail below.

The biggest development over the past few months with respect to PGP was the fund's distribution. In April, I highlighted how declining income production metrics were a concern, and that turned out to be well founded because PGP did get caught up in the round of distribution cuts from PIMCO. In fact, the drop in the income stream was quite substantial, shown below:

Source: Seeking Alpha

As you can see, this hit to the income was a key reason behind the terrible performance in the fund since that time. While income cuts are never a positive sign, PGP was hit especially hard because of the size of the cut, as well as the fact that the fund was trading at a substantial premium, which I will discuss later. The reality was PGP was set up for a big fall, and this distribution cut was just the catalyst that was needed for that to happen.

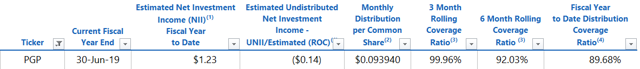

Of course, what is past is past, so what is important now is figuring out how safe PGP's distribution is from here. Unfortunately, PIMCO's July UNII report does not give the fund flying colors, but it does indicate some improvement. While the negative UNII balance remains a red flag, short-term coverage ratios are looking brighter, as shown below:

My takeaway here is mixed. While I never view a negative UNII balance in a good light, the fact that PGP's current ratios are improving tells me the income stream is likely safe for now. Considering the latest round of distribution cuts from PIMCO was very recent (in April), I do not see another round happening any time soon. Of course, if a particular fund is grossly under-earning, a cut could certainly happen in isolation, but PGP's coverage ratios are seeing some short-term strength. While the fiscal year-to-date metric at under 90% is not comforting, the fact that the 3-month coverage ratio is higher than the 6-month coverage ratio gives me some confidence the fund is finding its footing. With this in mind, I see PGP's high-yield as attractive at this level but, due to its history of cuts, would caution investors to monitor these metrics very closely going forward.

When it comes to investing in PIMCO CEFs, valuation is always a primary factor. Many options routinely trade at what seems like astronomical premiums, and no fund better illustrates that reality than PGP. Historically, PGP is consistently one of the most expensive PIMCO CEFs to purchase, and today that still rings true. With a premium at almost 28%, PGP is the fourth most expensive option from PIMCO right now. While this type of statistic would normally have me screaming to stay away from the fund, there are a few reasons why this is less scary right now.

First, while PGP is definitely on the top end of the pack when it comes to price, it is often the most expensive option, so its relative value has actually improved over the past few months. Furthermore, its current premium is roughly half what it was back in April, which tells me investors are getting a much better value today than they would have just a few months ago. Not only that, but its current premium is markedly below its average for the prior year, as shown in the chart below:

Source: PIMCO (with data calculated by Author)

As you can see, PGP is expensive, but its valuation has measurably improved.

Second, one of the reasons behind the shrinking premium is the fund's strong underlying performance. PGP has seen its NAV rise by over 5% since 2019 began, which tells me the fund is holding on to assets that are performing well in our low interest rate environment.

Of course, in fairness, PGP's NAV gain is not enough to make the fund trade at, what I consider, a reasonable level. The 28% premium is still very high on the surface. When its trading history is considered, we see that this price is not uncharacteristic, yet we still must face the fact that PGP can trade much lower (as the 1-year low of 13.9% represents). All this considered, I believe PGP right now is offering a decent entry point for itself in isolation. While the majority of PIMCO's offerings are much cheaper, and therefore more attractive to me, I do want to highlight that those investors interested in PGP could find some comfort in the valuation figures right now.

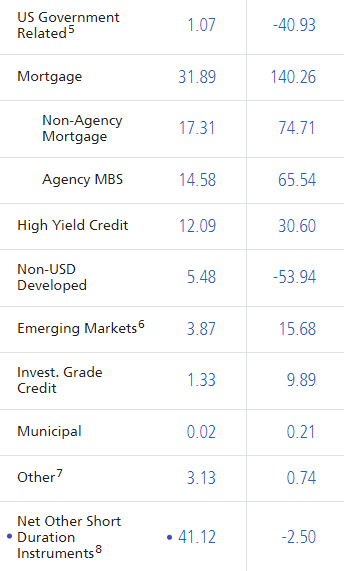

I now want to shift to the underlying holdings within PGP, to better gauge how the fund will perform in the future. Figuring out what is actually in PGP is a bit tricky. Similar to most of the PIMCO CEF offerings, PGP owns government treasuries, mortgage bonds, and high-yield corporate credit. However, unlike many of the PIMCO alternatives, PGP has a large percentage of its holdings, over 41%, under the ambiguous title "Net Other Short Duration Instruments", as shown below:

Source: PIMCO

Source: PIMCO

This category can mean many different things - in terms of what the actual holdings are, how they impact the duration and credit quality of the fund, and how they are contributing to the success or failure of the fund. Therefore, digging deeper into the holdings report of PGP can give us a little bit more insight in to what the fund actually holds.

In this case, a large percentage of the fund is actually exposed to notes that are technically in default, from SBSAA. After defaulting on the debt in April 2017, SBSAA has staved off bankruptcy by continuing to pay the monthly interest on these notes. This has been extremely profitable for PIMCO, as the notes currently yield 12.5% annually, as shown below:

Source: PIMCO

Obviously, this yield is quite high, and represents the risk PIMCO is taking by continuing to hold notes from a company one step away from bankruptcy, and whose shares trade for about $0.20. However, SBSAA has been paying the interest on a monthly basis since the April default date over two years ago, much to the ire of preferred shareholders. With PIMCO being a first-lien bondholder, they are using their muscle to keep SBSAA out of bankruptcy, helping to secure their claim on current revenue streams and preventing preferred shareholders from cashing in on a liquidation.

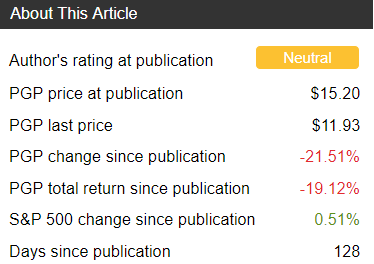

This situation is detailed in SBSAA's most recent 10-Q report that came out in May, which mentions the existing lawsuit on page 22, as shown below:

As you can see, this action is currently being contested in court, but this has been the case for some time, and the company continues to make good on its interest obligations to PIMCO. This commitment was reiterated in the 10-Q, as shown in the following excerpt on page 28:

Source: Seeking Alpha

Of course, this is just an intention, and does nothing to signal SBSAA's

to continue to pay the interest. Fortunately, the company is showing revenue growth in 2019, which is helping to boost the company's cash flow, along with its ability to continue to pay the interest of these outstanding notes. In fact, for Q1 2019, net revenue is up over 10%, as shown below:

Source: Seeking Alpha

My takeaway here is that investors need to look critically at PGP's individual holdings, because the sector weightings displayed on the home page of the fund do not provide much insight on the inner workings of the portfolio. However, after looking critically at one of the largest holdings within PGP, I believe the high income stream has some relative safety. The fund is currently obtaining 12.5% interest on a risky note, but SBSAA has reaffirmed its desire to continue paying off this note to prevent a bankruptcy filing. Further, its revenue improvement this year suggests PIMCO will be able to rely on this income for at least the short-term.

PGP is a fund I almost never recommend because its premium and risk profile are simply not in-line with my investment style. This time around, many of my same concerns remain. The fund's premium is still quite high, and its income production metrics are not especially reassuring. However, for risk-taking investors, I do see some upside at these levels. While PGP is expensive, its premium is down considerably, and its NAV has seen strong gains in 2019. Furthermore, the fund has short-term coverage ratios above 90%, which would indicate to me the risk of another distribution cut is off the table for now. Finally, PGP has large exposure to SBSAA's revenue stream, and that company is seeing growing revenues and has reaffirmed its willingness to pay the interest monthly. Therefore, I believe PGP offers a reasonable entry point for the right investor, as long as they are aware of the inherent risks of this high-yield fund.

I am/we are long PCI, PMF.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

推荐文章

港股周报 | 中国大模型“春节档”打响!智谱周涨超138%;巨亏超230亿!美团周内重挫超10%

一周财经日历 | 港美股迎“春节+总统日”双假期!万亿零售巨头沃尔玛将发财报

一周IPO | 赚钱效应持续火热!年内24只上市新股“0”破发;“图模融合第一股”海致科技首日飙涨逾242%

从软件到房地产,美国多板块陷入AI恐慌抛售潮

Meta计划为智能眼镜添加人脸识别技术

危机四伏,市场却似乎毫不在意

美股机会日报 | 降息预期升温!美国1月CPI年率创去年5月来新低;净利、指引双超预期!应用材料盘前涨超10%

财报前瞻 | 英伟达Q4财报放榜在即!高盛、瑞银预计将大超预期,两大关键催化将带来意外惊喜?