热门资讯> 正文

UGI Corp.'s Offer Is The Best Solution For AmeriGas Shareholders

2019-05-29 15:42

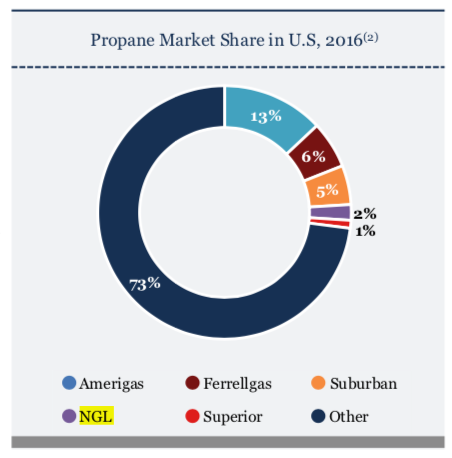

AmeriGas Partners is the largest retail propane marketer and distributor in the U.S.

The company announced on April 2, 2019 that it would be acquired by UGI Corporation.

AmeriGas’ outlook is negative due to its levered balance sheet and structural decline in its propane delivery business.

AmeriGas Partners (

APU

) saw its top and bottom lines declined in its Q2 F2019 despite a colder-than-normal weather pattern. The company’s growth outlook remains poor as propane usage gradually declines in the U.S. In addition, its leveraged balance sheet will continue to limit the company's ability to grow by acquisition. Therefore, the current offer by UGI Corporation (

UGI

) presents a good opportunity for AmeriGas shareholders to exit the investment. With the offer, AmeriGas shareholders can receive a slight premium to its peers. Given the company’s negative growth outlook, we think the offer is the best option for its shareholders.

Data by YCharts

AmeriGas benefited from generally colder weather pattern in its Q2 F2019 (4% colder than normal). However, the company's results were impacted by warm weather during the critical heating months in the southeastern U.S. As can be seen from the table below, its volumes declined by 1.6% year over year to 411.9 million gallons. As a result, adjusted EBITDA declined to $290.3 million in Q2 F2019 from $309.5 million in Q2 F2018.

(Source: Created by author)

Following the end of the quarter, AmeriGas announced that UGI will acquire 100% of the publicly held units of AmeriGas. The acquisition would provide unitholders an immediate 13.5% premium prior to the April 1, 2019 closing price of $31.13. Under the terms of the agreement, AmeriGas shareholders will receive 0.50 shares of UGI common stocks plus $7.63 in cash considerations. The acquisition is expected to close in Q4 F2019.

We think UGI’s offer to acquire AmeriGas is beneficial for AmeriGas shareholders for the following reasons:

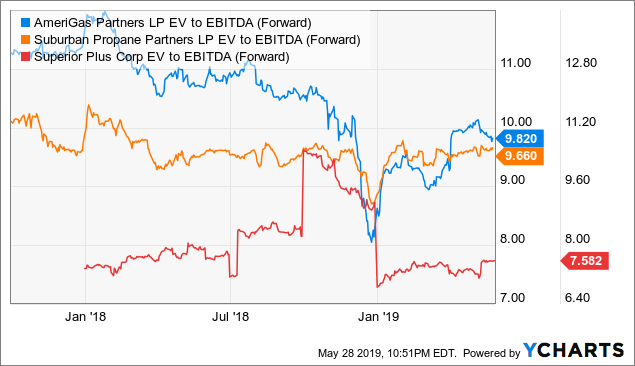

Below is a chart that compare AmeriGas’ EV-to-EBITDA ratio with that of its peers. As can be seen, the EV-to-EBITDA ratio spiked from about 9.4x to about 10.0x following the announcement on April 2, 2019. It has since declined a little bit to 9.82x. AmeriGas’ EV-to-EBITDA ratio is still better than Suburban Propane Partners’ (

SPH

) 9.66x and Superior Plus Corp.’s (

OTCPK:SUUIF

) 7.58x. Therefore, we think the offer is reasonable.

Data by YCharts

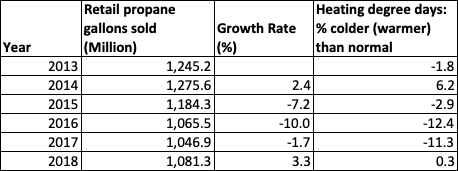

While some investors may argue that AmeriGas was trading close to an EV-to-EBITDA ratio of 12.0x a year ago, investors should understand that the propane delivery business is not a growing business in the United States. Even when the weather pattern was about 4% colder than normal in the past quarter, its volume declined by about 1.6% year over year. As can be seen from the table below, the company’s retail propane gallons sold has declined from 1.25 billion gallons in 2013 to only 1.08 billion gallons in 2018. This was a decline of 13.2% in 5 years.

(Source: Created by author;

2018 Annual Report

)

The reason for the slow decline is obvious. Propane as a heating option is generally only economically viable in rural areas, as houses in urban and suburban regions generally have natural gas pipelines connected already. As we know, rural areas generally have lower population growth rate than suburban and urban regions. Therefore, heating demand growth rate will likely remain modest, if at all. In addition, the decline in natural gas prices in the past decade has also resulted in more households switching from using propane as a heating option to natural gas. We believe this trend will continue. Therefore, we anticipate AmeriGas’ propane delivery business to continue to decline in the foreseeable future.

If AmeriGas were to continue to operate on its own, the company’s leveraged balance sheet will limit its growth. The propane delivery market is still quite fragmented, with over 4000 small or medium players that made up about 73% of the total market share (see chart below). This means that larger companies can take advantage of this opportunity by growing through acquisitions, provided they have a healthy balance sheet.

Unfortunately, this appears not be the case for AmeriGas. As can be seen from the table below, the company’s total debt has increased significantly in the past few years, from $2.3 billion in 2015 to $2.81 billion by the end of Q2 F2019. Although its interest coverage ratio stays more or less the same, the total debt-to-EBITDA ratio has increased from 3.8x in 2015 to 4.7x in the past 12 months. This ratio means that company management is not in a position to be an active acquirer of other smaller propane delivery players.

(Source: Created by author)

What is even worse is its distributable coverage ratio. As can be seen from the table below, its distribution coverage of about 1x means that it does not have excessive cash to repay its debt after paying dividends to its shareholders. If AmeriGas is to remain as a standalone business, we think a dividend cut is necessary so that the company can de-lever its balance sheet. For reader’s information, AmeriGas currently pays a quarterly dividend of $0.95 per share. This is equivalent to a dividend yield of about 11.1%.

(Source: Created by author)

AmeriGas’ business can be impacted by climate conditions. A warmer-than-expected winter can negatively impact its revenue. In fact, the company’s business has been impacted by 12.4% and 11.3% warmer-than-usual weather patterns in 2016 and 2017 respectively.

As discussed in our article, we have a negative growth outlook for AmeriGas and think that it will be very challenging for the company to grow its business with its leveraged balance sheet. Therefore, we think UGI’s offer to acquire 100% of AmeriGas shares is a good exit for AmeriGas shareholders. We think investors are better off putting their money elsewhere.

I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

推荐文章

美股机会日报 | 科技巨头迎利好?特朗普政府拟结构性豁免芯片关税;台积电1月销售额创历史新高,盘前股价涨近3%

一图看懂 | 净利大增60.7%!中芯国际Q4营收24.9亿美元,同比增长12.8%

美股机会日报 | 市场风格趋变?美银称接下来是小盘股的天下;金价重回5000美元上方,贵金属板块盘前齐升

新股暗盘 | 乐欣户外飙升超70%,中签一手账面浮盈4345港元;爱芯元智微涨超0.2%

高盛预计英伟达Q4营收达673亿美元 给出250美元目标股价

财报大跌背后:微软正在进行一场昂贵但精准的“利润置换”

港股IPO持续火热!下周6股排队上市,“A+H”占比一半

港股周报 | “AI红包大战”厮杀!腾讯周内暴跌近10%、阿里重挫8%,南下资金出手560亿港元大举抄底