热门资讯> 正文

MLP如何克服三大关键挑战

2019-05-27 22:22

The MLP sector has gone through a difficult set of challenges: fundamental restructuring, poor asset returns, and CEF underperformance.

We think that the sector may be turning a corner on all three, making us fairly upbeat about its prospects.

We do caution investors to select the appropriate trading vehicle for their tax position and desired MLP concentration.

For C-Corp CEF investors, we like FEI and FEN for their lower expenses, lower NAV volatility, lower leverage, and strong alpha.

The MLP sector has been to hell and back. In this article, we review the three main challenges that the sector has faced over the last few years. Our view is that it is turning the corner on all of them and we are quite upbeat about its prospects.

As we discuss below, the MLP sector is unusual in its tax-treatment of MLP concentration, so we caution investors to make sure they select the appropriate trading vehicle for them. For those investors who are sticking with C-Corp CEFs, we like the First Trust funds FEI and FEN for their lower expenses, lower NAV volatility, lower leverage, and strong alpha.

In the early part of the decade, MLP was synonymous with midstream and the boom in the popularity of the structure led to its high growth. Its appeal lies in the fact that MLPs do not pay corporate-level taxes. Instead, taxes are paid on the unitholder level. This elimination of double taxation leads to a lower cost of capital, supporting the valuation of assets within the structure, and leading to a competitive advantage relative to conventional corporates.

There is a second appealing feature of MLPs - this one on the investor level. MLPs provide investors with tax-advantaged yield, usually with the significant majority of yield being tax-deferred. This has made MLPs popular with retail investors who like both its high-yield and its tax-efficiency.

However, as MLPs kicked out cash to investors or the GP, it meant they were running cash-light businesses and required continued access to capital markets. Things came to a head during the oil crash in 2014 with many MLPs forced into a difficult position because of their reliance on share issuance to fund additional growth. During the crash, MLP unit prices fell as contagion spread from the upstream sector so much that share issuance no longer made sense and many MLPs were forced to move to a self-funding model. This took many forms from distribution cuts to elimination of IDRs to C-Corp conversion and partnership roll-up.

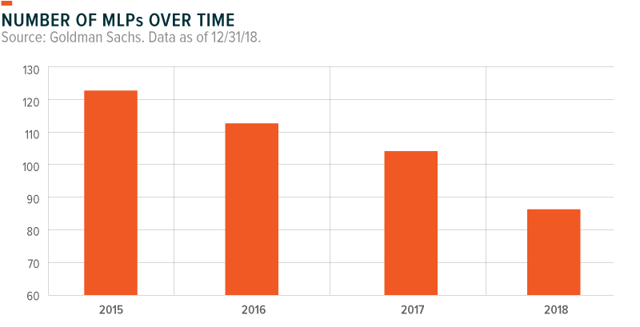

Besides the oil crash, other factors supported the shrinking of the sector. Firstly, the Jobs Act of 2017 reduced the appeal of MLPs by reducing their tax-advantage. Secondly, moving to a corporate structure potentially unlocked a large amount of passive, institutional and foreign capital that balked at owning partnerships, did not benefit from the tax advantage or was more interested in total return potential rather than income. Thirdly, the FERC ruling disallowed the recovery of some tax allowances for MLPs. All these factors supported the shrinking of the sector.

If these trends continue, the MLP sector will only exist in history books. There is some evidence, however, that it is losing steam. After all, the MLP structure continues to have appeal, so the more likely outcome is a simplification of the structure rather than its elimination. This will involve further elimination of the LP/GP combination as well as elimination of the IDR payments to the GP. In the medium term, we think the sector has right-sized and will continue evolving into a more efficient and attractive investment alternative to investors.

In retrospect, the "shale revolution" narrative of the first half of the decade proved unsustainable and the MLP sector paid the price. The sector's total return, proxied by its largest ETF AMLP, is a disappointment in comparison to other income equity-linked alternatives such as REITs, utilities, and dividend equities.

Even relative to the larger midstream space (roughly double the MLP space), MLPs have consistently underperformed.

There is some evidence, however, that the sector pain is coming to an end.

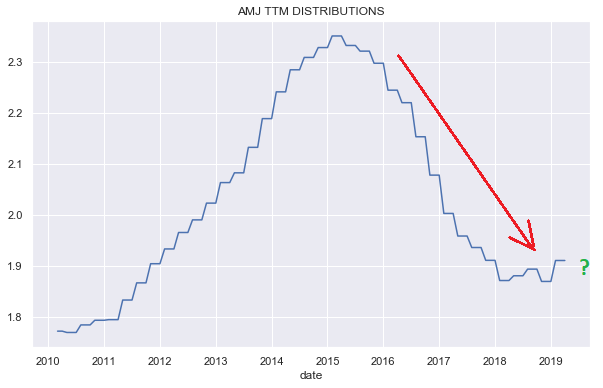

First, we see some stabilization in the distributions paid by the sector after several years of substantial cuts as illustrated by the chart below. The last quarter of 2018 was quite upbeat for MLP distributions with only one QOQ cut across the two combined Alerian MLP indices. Median distribution coverage has also ticked up from 1.2x to 1.3x according to Alerian.

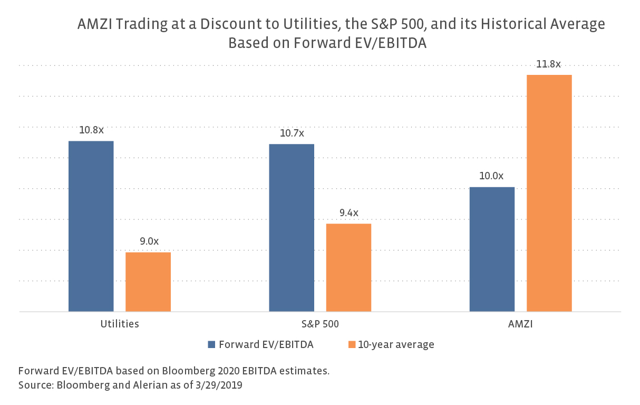

Secondly, sector valuations are looking attractive not only as compared to other equity sectors but also to the MLP sector itself.

We find tentative evidence that the MLP sector has pushed through a critical period and is beginning to turn around its business model with sustainable distributions at attractive valuations.

Funds such as ETFs, CEFs, or mutual funds that own more than 25% of MLPs are classified as C corporations. This means that as the fund's positions grow in value, they will accrue a tax liability at the current rate of 21% (below the previous rate of 35% due to the Jobs Act) that will be realized when the positions are sold. This means that when the fund appreciates, the tax will create a drag such that the fund will lag its index by the amount of the tax rate.

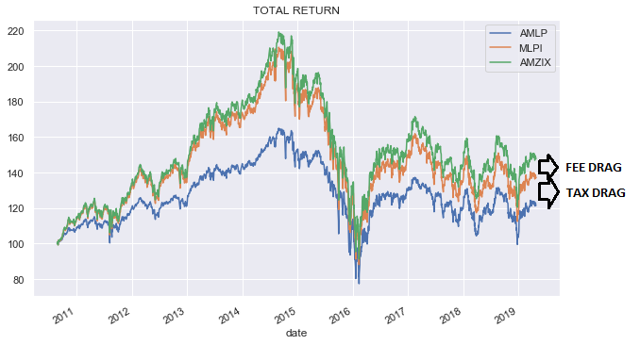

This dynamic is perhaps best illustrated with actual funds. In the chart below, we show three sets of total return:

We can see that both fund vehicles (MLPI and AMLP) lag the index. MLPI is an ETN and so can hold more than 25% MLPs without being liable for taxes. Because the ETN does not have tracking error relative to the index, the difference in performance between it and the index is just the ETN fee.

AMLP lags the index quite strongly because of the tax liability dynamic. There are other factors such as trading costs and cash drag but they are small relative to the impact of the tax drag.

The same issue faced by AMLP is faced by MLP CEFs that are structured as C-Corps. By our count, only 3 CEF Connect MLP funds are RICs which means that the rest of the sector faces this drag.

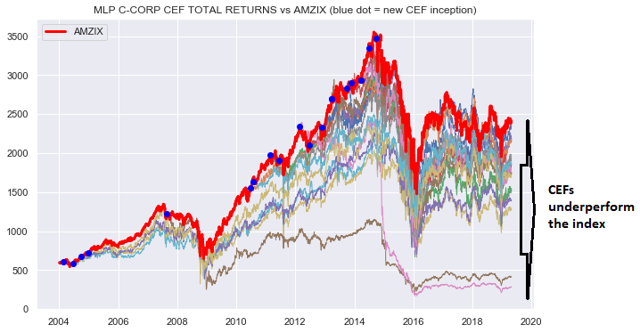

To see how C-Corp CEFs have performed, we compare their total price returns to AMZI - the Alerian MLP Infrastructure Index (as recommended by Alerian over AMZ) with the ticker AMZIX representing the total return of AMZI. The chart below is quite busy but conceptually simple. The red line is the Alerian MLP Infrastructure total return index. The thinner colored lines are the C-Corp CEFs with the blue dots representing the CEF inception dates which are when they are attached to the index and move in accordance with their total returns.

There are three striking conclusions from this chart:

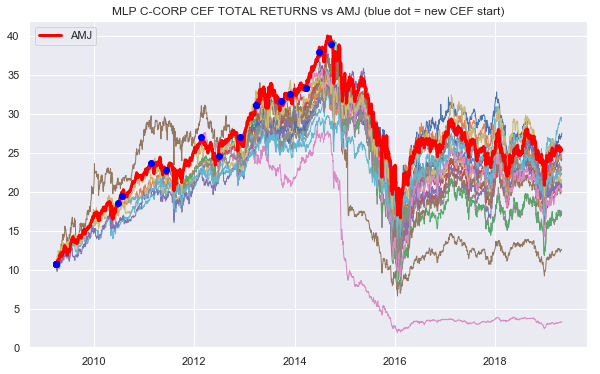

Could the underperformance be due to the fact that the index is non-investable and that to access the index performance one must incur substantial fees that are just too high to overcome with leverage and active management? To test this hypothesis, we run the same analysis on AMJ - a traded ETN on the same index. The results are slightly better for CEFs but still poor, although the analysis does not cover the same period as we skip over the financial crisis which would have significantly punished leveraged funds like CEFs.

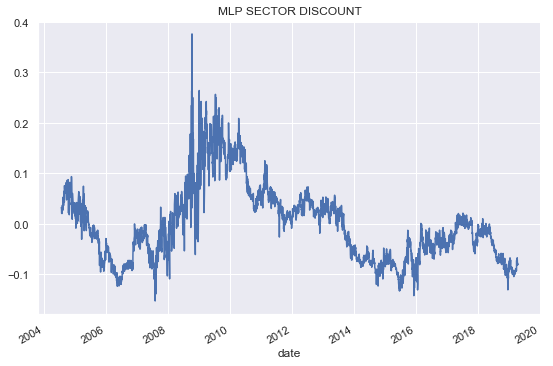

We choose to use prices rather than NAVs in the charts above for two reasons - first, the price data is more readily available and secondly, prices tend to include the net DTL which, though controversial, is generally agreed to be a real thing. It is true that the MLP sector discount now is lower historically, so that could slightly bias the results above; however, the impact would not be large enough to fundamentally change the conclusion, particularly as the discount tends to be wider for the worst-performing funds.

What else could explain the CEF underperformance relative to the index and the index ETN? We don't have easy answers, but we think possible explanations could include:

What does all this mean for CEFs going forward?

We don't have a crystal ball and much depends on the trajectory of MLP prices; however, at the margin, we think the lower tax drag should help C-Corp CEFs, while the new-and-improved MLP sector should dampen volatility making it more likely for CEFs to outperform the index. This makes us marginally more bullish on the CEF as a fund vehicle for pure MLP exposure.

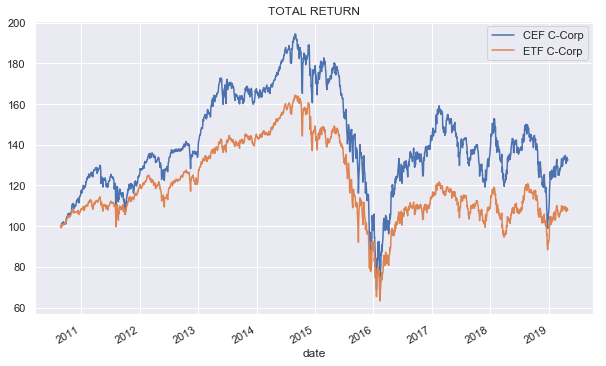

It's also likely that for some investors, ETNs are simply not viable options particularly for taxable accounts due to their distributions classified as ordinary income. This only leaves C-Corp CEFs and C-Corp ETFs in the exchange-traded arena, and on that front, CEFs have historically outperformed ETFs, though again, we only have data since the financial crisis.

For investors with access to tax-deferred accounts, we think ETNs are a serious contender for pure MLP exposure. And for investors who don't need pure MLP exposure, we would point to RIC CEFs and ETFs that diversify away from the MLP exposure with a maximum 25% allocation.

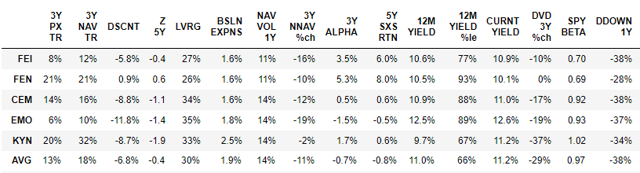

The five C-Corp CEFs below screen well on our metrics.

We particularly like the First Trust funds FEI and FEN for their lower expenses, lower NAV volatility, lower leverage, and strong alpha.

The MLP sector has gone to hell and back in the last few years. We review the three main challenges that the sector has faced and found that it is turning the corner on all of them. We do caution investors to make sure they pick the right trading vehicle for them based on their tax position and desired exposure to the MLP sector among others as that can often be overlooked with MLPs.

I am/we are long FEN.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

推荐文章

美股机会日报 | 降息预期升温!美国1月CPI年率创去年5月来新低;净利、指引双超预期!应用材料盘前涨超10%

春节休市提醒 | 港股除夕下午休市,大年初四开市;美股下周一休市一日

千亿资金需求下 OpenAI本周在ChatGPT上线广告

华盛早报 | 美股、金银全线暴跌,纳指跌超2%!韩国人再度扫货中国股票,大举买入MINIMAX、澜起科技;节前央行1万亿元买断式逆回购来了

美国联邦贸易委员会:苹果新闻偏袒左翼媒体、打压保守派内容

美股机会日报 | 就业数据转弱!美国至2月7日当周初请失业金人数超预期;存储概念股盘前齐升,闪迪大涨超7%

要点速递!《跑赢美股》春节特别直播核心观点总结

道指“一枝独秀”连创新高!特朗普喊话还能翻倍,轮动行情下如何平稳“上车”价值股ETF?