热门资讯> 正文

绘制新兴市场股票领导力图表:BAT与价值

2019-06-05 22:45

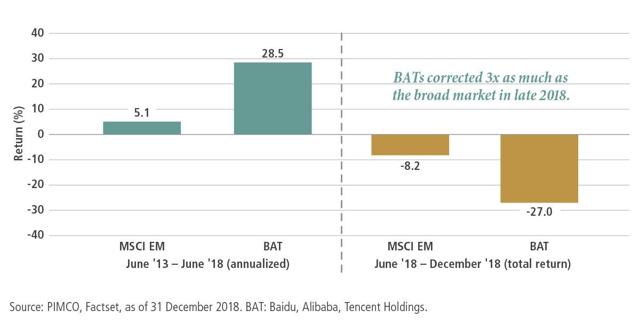

The BATs returned over 28% annualized for the five years ended June 2018, compared with 5% for the overall emerging markets (EM) index.

However, market leadership changed dramatically in the second half of 2018, when the BATs corrected three times as much as the broader market. This contributed to value stocks\' outperforming growth stocks by 7.5% for the year.

We continue to see opportunities in EM equities, which broadly are trading at half the valuations of U.S. stocks, and EM value equities are cheaper still (using cyclically adjusted price/earnings ratios as of 31 March 2019).

While the market-leading U.S. "FANG" stocks (Facebook (NASDAQ:

FB

), Amazon (NASDAQ:

AMZN

), Netflix (NASDAQ:

NFLX

), and Google (NASDAQ:

GOOG

) (NASDAQ:

GOOGL

)) are well known to investors, their emerging market "BAT" cousins - Baidu (NASDAQ:

BIDU

), Alibaba (NYSE:

BABA

), and Tencent Holdings (

OTCPK:TCEHY

) - may be less familiar. But as the chart shows, movements in BAT stocks are worth watching. The BATs returned over 28% annualized for the five years ended June 2018, compared with 5% for the overall emerging markets (NYSE:

EM

) index. However, market leadership changed dramatically in the second half of 2018, when the BATs corrected three times as much as the broader market. This contributed to value stocks' outperforming growth stocks by 7.5% for the year.

We continue to see opportunities in EM equities, which broadly are

trading at half the valuations

of U.S. stocks, and EM value equities are cheaper still (using cyclically adjusted price/earnings ratios as of 31 March 2019). While a discount is to be expected given the higher risk of those markets, the current valuation gap is wide compared with historical norms.

The key takeaway for investors? EM equities may help support long-term returns of an overall diversified portfolio, but many investors may be overweight growth stocks in their EM equity allocations. Adding EM value strategies may improve portfolio diversification potential and help focus portfolios on areas with attractive valuations.

Past performance is not a guarantee or a reliable indicator of future results. All investments

contain risk and may lose value. Investing in

foreign-denominated and/or -domiciled securities

may involve heightened risk due to currency fluctuations, and economic and political risks, which may be enhanced in

emerging markets. Equities

may decline in value due to both real and perceived general market, economic and industry conditions. There is no guarantee that these investment strategies will work under all market conditions or are suitable for all investors and each investor should evaluate their ability to invest long-term, especially during periods of downturn in the market. Investors should consult their investment professional prior to making an investment decision.

This material contains the opinions of the manager and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. It is not possible to invest directly in an unmanaged index. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America L.P. in the United States and throughout the world. © 2019, PIMCO

Editor's Note:

The summary bullets for this article were chosen by Seeking Alpha editors.

推荐文章

美股机会日报 | 就业数据转弱!美国至2月7日当周初请失业金人数超预期;存储概念股盘前齐升,闪迪大涨超7%

要点速递!《跑赢美股》春节特别直播核心观点总结

华盛早报 | 非农数据大超预期!首次降息或延至7月;AI恐慌交易蔓延至房地产服务板块, CBRE暴跌12%;智谱发布新模型

美股机会日报 | 经济数据强劲!美国1月非农就业大超预期,纳指期货涨至0.6%;AI应用股业绩超预期,Shopify涨超10%

资金复盘 | 北水净买入港股超48亿港元,逾7亿港元抢筹腾讯

华盛早报 | “AI威胁”波及华尔街!财富管理公司全线暴跌;豆包官宣“参战”!春节AI红包战愈演愈烈

美股机会日报 | 科技巨头迎利好?特朗普政府拟结构性豁免芯片关税;台积电1月销售额创历史新高,盘前股价涨近3%

一图看懂 | 净利大增60.7%!中芯国际Q4营收24.9亿美元,同比增长12.8%