热门资讯> 正文

MIE:押注中游增长的好基金

2019-05-31 02:40

MIE is one of the better funds focusing on midstream MLPs.

Midstream companies are among the most stable energy companies due to having relatively low exposure to commodity prices.

These companies also have most of their revenues backed by contracts, helping to ensure their stability.

Midstream companies have been delivering growth over the past few years due to upstream production growth, and this trend is likely to continue.

The fund boasts a near 10% yield and trades at an attractive discount to NAV.

For the past year or two, I have been actively discussing various opportunities for investors in the MLP sector of the energy space. These companies by and large boast stable business models, at least in relation to the rest of the energy industry. In addition, master limited partnerships typically boast relatively high distribution yields and many of them have strong growth prospects. However, it can sometimes be a challenge picking and choosing between the individual ones to add to a portfolio. One method by which an investor could overcome this is by investing in a fund that invests in master limited partnerships. A good option here would be the Cohen & Steers MLP Income and Opportunity Fund (

MIE

).

According to the fund's

web page

, the Cohen & Steers MLP Income and Opportunity Fund has the objective of providing an attractive total return, which consists primarily of current income and price appreciation. In order to achieve this goal, the fund invests primarily in midstream MLPs and other energy investments. A look at the largest holdings the fund reveals that the majority of the holdings in the fund are indeed midstream MLPs:

Midstream companies have a number of advantages over other energy companies. Chiefly among these advantages is the fact that the revenues of these companies are largely independent of energy prices. This is because they often operate under a "toll road" business model in which the company simply charges a fee for each unit of liquids or natural gas that moves through its network of pipelines. The fees for this service are defined under long-term contracts that typically include a minimum volume guarantee. This guarantee ensures that the company will receive a guaranteed minimum amount of cash flow from its pipelines and the fact that these contracts are long-term means that these companies do not really have to worry about short-term changes in the market. While the percentage of each company's revenue that comes from these contracts varies, it is usually at least 65-70%. This ensures that the midstream companies maintain a certain steady amount of cash flow with which to support their distributions.

As my regular readers on the topic of funds are no doubt aware, I do not generally like to see any individual position account for more than 5% of the fund's total assets. This is because this is approximately the level at which that asset begins to expose the portfolio as a whole to idiosyncratic risk. Idiosyncratic, or company-specific, risk is that risk which any financial asset possesses that is independent of the market as a whole. Thus, the risk here is that some event will occur that causes the value of a heavily-weighted asset to decline and it ends up dragging the portfolio down with it. As we can see above, there are four companies in the fund's portfolio that account for more than 5% of its total assets. One of these positions, Enterprise Products Partners (

EPD

), accounts for more than double this weighting. Thus, the fund has some very real exposure to the risks surrounding these companies. With that said though, MIE does appear to be somewhat more diversified than the First Trust MLP & Energy Income Fund (

FEI

), which I discussed in a

recent article

.

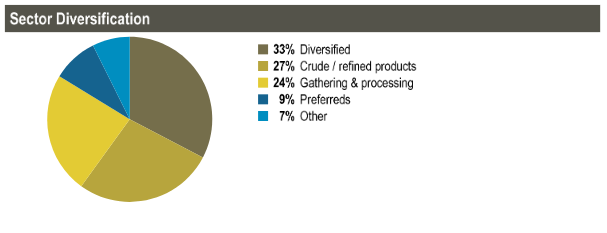

A closer look at the sectors in which the fund is invested clearly reveals that the majority of its holdings are indeed in the midstream sector:

As we can see here, 27% of the fund's portfolio is invested in crude oil or refined products pipelines and 24% of it is invested in natural gas gathering & processing companies. In addition, 33% of the fund is invested in diversified companies, which would describe companies that are involved in both sectors. All of the companies involved in these different sectors generally operate with the same business model that was already discussed. In short, they will see their revenues and cash flows increase as the volume of resources flowing through their infrastructure does.

In addition, we can see that approximately 9% of the fund's assets are invested in preferred equity issued by MLPs. This adds a certain amount of stability to the fund's income. This is because these shares have fixed dividends and usually have much higher distribution coverage than the common units do. Therefore, these units have safer distributions than the common does, but do not derive the same benefits from growth. Their presence does somewhat reduce the overall risk profile of the fund.

Midstream companies are a vital component of the energy industry. This is the sector that transports resources from the resource basins where they are extracted from the ground to the market as well as processing these resources in order to prepare them for sale. This sector has seen significant growth in North America over the past few years as growing production of resources has required ever greater amounts to be transported to the market.

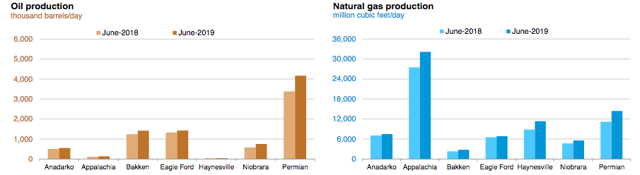

As we can see here, the production of both liquids and gas is currently higher than it was last year in every major basin in the continental United States in which these resources are produced:

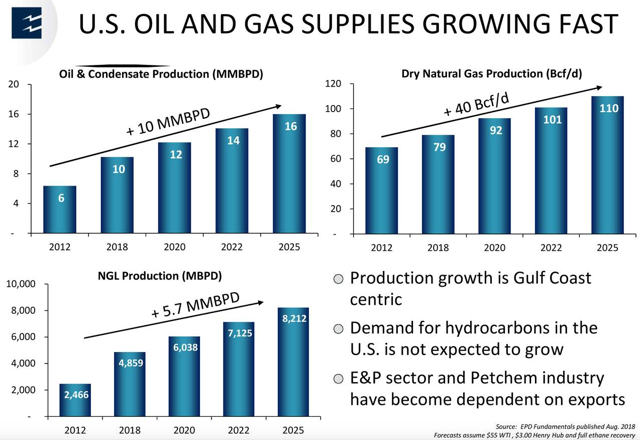

Furthermore, this production is expected to continue to grow over the coming years. We can clearly see this here:

Naturally, this production growth would be pointless if the upstream producers cannot get their incremental production to the market in order to be sold. This is where midstream companies come in as they are the ones that will be performing these transportation services. However, pipelines, gas processing plants, and similar things only have a finite capacity. Therefore, the nation's midstream companies have embarked on fairly ambitious growth projects meant to increase their capability to transport greater volumes of resources. I have discussed these projects in various past articles on each respective company. Overall though, this should have the effect of generating growth for the various companies in the industry, which will then flow through to the owners of the fund.

As already mentioned, one of the major reasons why investors purchase units of master limited partnerships is the high distributions that these entities pay out. As such, we might expect MIE to boast a sizable distribution yield. This is indeed the case. The fund pays out a monthly distribution of $0.077 per share, which works out to $0.924 annually. This gives the fund a distribution yield of 9.82% at the current price, which is certainly appealing.

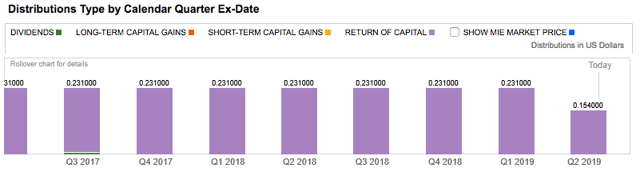

One thing that might concern potential investors is that a sizable percentage of the fund's distributions are classified as return of capital. We can see this quite clearly here:

The reason why this may be concerning is that return of capital distributions can be a sign that the fund is not actually generating money off of its investments to cover its distributions. Thus, such a distribution may represent the fund simply returning an investor's own money back to them. There are, however, other things that can cause a distribution to be classified as return of capital. One of them is distributing money that the fund received from investments in partnerships. As MIE invests almost exclusively in partnerships, this appears to be the cause of these distributions. Therefore, there is little real reason for investors to be concerned here and instead they should simply enjoy the tax-advantaged distributions.

As is always the case, it is critical for us to ensure that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a sure-fire way to ensure that we generate sub-optimal returns from that asset. In the case of a closed-end fund like MIE, the usual way to value it is by looking at the fund's net asset value. Net asset value is the market value of all of the assets held by the fund minus any outstanding debt. It is therefore the amount that the common investors would receive if all of the fund's assets were liquidated and the fund were shut down.

Ideally, we want to acquire shares of the fund when we can get them at a price that is below net asset value. This is because such a scenario essentially means that we are acquiring the assets of the fund for less than they are actually worth. Fortunately, that is the case right now. As of May 28, 2019 (the most recent date for which data was available as of the time of writing), MIE had a net asset value of $9.85 per share. This represents a 4.47% discount over the $9.41 share price. This is certainly a reasonable price to pay for the fund, although it is not as large of a discount as the First Trust MLP funds trade for.

In conclusion, there are quite a few reasons to have some money invested in midstream master limited partnerships. Chief among these is the fact that many of these companies boast significant growth prospects and high sustainable distributions. MIE offers a great way to invest in several of these companies at once and receive a high tax-advantaged level of income off of the position. The fund also currently trades at a discount to net asset value, so the price certainly looks right. Overall, the fund may be worth considering for your portfolio.

I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

推荐文章

华盛早报 | “AI威胁”波及华尔街!财富管理公司全线暴跌;豆包官宣“参战”!春节AI红包战愈演愈烈

美股机会日报 | 科技巨头迎利好?特朗普政府拟结构性豁免芯片关税;台积电1月销售额创历史新高,盘前股价涨近3%

一图看懂 | 净利大增60.7%!中芯国际Q4营收24.9亿美元,同比增长12.8%

美股机会日报 | 市场风格趋变?美银称接下来是小盘股的天下;金价重回5000美元上方,贵金属板块盘前齐升

新股暗盘 | 乐欣户外飙升超70%,中签一手账面浮盈4345港元;爱芯元智微涨超0.2%

高盛预计英伟达Q4营收达673亿美元 给出250美元目标股价

财报大跌背后:微软正在进行一场昂贵但精准的“利润置换”

港股IPO持续火热!下周6股排队上市,“A+H”占比一半